- The WTI crude rises above $ 62 while the OPEC+ indicates that there will be no immediate changes in the current production policy.

- Oil prices rise to the expectations that supply increases will continue to be limited in the short term.

- The eight central members of the OPEC+ meet on Saturday to decide on a proposed increase of 411,000 barrels per day (BPD) for July.

The organization of oil exporting countries and its allies (OPEP+) met at its Vienna headquarters on Wednesday to evaluate the current state of the oil market.

Although immediate changes were announced in the production policy, the meeting laid the foundations for continuing the discussions on the production base lines of 2027 and the potential for future production adjustments in the coming months.

At the time of writing, WTI crude oil is quoted above $ 62, earning more than 1.50% in the day while the markets respond to the cautious posture of the group.

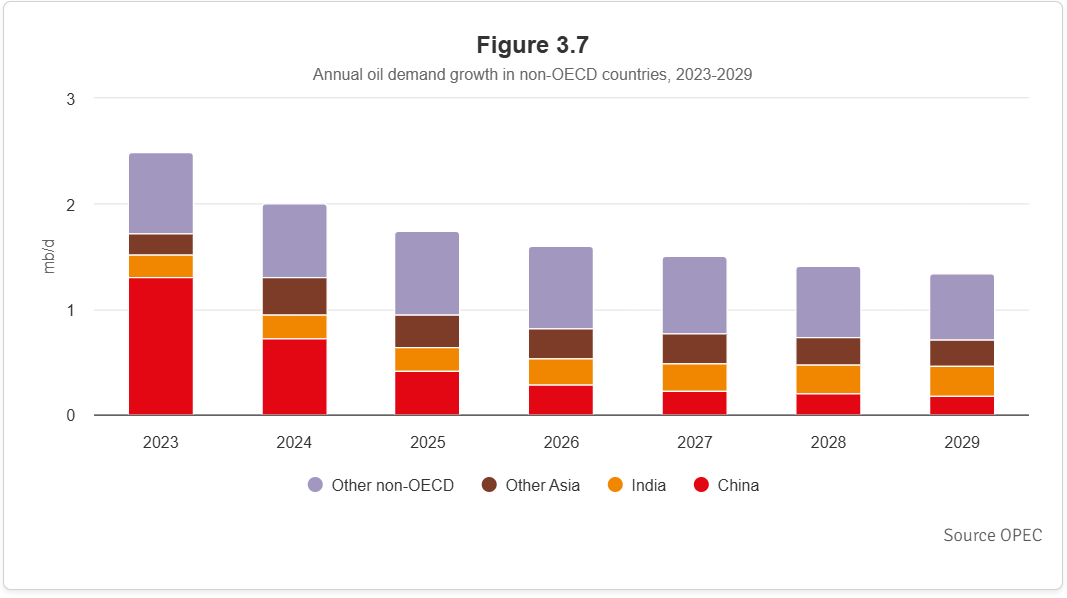

A key context for Wednesday’s meeting was the evolutionary trajectory of global oil demand, particularly in economies not belonging to the OECD. According to the last projections of the OPEC, the growth of the annual demand is expected to make up until 2029, with the contribution of China decreasing drastically after 2023. In contrast, it is projected that the economies “others not OECD” will boost most of the growth of the demand beyond 2025, even when the total volumes begin to moderate.

*NO OECD refers to countries that are not members of the Organization for Economic Cooperation and Development (OECD). These are typically emerging and developing economies, in contrast to OECD nations, which are mostly advanced and high income.*

Source: OPEC

This demand panorama directly reported the cautious approach of the OPEC+ towards the planning of future production.

He also stressed the urgency behind the ongoing conversations to review the production lines of 2027, since countries such as the EAU and Iraq seek higher fees aligned with their growing capacity to serve emerging markets.

With demand patterns by changing and long -term growth slowing down, the alliance is under growing pressure to balance supply discipline with internal quotas reform, which makes the result of these baseline negotiations fundamental for the long -term strategy of OPEC+.

On Saturday, a meeting separated by videoconference will be held between the eight key OPEC+producers. Members include Saudi Arabia, Russia, the United Arab Emirates (EAU), Kuwait, Iraq, Algeria, Oman and Kazakhstan.

The main objective of this meeting is to decide on a proposed increase of 411,000 barrels per day (BPD) in oil production for July, after similar adjustments in May and June.

This decision will be observed closely by the markets, since it underlines the continuous efforts of the OPEC+ to align the supply with the conditions of global demand in evolution and maintain price stability.

WTI FAQS oil

WTI oil is a type of crude oil that is sold in international markets. WTI are the acronym of West Texas Intermediate, one of the three main types that include the Brent and Dubai’s crude. The WTI is also known as “light” and “sweet” by its relatively low gravity and sulfur content, respectively. It is considered high quality oil that is easily refined. It is obtained in the United States and is distributed through the Cushing Center, considered “the crossing of the world.” It is a reference for the oil market and the price of WTI is frequently traded in the media.

Like all assets, supply and demand are the main factors that determine the price of WTI oil. As such, global growth can be a driver of the increase in demand and vice versa in the case of weak global growth. Political instability, wars and sanctions can alter the offer and have an impact on prices. OPEC decisions, a group of large oil -producing countries, is another key price factor. The value of the US dollar influences the price of WTI crude oil, since oil is mainly traded in US dollars, so a weaker dollar can make oil more affordable and vice versa.

Weekly reports on oil inventories published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) influence the price of WTI oil. Changes in inventories reflect the fluctuation of supply and demand. If the data show a decrease in inventories, it can indicate an increase in demand, which would raise the price of oil. An increase in inventories may reflect an increase in supply, which makes prices lower. The API report is published every Tuesday and that of the EIA the next day. Their results are usually similar, with a 1% difference between them 75% of the time. EIA data is considered more reliable, since it is a government agency.

The OPEC (Organization of Petroleum Exporting Countries) is a group of 13 nations oil producing that collectively decide the production quotas of member countries in biannual meetings. Their decisions usually influence WTI oil prices. When OPEC decides to reduce fees, it can restrict the supply and raise oil prices. When OPEC increases production, the opposite effect occurs. The OPEC+ is an expanded group that includes another ten non -members of the OPEC, among which Russia stands out.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.