- Xau/USD falls below $ 3,300 while Trump tariff pauses improves the American feeling and dollar.

- Trump delays 50% tariffs to the EU until July 9, improving the mood of the market and weighing on the demand for safe refuge.

- DXY shoots 0.62% to 99.54, promoted by a maximum of four years in the confidence of the US consumer.

Gold prices recorded losses of almost 2%, falling below the figure of $ 3,300, while market participants celebrated the decision of US President Donald Trump to delay tariffs on the goods of the European Union. Consequently, an improvement in the appetite for the risk and the US dollar cutting some of the losses of last week weighed on the non -productive metal.

During the weekend, a call between Trump and the EU head, Ursula von der Leyen, ended with Washington’s decision to postpone 50% tariffs on EU’s assets until July 9. This change in the mood of investors caused refuge assets, except for the US dollar, and pushed global upward shares.

The US dollar index (DXY), which tracks the value of the green ticket in front of a basket of six currencies, rises more than 0.62% to 99.54, driven by an improvement in consumer’s confidence, which according to the Board Conference (CB) increased more in four years.

The news that Washington could be about to ensure additional commercial agreements in the short term added to the positive feeling among the operators. Fox Business News Gasparino, in an X publication, revealed that a framework between the US and India is close to being announced.

Other economic data in the US revealed that the requests for durable goods fell in April more than since October, with a strong decline in the business team due to uncertainty about tariffs and US fiscal policy.

Faith in gold for the rest of the week rests on the next US economic agenda will be attentive to the minutes of the last meeting of the Federal Reserve (Fed), the second estimate of the Gross Domestic Product (GDP) in the first quarter of 2025 and the Fed preferred inflation indicator, the Personal Consumption Price Index (PCE).

Daily Gold Market Movements: Precious Metal collapses by the strong US dollar and the solid confidence of the US consumer

- The yields of the US Treasury bonds remain stable. The 10 -year Treasure Note performance falls six basic points (PB) up to 4,446%. Meanwhile, real US yields also decreased by six basic points to 2,116%.

- Consumer confidence in the US in May improved from 85.7 to 98.0, with the recovery attributed to the truce over tariffs. Stephanie Guichard, a senior economist of the Conference Board, said: “The recovery was already visible before the commercial agreement between the US and China of May 12, but won an impulse later.”

- The requests for durable goods in the US disappointed investors, falling a -6.3% monthly in April, compared to the increase of 7.6% in March, but exceeded the contraction forecasts of -7.8%.

- The president of the Fed of Minneapolis, Neel Kashkari, said that interest rates should be kept unchanged until there is clarity on how higher tariffs affect price stability.

- Despite the context, the prospects for the price of gold remain optimistic due to the still fragile market mood over US assets, fueled by the growing fiscal deficit in the US, which led Moody’s to reduce the debt of the US government of AAA to AA1.

- In addition, Reuters revealed that “net imports of Gold from China through Hong Kong more than they doubled in April compared to March, and were the highest since March 2024, according to data.”

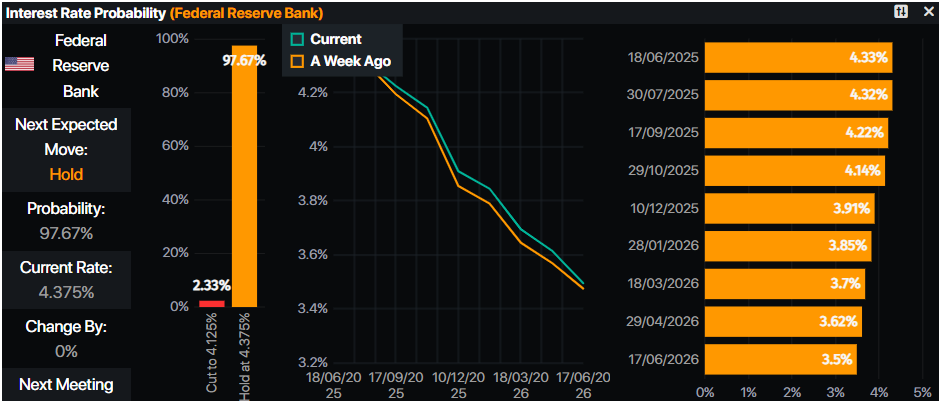

- The monetary markets suggest that the operators are valuing 46.5 basic points of relaxation towards the end of the year, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

Xau/USD technical perspectives: The price of gold goes back to challenge the $ 3,250

The price of gold remains stable, around the lower part of the figure of $ 3,300, but prepares to consolidate within the range of 3,250 $ -3,300 $ on. However, the upward trend remains intact, with buyers attentive to a decisive breakdown above $ 3,300, which could pave the way to test the peak last week of 3,365 $ before a challenging $ 3,400. More rise is above the maximum of May 7, $ 338.

On the bearish side, if gold falls below $ 3,250, a movement towards the confluence of the minimum of May 20 and the simple mobile average (SMA) of 50 days about 3,204/05 $ is expected.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.