By Javier Blas

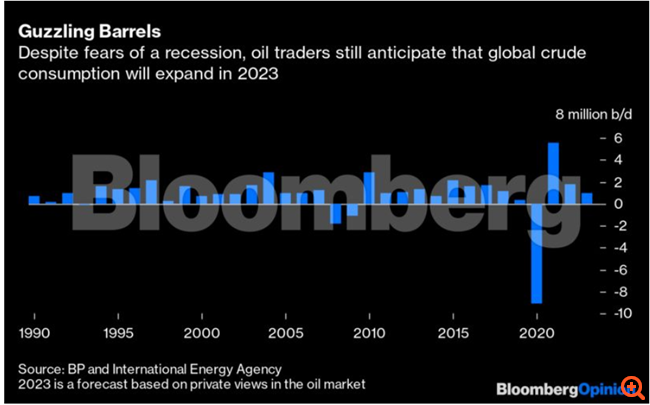

Wall Street may be full of talk of a recession next year, but the energy market is another story. Most traders, policymakers and analysts see oil demand growing in 2023 and supply struggling to keep up.

In private discussions, Western officials are worried that Brent crude will soon reach $ 150 a barrel from about $ 120 today. Some fear it will continue to rise, with the wildest gossip talking about oil reaching $ 175 or even $ 180 by the end of 2022, amid rising demand after Covid and European sanctions against Russia. . And the shock is not going to end this year.

Amid widespread fears of a spike in oil prices this summer, a new storm is looming on the horizon: the oil shock will not end in 2022. It is almost certain to spread next year.

The International Energy Agency (IEA) will release its first oil supply and demand balance estimate for 2023 on Wednesday – marking the start of the shift to next year, as investors increasingly focus on this.

Already, money has flowed into Brent delivery in December 2023, raising its price close to $ 100 – a clear sign that traders are seeing the “close offer” market last. The prospect of higher oil prices for a longer period of time will intensify global inflationary pressures and erode the profit margins of companies in the wider manufacturing sector.

Calculations

While everyone is waiting for the ILO forecast, commodity trading companies, oil companies and OPEC member countries, as well as western consumer countries, have already made their calculations. Consensus on oil demand in 2023 ranges between an additional 1 million barrels per day and an additional 2.5 million barrels. By 2022, it is likely to have increased by 1.8 million barrels per day, according to the ILO, to about 100 million. Typically, an annual increase in demand of more than 1 million per day is considered strong enough.

The supply side does not look much more auspicious. At best, oil traders expect Russia to maintain its current level of about 10 million barrels per day, down about 10% from the period before its invasion of Ukraine. But many believe that another 1 million barrels or even 1.5 million barrels can fall by another.

The OPEC + cartel, which started in 2022 with abundant overcapacity, is also reaching production limits. “With the exception of two or three members, everyone else is moving to their limits,” OPEC Secretary-General Mohammad Barkido said last week, referring to Saudi Arabia and the United Arab Emirates.

The result is likely to be a third consecutive year of depletion of existing oil reserves – following a sharp drop in global crude and refined stocks over the past 18 months.

So far this year, Western governments have mitigated the impact of falling supply by releasing most of the barrels from their strategic oil reserves in their history. Without further ado, these emergency release releases will expire in November, removing the largest cushion currently on the market.

Refining is a factor in further price spurts

The refining industry represents another problem. The world has virtually exhausted its surplus capacity to convert crude into usable fuels such as gasoline and diesel. As a result, refineries’ profit margins have exploded, which in turn means consumers are paying much more to fill their tanks than oil prices suggest.

The industry measures refining margins using a rough calculation called “3-2-1 crack spread”: three barrels of West Texas Intermediate crude oil are refined into two barrels of gasoline and a fuel distillate, such as diesel. From 1985 to 2021, the spread – the price gap between crude and refined products – averaged about $ 10.50 a barrel. Last week, it jumped to an all-time high of almost $ 61.

Very few new refineries will be operational in the next 18 months, suggesting that margins may remain high for the rest of the year, but also in 2023.

The 2023 picture has some big unknowns X – and most of them are related to government action. Each of these question marks can shift supply and demand by 1 to 1.5 million barrels per day, more than enough to drive up prices significantly.

Most important is the duration of the oil sanctions against Russia, which are linked to its invasion of Ukraine. The others are the policy of zero tolerance in China’s Covid, the Western sanctions against Iran and Venezuela and the release of strategic reserves.

The duration and not the amount of the “key” price for the crisis

Oil price shocks are usually remembered for their height. But that is only half the question. The other half is their duration. And that is where the prospect of 2023 forecasts comes in.

The last jump in the price of oil was short. After a slight rise in prices in 2007 and early 2008, the rally accelerated in May 2008, with prices climbing above $ 120. By July, oil prices had reached a high of 147.50. dollars, however in early September, had fallen below $ 100. Brent was trading below $ 40 in December 2008.

So far, the 2021-22 oil price rally has been a copy of 2007-08. Price charts are almost completely identical. However, any hope that the oil market will follow the pattern of what happened 14 years ago misinterprets reality. Oil prices are not going to collapse.

A better analogy would be the period between 2011 and 2014: oil prices never returned to the all-time high of 2008, but remained above $ 100 almost non-stop for more than 40 months.

Brent is already moving at an average of $ 103 a barrel in 2022, above the annual average of 2008, which was $ 98.50 a barrel. We may see even higher prices in the next six months. However much more important is how long these prices will remain high. At the moment, the end of the crisis does not appear on the horizon.

Source: Bloomberg

I’m Ava Paul, an experienced news website author with a special focus on the entertainment section. Over the past five years, I have worked in various positions of media and communication at World Stock Market. My experience has given me extensive knowledge in writing, editing, researching and reporting on stories related to the entertainment industry.