- The Mexican Peso maintains its upward trend despite the bad data from Mexico and risk aversion.

- The wide interest rate differential between Mexico and Western countries continues to favor the Peso in the carry trade.

- USD/MXN reaches the conservative target of its range breakout.

The Mexican Peso (MXN) wavered between marginal gains and losses on its key pairs on Tuesday after shrugging off poor Mexican retail sales data and hawkish comments from Federal Reserve (Fed) spokespeople on Monday, and continues to rise.

The wide interest rate differential between Mexico and most major economies – with relatively higher interest rates in Mexico (11.00%) attractive to carry trade operators – is a key factor driving the upward trend of the MXN, with little prospect of the gap closing soon.

USD/MXN is trading at 16.55, EUR/MXN at 17.98 and GBP/MXN at 21.05, at the time of writing.

The Mexican peso ignores the bad data

The Mexican Peso is trading relatively flat on Tuesday despite recent data showing a drop in Mexican retail sales, both on a monthly and annual basis.

Although data indicated that the high interest rates imposed by the Bank of Mexico (Banxico) are likely having the desired effect of cooling the economy, Banxico has given no signs that it is in a hurry to reduce interest rates yet.

In fact, on Friday, Banxico Deputy Governor Irene Espinosa said she thought interest rates should remain at their current level until inflation has been sustainably reduced.

The gloomy mood of the market limits the rise of the Peso

However, Tuesday's gloomy market environment is limiting the peso's gains as investors pull out of risk assets and commodities, including the MXN, fearing that high interest rates are here for the day. stay. Asian stock markets are down, and oil, metals and raw materials are doing the same.

The shift in sentiment comes as comments from central bankers in both the US and Australia suggest they are not only reluctant to cut interest rates in the near future, but are even discussing raising them. .

In the US, the president of the Federal Reserve Bank of Cleveland, Loretta Mester, he claimed that inflation risks “lean to the upside,” that the Fed could “even raise (rates)” if inflation rises, and that it is “no longer appropriate” to expect the Fed to make three cuts this year.

The minutes of The RBA's May meeting, published on Tuesday morning, shows that the board of governors discussed the possibility of raising interest rates. It was the first time in many months that there was talk of further tightening of monetary policy.

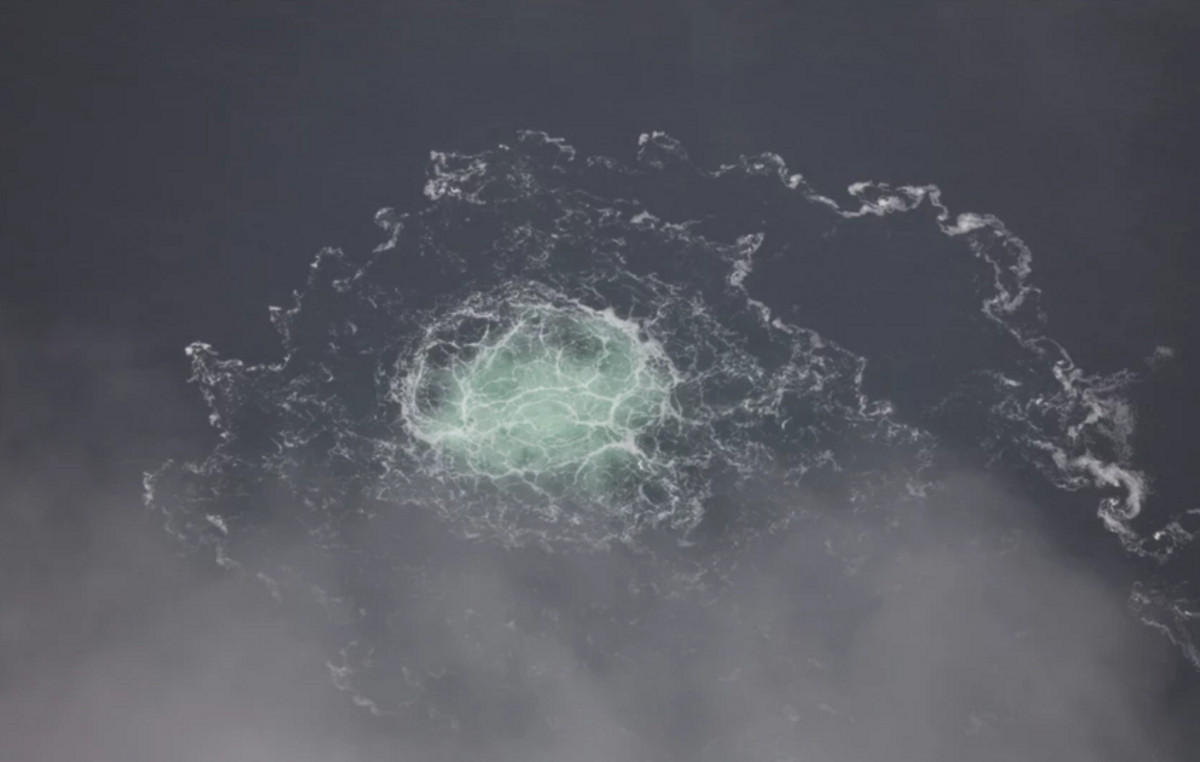

Technical analysis: USD/MXN reaches its first bearish target

The USD/MXN (or the number of pesos that can be purchased with one US Dollar) fell on Tuesday, continuing its general bearish trend of recent weeks.

USD/MXN 4-hour chart

USD/MXN is falling into a short-term bearish trend within a descending channel that favors short bets over long bets.

The pair just hit its conservative price target for the breakout of the mid-April-May range at 16.54. This is calculated as the 0.618 Fibonacci ratio of the range height extrapolated downward.

If the downtrend continues, USD/MXN could reach 16.34, the most bearish target, calculated by taking the full height of the range and extrapolating it downwards.

The Relative Strength Index (RSI) remains oversold, indicating that traders should not increase their short positions. If the RSI breaks out of oversold conditions and returns to neutral territory above 30, it would be a signal to close existing short positions as a correction is likely underway. However, once the correction is over, the descending channel is expected to continue taking prices lower in line with the dominant bearish trend.

Since the medium and long-term trends are also bearish, the probabilities favor declines even more.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.