- The Mexican Peso recorded new gains against the US Dollar during trading on Monday.

- Mexican inflation is expected to decrease considerably, which would boost expectations of cuts from Banxico.

- Seasonal flows usually boost the Mexican peso at the end of the first quarter.

The Mexican Peso (MXN) gained ground against the US Dollar (USD) on Monday, while counterbalancing rate cut expectations push the USD/MXN pair lower on the charts. Common seasonal flows see bullish momentum filtering into the Mexican peso during the first quarter, and markets anticipate a drop in Mexican inflation.

The Bank of Mexico, also known as Banxico, is generally expected to cut interest rates again. The main Mexican reference rate remains at historic highs of 11.25% since April 2023. US labor numbers are also in the mix, with Friday's Non-Farm Payrolls (NFP) on tap. Hopes that the Federal Reserve (Fed) will reduce market interest rates also weigh on Monday's market action.

Daily summary of market movements: Bets on a Banxico rate cut push the peso to six-week highs

- Mexico inflation due to be released on Thursday is expected to show a continued decline in Mexican price growth, with a forecast of 0.12% for February compared to 0.89% previously.

- Mexican inflation in January (0.89%) was the highest in the last 22 months.

- This week's US jobs numbers begin with Wednesday's ADP employment change for February, which is forecast to rise to 150,000 from 107,000 previously.

- Fed Chair Jerome Powell will testify before the Financial Services Committee on the semiannual monetary policy report on Wednesday and Thursday.

- US February NFP on Friday is expected to fall to 200,000 from 353,000 previously, and investors will be watching for revisions to earlier data.

- The US weekly data agenda begins on Tuesday, with the ISM services Purchasing Managers' Index (PMI) forecast to fall to 53.0 from 53.4 in February.

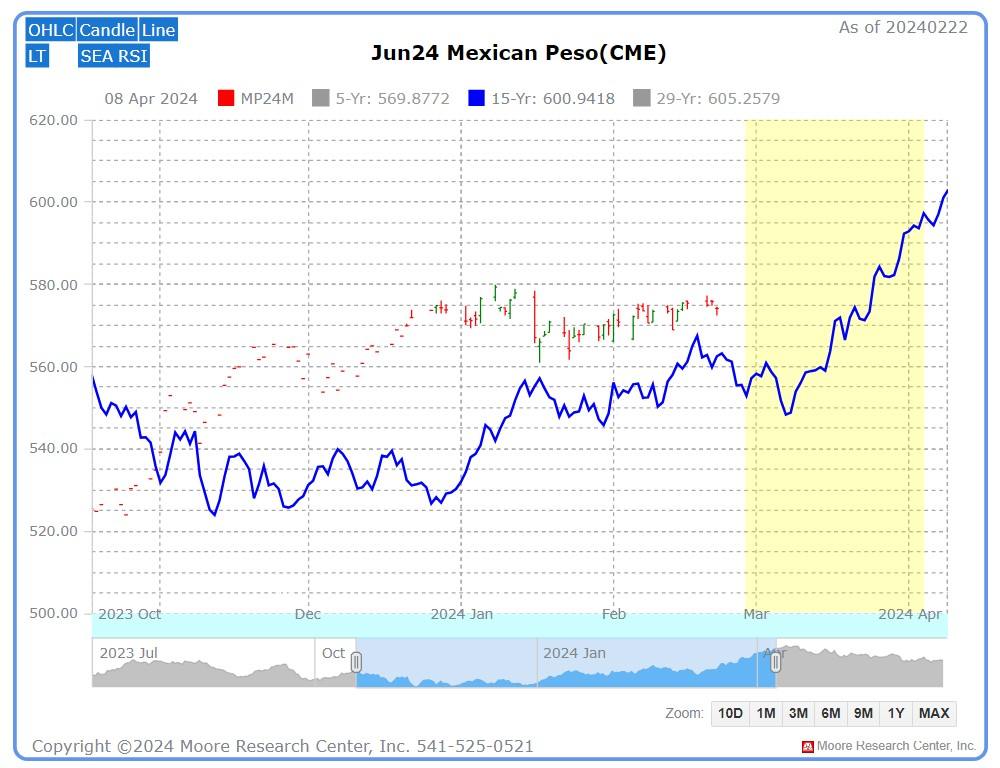

- The Mexican peso usually finds bullish interest heading into the second quarter, according to the Moore Research Center (MRCI).

- MRCI: The Mexican peso has closed higher from February 28 to April 4 approximately 93% of the time in the last 15 years.

The Mexican Peso (MXN) is rising on Monday, taking the USD/MXN pair below the 17.00 zone for the first time since mid-January. The pair is down nine tenths from last week's high bids near 17.12.

The USD/MXN pair is on track to close in the red for the third day in a row, and bids are falling into chart territory last seen in January. The 2024 technical floor lies at the January low at 16.80, and the pair continues to fall away from the 200-day simple moving average (SMA) at 17.25.

USD/MXN hourly chart

USD/MXN daily chart

Frequently Asked Questions about the Mexican Peso

What is MXN?

The Mexican Peso is the legal tender of Mexico. The MXN is the most traded currency in Latin America and the third most traded on the American continent. The Mexican Peso is the first currency in the world to use the $ sign, prior to the later use of the Dollar. The Mexican Peso or MXN is divided into 100 cents.

What is Banxico and how does it influence the MXN?

Banxico is the Bank of Mexico, the country's central bank. Created in 1925, it provides the national currency, the MXN, and its priority objective is to preserve its value over time. In addition, the Bank of Mexico manages the country's international reserves, acts as a lender of last resort to the banks and advises the government economically and financially. Banxico uses the tools and techniques of monetary policy to meet its objective.

How does inflation impact the MXN?

When inflation is high, the value of the Mexican Peso (MXN) tends to decrease. This implies an increase in the cost of living for Mexicans that affects their ability to invest and save. At a general level, inflation affects the Mexican economy because Mexico imports a significant amount of final consumption products, such as gas, fuel, food, clothing, etc., and a large amount of production inputs. On the other hand, the higher the inflation and debt, the less attractive the country is for investors.

How does the Dollar influence the Mexican Peso (MXN)?

The exchange rate between the USD and the MXN affects imports and exports between the United States and Mexico, and may affect demand and trade flows. The price of the Dollar against the Mexican Peso is affected by factors such as monetary policy, interest rates, the consumer price index, economic growth and some geopolitical decisions.

How does the Fed's monetary policy affect Mexico?

The exchange rate between the USD and the MXN affects imports and exports between the United States and Mexico, and may affect demand and trade flows. The price of the Dollar against the Mexican Peso is affected by factors such as monetary policy, interest rates, the consumer price index, economic growth and some geopolitical decisions.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.