- The Mexican weight advances as inflation trends and the feeling of risk support the continuous strength of the currency.

- It is expected that Banxico’s next decision on Thursday will shape the short -term address of the weight.

- The USD/MXN falls below the key support, with more fallen possible if the bearish pressure persists.

The Mexican peso (MXN) records a second consecutive day of profits on Wednesday against the US dollar (USD), falling below 19.40 before key comments from the Federal Reserve officials (FED) that could influence the monetary policy perspectives.

At the time of writing, the USD/MXN is traded 0.32% lower during the European session, since the markets continue to digest the softest data of the American CPI on Tuesday, reducing the differentials of interest rates and showing an investment feeling resilient towards emerging markets.

The US Consumer Price Index (CPI) report, published on Tuesday, was below expectations, pointing to greater relief in inflation and reinforcing market confidence in a possible rate cut by the Federal Reserve later this year. With the Fed keeping the rates without changes in their last meeting, the markets continue to assess the first rate cut for September. However, the next comments of the Central Bank officials will be crucial to determine if this schedule is maintained.

On Wednesday, Vice President Philip Jefferson, a voting member, and the president of the Fed of San Francisco, Mary Daly, a non -voting member, are scheduled to speak.

Their comments will offer a first vision of how the Federal Open Market Committee (FOMC) is interpreting the recent softest inflation data.

This prepares the stage for Thursday, when the president of the FED, Jerome Powell, will take the prominence. Their comments will be examined closely in search of any change in the tone of politics after the last report of the CPI, being the short -term address of the US dollar particularly sensitive to any Dovish or Hawkish signal of these key appearances.

Banxico is expected to cut rates again as the differential is reduced

The Bank of Mexico (Banxico) will announce its last decision on interest rates on Thursday at 7:00 p.m., and analysts widely expect a third consecutive cut of 50 basic points (0.5%), which would carry the reference rate to 8.5%.

The moment is especially significant given the contrast in the direction of politics between the US and Mexico.

With the Fed hoping to keep the stable rates up to at least September and Banxico accelerating its relief cycle, the narrowing of the interest rates differential is reducing the advantage of Mexican weight performance.

Although Mexico’s inflation perspectives support greater relief, the diminished attractiveness of the peso in relation to the dollar could weigh on the MXN in the short term, particularly if Fed officials oppose the expectations of imminent rates cuts after the softest data of the CPI.

Daily summary of the Mexican peso: Relief of Banxico, divergence of the FED and commercial risks of the USA

- Banxico has cut rates in six consecutive meetings since August, so a 0.50% cut on Thursday would mark a cumulative reduction of 2.5% in seven decisions.

- In contrast, the Fed has cut rates three times since July, reducing its reference rate of 5.25% -5.50% to 4.25% -4.50% for January.

- The growing commercial tensions with the US threaten the economy driven by Mexico’s exports, since the US represents more than 80% of Mexican exports; Tariffs could interrupt manufacturing, weaken investor confidence and decelerate economic growth.

- US has imposed 25% tariffs on Mexican goods not covered by the T-MEC, including steel and aluminum, citing concerns about border security and fentanyl traffic.

- According to Reuters, Mexico’s Minister of Economy, Marcelo Ebrard, has proposed to initiate the review of the T-MEC this year, before the formal timeline of 2026, stating that the objective is to “give investors and consumers. The T-MEC is the basis of American trade, which regulates more than 1.5 billion dollars in annual trade and ensures the stability of cross-border supply chains, jobs and investments.

