- The Mexican weight gains strength before Trump’s “great beautiful” fiscal legislation.

- The economic projections for the United States and the direction of the US dollar remain the main drivers of the USD/MXN exchange rate.

- The USD/MXN remains below critical technical levels with a bearish momentum that pushes the downward MSI.

The Mexican peso (MXN) remains firm against the US dollar (USD) on Tuesday after reaching a new maximum so far this year in the early hours of the European session, while the markets become cautious before the vote of Wednesday’s chamber on the “great beautiful law” of President Trump.

The legislative uncertainty around the proposed fiscal package weighs on the USD, with investors evaluating their possible implications for fiscal policy and US debt levels.

As the market responds, the USD/MXN continues to quote below the pivotal level of 19.30 at the time of writing.

Daily summary of the Mexican peso: the USD/MXN continues at the mercy of the dollar

- As the US dollar promotes the market management in general, changes in the feeling towards the USD, driven by US fiscal policy, economic data or Fed signals tend to issue the short -term trajectory of the USD/MXN, with the weight reacting accordingly.

- The Chamber will vote on the “A Great Beautiful Law” of President Trump, which seeks to extend the 2017 tax and job cuts law and introduce new tax relief measures.

- Although the bill could boost short -term growth, it is projected that the federal deficit will significantly increase in the next decade, generating concerns about the sustainability of the US long -term debt. And exerting pressure on the US dollar.

- Throughout the day, Fed Thomas Barkin officials, Alberto Musalem, Adriana Kugler, Raphael Bostic, Mary Daly and Beth Hammack are scheduled to speak, with the markets, observing their comments closely in search of clues about the Fed policy perspective in the midst of fiscal and economic uncertainty.

- On Friday, Moody’s became the last qualification agency to reduce US sovereign qualification.

- As the perceived credit risk increases, the US must offer higher interest rates to attract investors that could otherwise move capital to alternative assets of safe refuge.

- On Wednesday, Mexico will publish its March retail sales data, while on Thursday, the country will announce the inflation of the first half of May and the data of the Gross Domestic Product (GDP) of the first quarter.

- On the US side, S&P Global will publish the Purchase Managers Index (PMI) of May and the sales data of existing housing on April on Thursday to obtain new economic signals.

- In summary, the USD/MXN torque is sensitive to the data that remodel the expectations of growth, inflation and direction of the Central Bank in any of the countries.

