- The Mexican peso is strengthened against the US dollar while Moody’s’s reduction on US debt weighs on the dollar.

- The Federal Reserve (FED) is expected to review the discount rate on Monday, the rate at which commercial banks are charged.

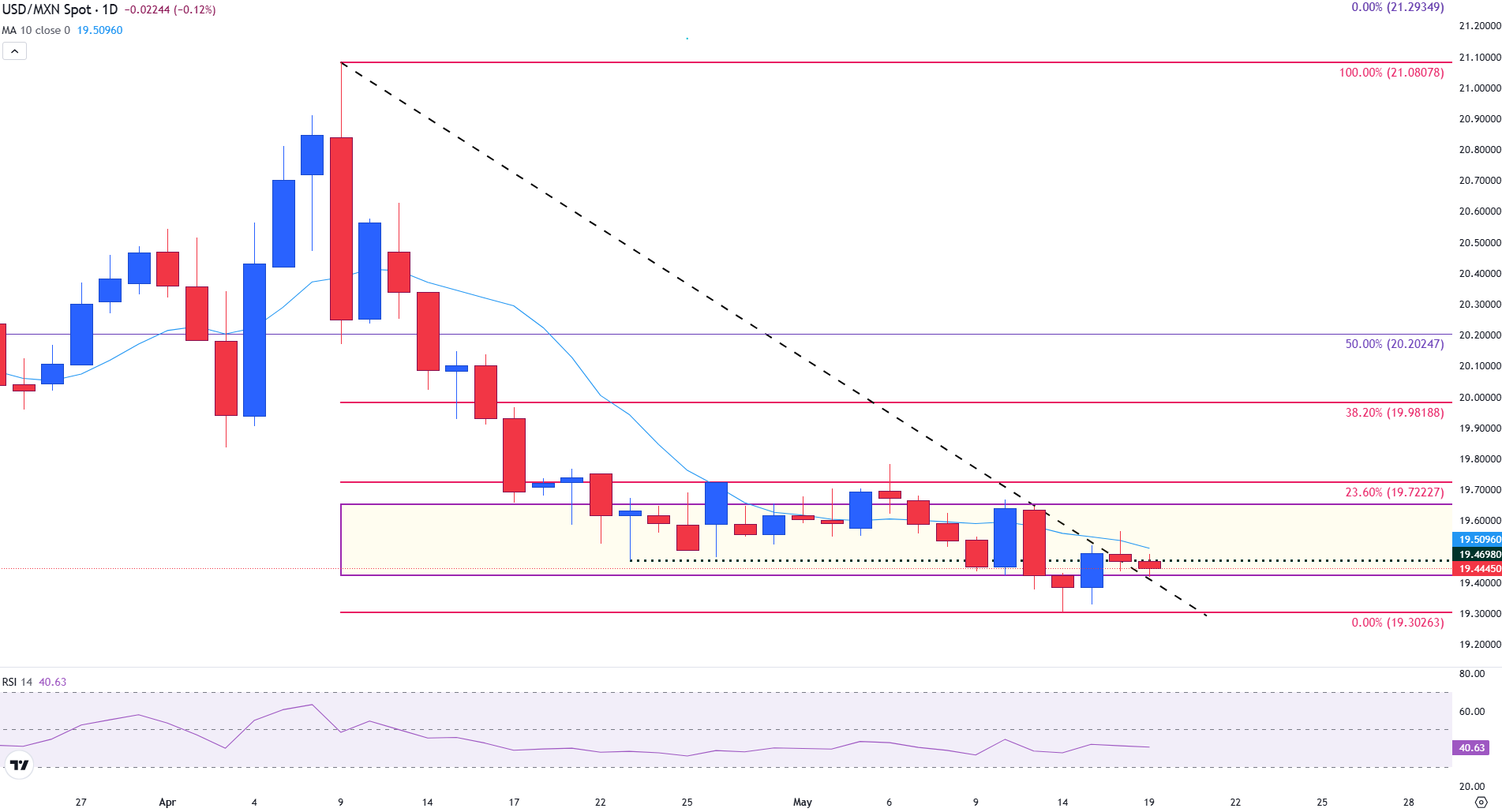

- The USD/MXN remains cautious below the critical psychological resistance in 19.50.

The Mexican peso (MXN) remains firm against the US dollar (USD) while the markets react to the renewed uncertainty after the reduction of Moody’s of the US credit rating the decision to lower the sovereign rating to AA1 from AAA has caused a reevaluation of the status of the US dollar. Although MXN benefits slightly from the weakness of the USD, the broadest tone of market risk aversion causes the Mexican currency to fall against other pairs such as the euro (EUR), the sterling pound (GBP) or the Australian dollar (Aud).