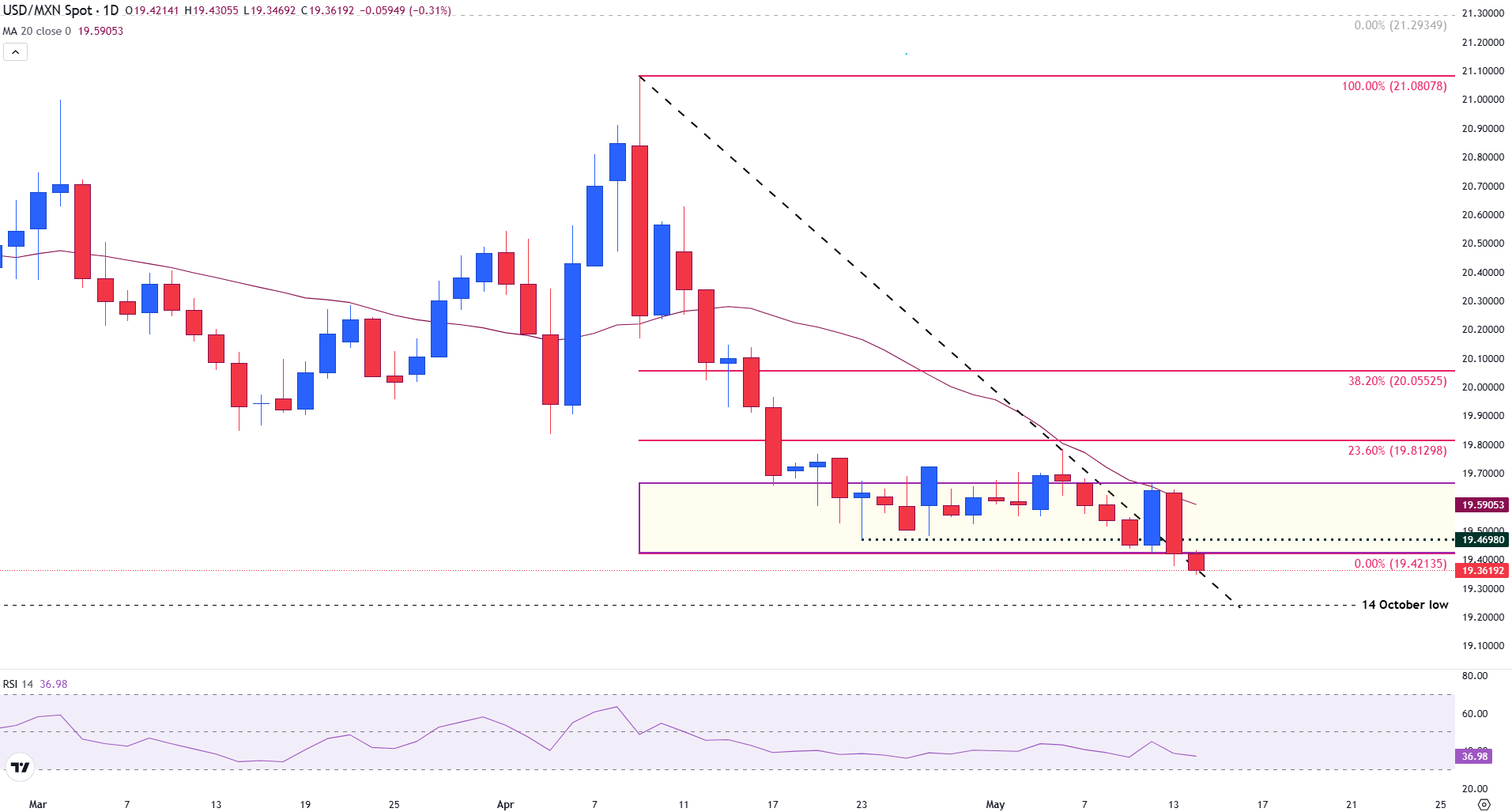

USD/MXN breaks down as the strength of the weight drives the bearish rupture

The USD/MXN extends its fall on Wednesday after Tuesday, breaking below the key horizontal support in the minimum of April 19.42.

The torque has now left the consolidation range of one month, marked by multiple attempts to recover above the 20 -day mobile average in 19.59 and the Fibonacci setback level of 23.6% of the fall of April in 19.81. With this decisive movement down, the weight has reached its strongest level since October, reinforcing a bearish break.

The Relative Force Index (RSI) in 36.86 confirms the increase in the downward momentum, although it is not yet oversized, leaving room for more losses.

USD/MXN daily graphics

If the bassists maintain control, the next support zone is around 19.30, near the oscillation minimum of October 14.

However, a daily closure above 19.42 would neutralize the bearish structure, exposing the torque to a possible rebound around 19.81 and, if the momentum accumulates, towards the psychological level of 20.00, which is aligned with the Fibonacci level of 38.2% in 20.06.

BANXICO FAQS

The Bank of Mexico, also known as Banxico, is the central bank of the country. Its mission is to preserve the value of the Mexican currency, the Mexican weight (MXN), and set the monetary policy. For this, its main objective is to maintain low and stable inflation within the target levels – in or close to its 3%target, the midpoint of a tolerance band between 2%and 4%.

The main Banxico tool to guide monetary policy is the fixation of interest rates. When inflation is above the goal, the bank will try to control it by raising the rates, which makes the debt of homes and companies more expensive and, therefore, cools the economy. The highest interest rates are generally positive for Mexican weight (MXN), since they lead to higher yields, which makes the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken the MXN. The rate differential with the dollar, or the way in which Banxico is expected to set interest rates compared to the United States Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year and its monetary policy is very influenced by the decisions of the United States Federal Reserve (Fed). Therefore, the decision -making committee of the Central Bank usually meets a week after the Fed. In this way, Banxico reacts and sometimes anticipates the monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised the rates, Banxico first did it in an attempt to reduce the possibilities of a substantial depreciation of the Mexican weight (MXN) and avoid capital outputs that could destabilize the country.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.