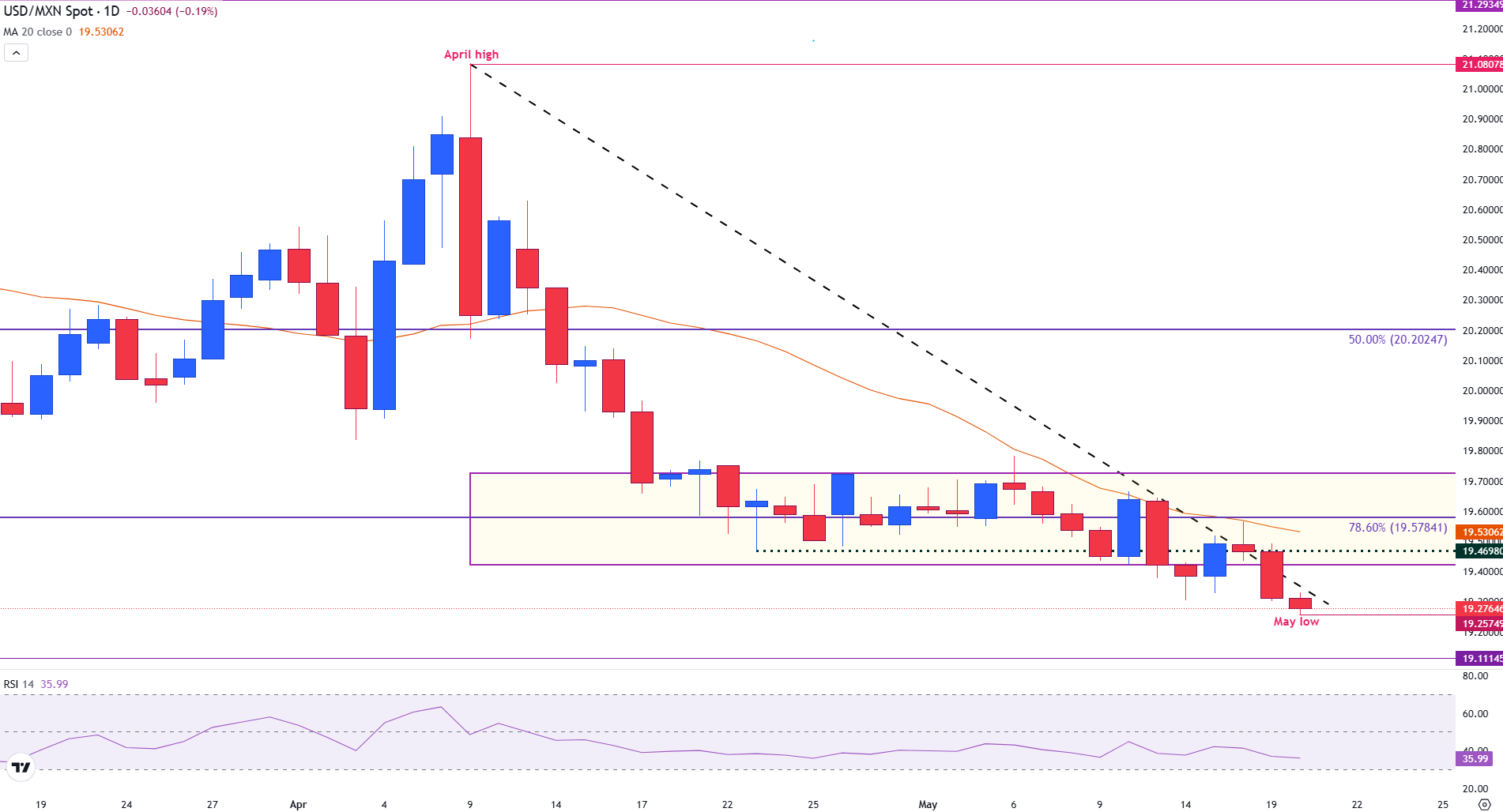

Technical analysis of the Mexican weight: the weight is stabilized with the USD/mxn below 19.30

The USD/MXN has fallen to its lowest level since October, breaking the previous level of psychological support, which has now become resistance in 19.30.

Currently, prices are below the descending trend line established during the fall in April.

The Relative Force Index indicator (RSI) in 36 shows an increase in the bearish momentum. Since the 30 mark is considered a potential over -sales territory, the bearish trend remains intact, with the next key support level in the round number of 19.20.

USD/MXN daily graphics

If prices fall below 19.20, it could open the door to the minimum of October of around 19.11, raiding the road to the 19.00 mark.

On the other hand, if the USD strength resurfaces and prices rise above the descending trend line, the USD/XN could see a new April minimum test about 19.47, taking the simple mobile average (SMA) of 20 days in 19.53.

FAQS risk feeling

In the world of financial jargon, the two terms “appetite for risk (Risk-on)” and “risk aversion (risk-off)” refers to the level of risk that investors are willing to support during the reference period. In a “Risk-on” market, investors are optimistic about the future and are more willing to buy risk assets. In a “Risk-Off” market, investors begin to “go to the safe” because they are concerned about the future and, therefore, buy less risky assets that are more certain of providing profitability, even if it is relatively modest.

Normally, during periods of “appetite for risk”, stock markets rise, and most raw materials – except gold – are also revalued, since they benefit from positive growth prospects. The currencies of countries that are large exporters of raw materials are strengthened due to the increase in demand, and cryptocurrencies rise. In a market of “risk aversion”, the bonds go up -especially the main bonds of the state -, the gold shines and the refuge currencies such as the Japanese yen, the Swiss Franco and the US dollar benefit.

The Australian dollar (Aud), the Canadian dollar (CAD), the New Zealand dollar (NZD) and the minor currencies, such as the ruble (Rub) and the South African Rand (Tsar), tend to rise in the markets in which there is “appetite for risk.” This is because the economies of these currencies depend largely on exports of raw materials for their growth, and these tend to rise in price during periods of “appetite for risk.” This is because investors foresee a greater demand for raw materials in the future due to the increase in economic activity.

The main currencies that tend to rise during the periods of “risk aversion” are the US dollar (USD), the Japanese yen (JPY) and the Swiss Franco (CHF). The dollar, because it is the world reserve currency and because in times of crisis investors buy American public debt, which is considered safe because it is unlikely that the world’s largest economy between in suspension of payments. The Yen, for the increase in the demand for Japanese state bonds, since a great proportion is in the hands of national investors who probably do not get rid of them, not even in a crisis. The Swiss Franco, because the strict Swiss bank legislation offers investors greater protection of capital.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.