- Gold falls 0.67% while the US limits tariffs on specific business partners, relieving fears on global trade.

- The increase in the yields of the US Treasury bonds and the strength of the dollar continue to drain the golden impulse of gold.

- The president of the FED, Bostic, points out only one rate cut in 2025, postponing the inflation target until 2027.

The price of gold extended its fall for the third consecutive negotiation day, since the feeling improved with the news that reciprocal tariffs would focus on some commercial partners in the United States (USA). At the time of writing, the XAU/USD is quoted at $ 3.002, with a fall of 0.67%.

Wall Street operates in a positive environment, climbing slightly. The increase in the yields of the US Treasury bonds and the general strength of the dollar (USD) prevented the prices of precious metals from prolonging their recovery, with the yellow metal winning more than 13% in the year.

A Bloomberg article showed that the administration of the president of the United States, Donald Trump, would point to specific countries on April 2, instead of applying reciprocal tariffs against most countries. Instead, the measures are aimed at the so -called “dirty 15” business partners.

According to data last year, the Wall Street Journal reported in a article that US has the highest commercial deficits of goods with China, the EU, Mexico, Vietnam, Taiwan, Japan, South Korea, Canada, India, Thailand, Switzerland, Malaysia, Indonesia, Cambodia and South Africa.

Regarding data, S&P Global revealed that the preliminary PMIs for the US were mixed, with the manufacturing activity contracted, while the services sector was strengthened, improving with respect to the February figures. The divergence highlights the continuous weakness in the industrial sector, mainly driven by tariffs, amid higher prices fears.

Recently, the president of the Fed of Atlanta, Raphael Bostic, said that he supports only a rate cut this year and does not see that inflation returns to the target until around 2027. BOSTIC added that inflation is expected to be very volatile and said that he does not expect the Fed to stay behind.

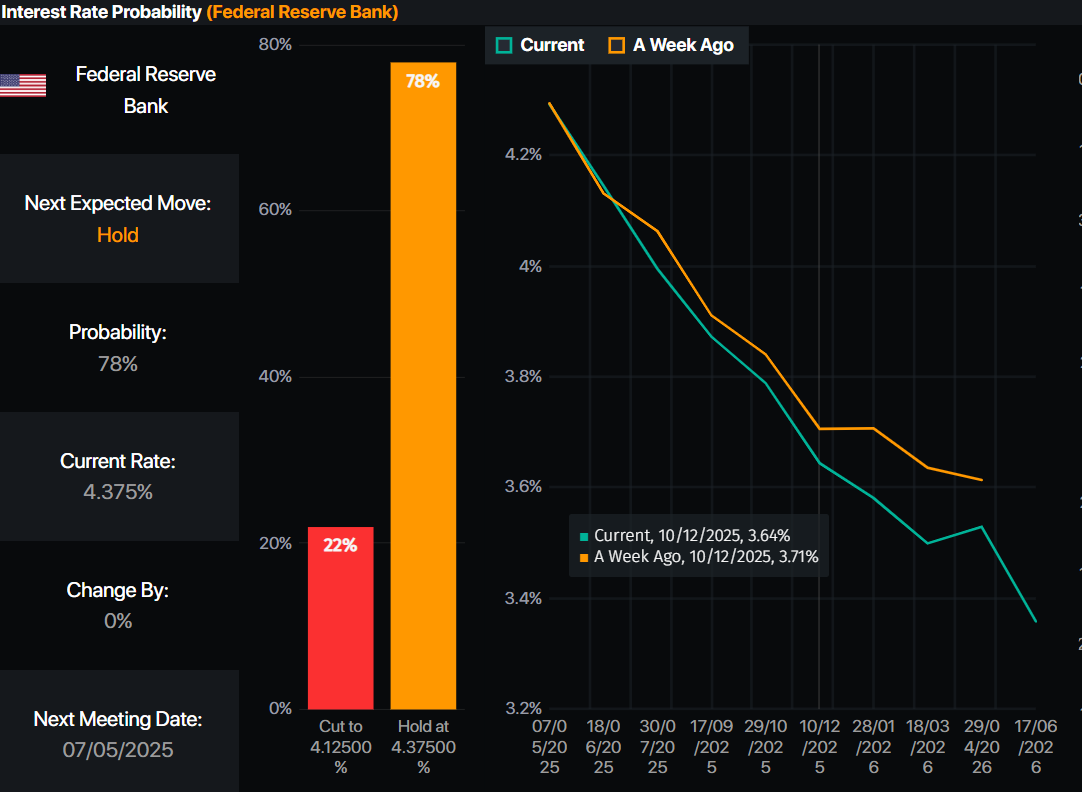

The monetary market has incorporated 62.5 basic relaxation points of the Fed in 2025, according to the probabilities data of interest rates of interest of Prime Market Terminal.

Source: Prime Market Terminal

What moves the market today: gold bears have moved, pushing prices for $ 3,000

- Gold prices are still pressured by the increase in yields of US Treasury Bonds The 10 -year bonus yield has increased eight basic points to 4,331%.

- The real US yields, measured by the performance of US Treasury values protected against inflation at 10 years, which correlates inversely with the prices of precious metals, almost 2 bp at 1,980%rise.

- The American dollar index (DXY), which tracks the value of the dollar value against a basket of six currencies, rose 0.20% to 104.35.

- The manufacturing PMI of March of S&P global showed acute deterioration in the manufacturing activity of the US, falling from 52.7 to 49.8, pointing out contraction and failing in the expectations of an expansion of 51.7.

- In contrast, the PMI of Global S&P services shot 51,0 to 54.3, exceeding 50.8 forecasts and highlighting a strong impulse in the services sector.

Xau/USD technical perspective: The price of gold goes back but remains firm around $ 3,000

The upward trend of gold is maintained, although operators are taking benefits as the Xau/USD falls below $ 3,010, threatening to clear the $ 3,000 figure. A rupture of this last will present the maximum of February 24 at $ 2,956, followed by the 2,900 $ brand and the simple mobile average (SMA) of 50 days in 2,874 $.

On the contrary, if the precious metal remains above $ 3,000, the first resistance would be the Picos on March 21 at 3,047 $, followed by the maximum of the year to date (YTD) at $ 3,057 and the mark of 3,100 $.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.