Although the dollar has maintained its global reserve status and its attractiveness as a safe refuge, the growing concerns about commercial tensions, the instability of tariffs and a deteriorated tax panorama are weighing about the feeling. The winds against structural, including the growing US debt and moderate growth prospects, have moderated interest rates expectations and contributed to the general weakness of the dollar.

At the time of writing, the USD/MXN is quoted about 19.43, lowering 0.12% in the day. The old psychological support in 19.50 has now become a resistance barrier, with market participants observing whether the weight can maintain their bullish impulse.

Daily summary of the Mexican weight: USD pressed by the reduction of Moody’s and the Fed approach

- Moody’s became the last important credit qualification agency to reduce the sovereign qualification of the US, which triggered an increase in the yields of the treasure bonds and a fall in the DXY dollar index.

- As the perceived credit risk increases, the US must offer higher interest rates to attract investors that could otherwise move capital to alternative assets of safe refuge. Although the increase in returns tends to be favorable for the USD, the broader context of fiscal instability has the potential to weigh over the dollar.

- The comments of the Fed speakers throughout the day can provide information on the path of the US monetary policy, influencing the performance of the US dollar in front of its global counterparts, including USD/MXN.

- Five Fed officials are on the agenda: the president of the Fed of Atlanta, Raphael Bostic, the vice president of the FED, Philip Jefferson, the president of the Fed of New York, John Williams, the president of the Fed of Dallas, Lorie Logan, and the president of the Fed of Minneapolis, Neel Kashkari.

- Persistent commercial tensions between Mexico and the United States continue to create downward risks for weight. With approximately 80% of Mexican exports directed towards the US, any interruption or uncertainty related to tariffs could magnify market volatility in the pair.

Technical analysis of the Mexican weight: USD/MXN remains while bulls and bears fight below 19.50

The USD/MXN continues to consolidate within a narrow range, staying below the simple mobile average (SMA) of 10 days, currently in 19.51, which acts as dynamic resistance. The torque remains limited below the Fibonacci recoil level of 23.6% of October from October to February in 19.72, reinforcing the broader bearish bias. Despite the repeated attempts to recover higher ground, the price action remains confined within a consolidation zone marked between 19.40 and 19.70, with a clear downward inclination.

USD/MXN daily graphics

A decisive breakdown below 19.40 – the lower limit of the current range – could expose the minimum of May and the key support in 19.30. On the positive side, the bulls would need a daily closure above 19.72 to change the impulse and point to the 38.2% decline level in 19.98, followed by the psychological barrier of 20.00.

The relative force index (RSI) is flattened in 41.07, pointing out a slight bassist impulse and increasing the risk of a continuation down.

US dollar FAQS

The US dollar (USD) is the official currency of the United States of America, and the “de facto” currency of a significant number of other countries where it is in circulation along with local tickets. According to data from 2022, it is the most negotiated currency in the world, with more than 88% of all global currency change operations, which is equivalent to an average of 6.6 billion dollars in daily transactions. After World War II, the USD took over the pound sterling as a world reserve currency.

The most important individual factor that influences the value of the US dollar is monetary policy, which is determined by the Federal Reserve (FED). The Fed has two mandates: to achieve price stability (control inflation) and promote full employment. Its main tool to achieve these two objectives is to adjust interest rates. When prices rise too quickly and inflation exceeds the 2% objective set by the Fed, it rises the types, which favors the price of the dollar. When inflation falls below 2% or the unemployment rate is too high, the Fed can lower interest rates, which weighs on the dollar.

In extreme situations, the Federal Reserve can also print more dollars and promulgate quantitative flexibility (QE). The QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is an unconventional policy measure that is used when the credit has been exhausted because banks do not lend each other (for fear of the default of the counterparts). It is the last resort when it is unlikely that a simple decrease in interest rates will achieve the necessary result. It was the weapon chosen by the Fed to combat the contraction of the credit that occurred during the great financial crisis of 2008. It is that the Fed prints more dollars and uses them to buy bonds of the US government, mainly of financial institutions. Which usually leads to a weakening of the US dollar.

The quantitative hardening (QT) is the reverse process for which the Federal Reserve stops buying bonds from financial institutions and does not reinvote the capital of the wallet values that overcome in new purchases. It is usually positive for the US dollar.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.