Of Leonida Stergiou

From the beginning of 2020 until today, that is, from the moment the pandemic with its consequent lockdown and the sharp drop in economic activity showed its threatening teeth, governments and monetary authorities have decided not to be sparing in their support packages. In Greece, banks received emergency liquidity from the ECB over 38 billion euros, fiscal support measures reached 40 billion euros, while banks and management companies proceeded with installment suspensions, loan write-offs and arrangements totaling about 50 billion. euro.

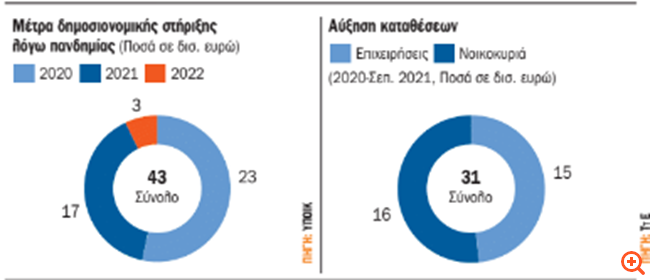

This is a very brief account of the support that households and businesses have received since the beginning of the pandemic. Some of the support measures are still in force, such as loan subsidies, but also the expansion of others, such as the “haircut” of repayments and other measures over 9 billion by 2023, raising the total size of budget support to 42.7 billion. Euros, as recently mentioned in Parliament by the Minister of Finance, Mr. Christos Staikouras, revising upwards the previous amount that was announced last July (41 billion).

Debt increase

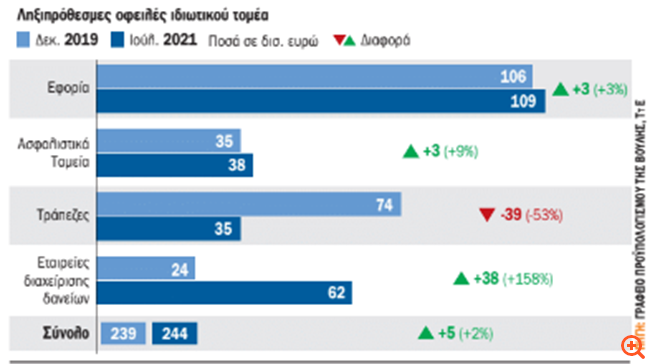

All these measures, as well as the sharp and forced reduction of consumer spending and investment, could not change the increasing course of overdue debts of the private sector to the State and banks. On the contrary, there is an increase of 5 billion euros, which comes mainly from debts to the tax authorities and the insurance funds. One wonders how much the overdue debts would have increased during the pandemic crisis if not for all this support and what the consequences would have been for the economy, society and the next day, that is, the restart.

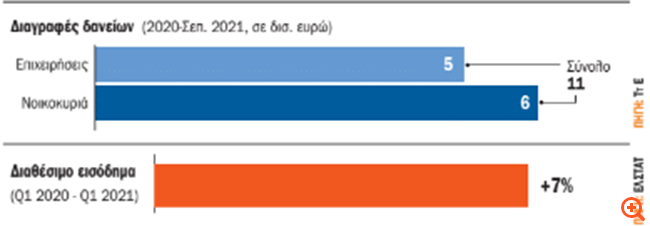

Regarding the red loans, the securitizations carried out from the end of 2019 until today, mainly through the “Hercules” program, transferred non-performing loans from the banks’ balance sheets to the management companies. The report shows that red loans from banks decreased by 39 billion and red loans under management increased by 38 billion. Thus, despite the regulations and write-offs, the reduction of non-performing loans for households and businesses is 1 billion. . euro. This, perhaps, is the only component of overdue private debt that has declined during the pandemic.

Development

The increase in private debt (whether serviced or not) could also have come from sustainable borrowing for growth-friendly investments. However, this is not the case so far, as the net credit expansion is negative. Therefore, we need to look at the side of deposits, consumption and equity investment. Here we will see an increase in the total savings of households and businesses and investments, which have become apparent in the real estate market and which are estimated at more than 1.5 billion euros. In terms of consumption, it has increased, but has not yet reached pre-crisis levels.

Deposits

But what about the overdue debts of the private sector and why are they not reduced by an increase in deposits by 31 billion euros? The answer, obviously, is not easy, as it should take into account the uncertainty, the creation of a “cushion” for restarting and avoiding padlocks in businesses and households with the opening of the economy, but also social shocks that can be caused from unemployment and insecurity.

The dangers

Moreover, the opening of the economy has found economies facing the spectrum of inflation and high energy prices internationally, while the epidemiological data lately are far from the optimistic scenario. In addition, in this difficult answer, the so-called statistical averages should be taken into account, which may give the big picture, but do not explain each case separately.

Thus, the increase of deposits by 31 billion euros, which brought an increase in disposable income in the second quarter of 2021, on an annual basis, by 7%, is accompanied by a slight increase in consumption, but not to pre-COVID levels, with an increase in investment expenditure, which is estimated at higher levels thereafter, with a reduction in padlocks and unemployment. At the same time, however, it is accompanied by an increase in total overdue debts by 5 billion euros, ie to 244 billion euros (compared to 239 billion before the pandemic), exceeding 145% of GDP. If, in fact, all the obligations of the private sector are taken into account, ie the serviced bank loans and other up-to-date debts, then, according to the Bank of Greece, the private debt reaches 345 billion euros, ie 185% of GDP.

Per capita private debt

This is a huge amount for the size of the Greek economy, as it corresponds to almost 85% of the per capita income. That is, of the 11,662 euros that the ECB estimates of the Greek per capita disposable income, 9,900 euros are debts. In fact, the ECB estimates that of these 11,662, about 680 euros came from an increase in deposits in the pandemic and from loan repayments (mainly from households), as the credit expansion is negative.

There are, however, other readings. Of the total overdue debt to the tax authorities, about 25 billion are considered uncollectible, so the total debt is reduced. Receivables or support also include repayable advances, which are borrowed, but, apparently, are not repaid in full.

Threat of new red loans

Whatever the data analysis, there are some facts that most economists seem to agree with, at least those who oversee the banking and financial system. For months, with the first encouraging signs of growth, consumption, declining unemployment and red loans, but also the padlocks, Frankfurt has not stopped warning that the crisis is not over and, above all, has not been captured. The warnings from the ECB, the SSM, but also from the Bank of Greece, are continuous and had started before the inflation and the outbreak of the fourth wave of the pandemic appeared.

High private debt, which may come from borrowing for productive investment, may mean growth. At a time of shrinking credit expansion and in an economy that sees rising disposable income, falling unemployment and limited padlocks in the midst of a crisis, rising private debt can become a serious threat and a time bomb. This is one of the main arguments used by the ECB and the SSM when warning banks to take higher risk forecasts, as the crisis has not yet been fixed.

According to the international literature, cited by ECB studies, as well as analysis of historical data, high private debt makes an economy more vulnerable to external crises. The example of the fiscal crisis that hit Greece from a foreign bank has spread throughout the real economy and the financial system. It hit the private sector, boosted unemployment, slashed incomes and boosted red loans.

Today, a new wave of pandemics is under way, with soaring energy prices and inflation directly threatening households and businesses, which already owe more than a GDP. Despite the positive prospects of the Greek economy and the transience of inflation, which the ECB points out, the same economists do not hide their concern about the possibility of stagnant inflation. That is, to trap large liquidity between higher interest rates than growth rates.

.

Source From: Capital

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.