The distribution of Ethereum options expiring in June indicates increased bets on the asset moving above $3,600. This is evidenced by the data Deribit.

The volume of open call options at the specified exercise price increased to $161.4 million. It was higher only at the strike price of $6,500 ($193.9 million).

Generally OI for June calls is $1.89 billion – 2.37 times more than for puts ($795.6 million).

According to The Block, such a high concentration of call options not only indicates the optimism of market participants. It may also indicate potential support for the underlying asset.

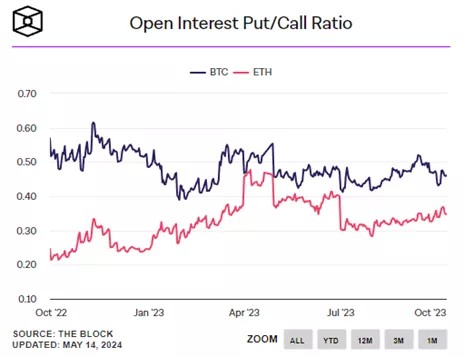

The put to call ratio is 0.35. Values below one indicate the predominance of bullish sentiment.

Earlier, Glassnode linked Ethereum’s lag behind Bitcoin after halving with capital rotation.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.