- Xau/USD collapses, ready to lose more than 2.5% weekly while operators reduce fees of feat cuts from the Fed and improve the appetite for risk.

- The non -agricultural payrolls of April exceed estimates; Unemployment remains stable at 4.2%, limiting the expectations of an aggressive relief of the Fed.

- China says that USA is open to commercial conversations, improving feeling and pressing gold.

The price of gold (Xau/USD) dropped more than 0.35% on Friday, prepared to finish the week with losses of more than 2.50%. An improvement in appetite for risk due to the relaxation of commercial tensions along with a strong labor market report in the United States (USA) led investors to take benefits before the weekend. At the time of writing, the XAU/USD is quoted at $ 3,226 after going back from a daily maximum of $ 3,269.

Night’s news revealed that China’s Ministry of Commerce said US was willing to start commercial conversations and rates, and assured Washington that Beijing’s door is open for discussions.

The bullion prices expanded their losses after the head that the non -agricultural payrolls crushed the estimates, with the unemployment rate remaining firm compared to the numbers of March. The fall of the Xau/USD towards the minimum of $ 3,222 was precipitated by the operators that reduced their bets that the Federal Reserve (Fed) would cut rates three times instead of four.

The yields of the US Treasury bonds rose sharply, but the US dollar index (DXY), which tracks the performance of the dollar against a basket of six other currencies, fell 0.20% to 99.98.

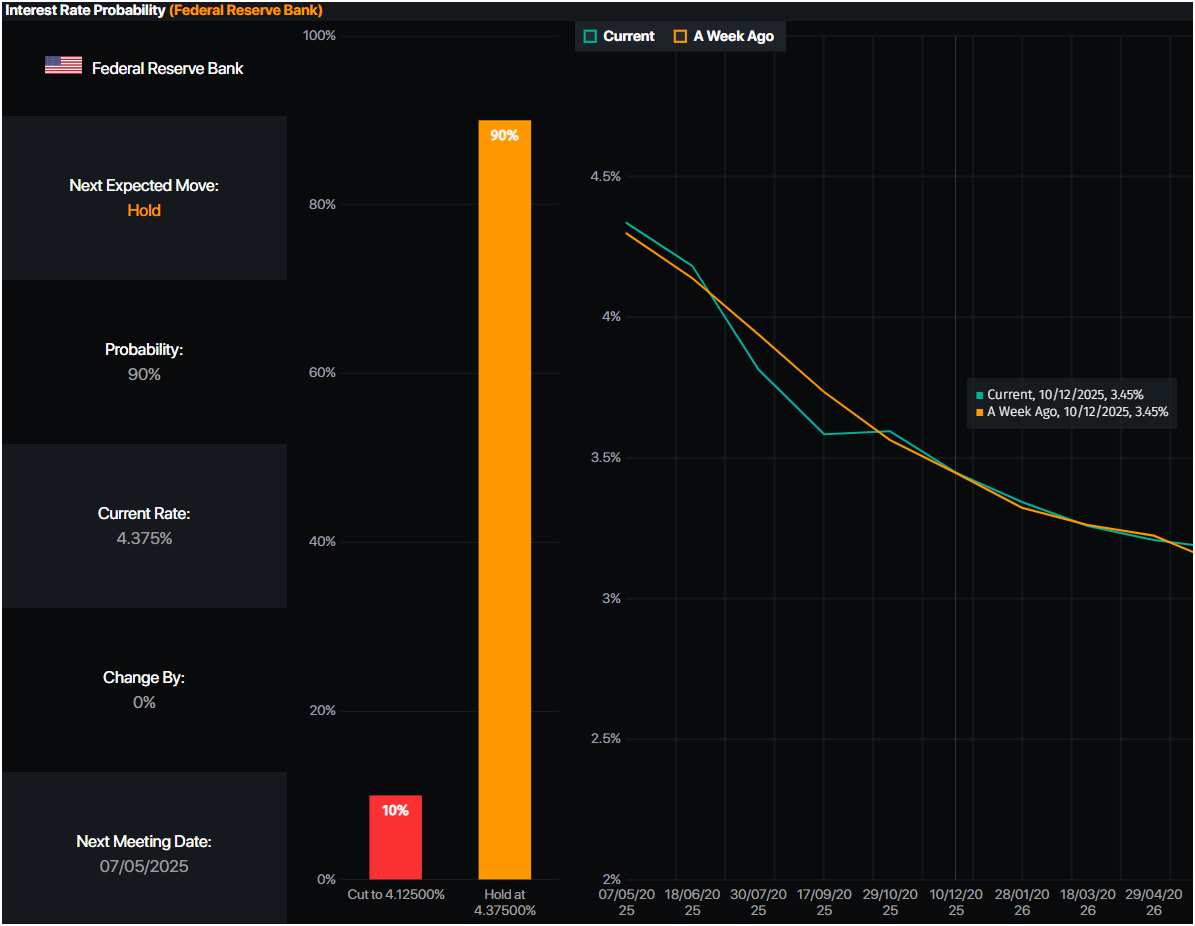

After the publication of the data, the investors rushed to incorporate 78 basic points of fees of the Fed, as revealed by Prime Market Terminal data.

Fountain: Prime Market Terminal

Next week, gold operators are pending the publication of the Monetary Policy Meeting of the Federal Reserve, during which the US Central Bank is expected to maintain unchanged fees.

What moves the market today: the price of gold drops while the yuos treasury yields

- The recently published data pushed the prices of US bonds down, increasing the yields of US Treasury bonds. The 10 -year Treasury bonus yield of the US Treasury is raising nine basic points, up to 4,312%. At the same time, US real yields increased nine and a half points to 2,062%, as shown by the yields of the US treasure inflation in 10 years.

- Non -Agricultural Payrolls of the United States increased by 177K in April, below the 185K decreased number in March, but exceeding 130k estimates. At the beginning of the week, a disastrous National Employment Change Report of ADP suggested that companies were hiring less people than the NFP revealed.

- The US unemployment rate remained unchanged by 4.2%, which is aligned with forecasts and could prevent the Federal Reserve (Fed) from relieving its policy.

Xau/USD technical perspective: The price of gold remains bullish but is prepared to fall below $ 3,200

The correction of the price of gold extended below $ 3,250 after the operators tried to recover $ 3,270 but failed. The relative force index (RSI) shows that sellers are gaining impulse; Therefore, a fall below the figure of $ 3,200 is likely.

In that case, the following support would be the maximum of April 3, which became support in 3,167 $. Once surpassed, the next stop would be the Simple Mobile (SMA) of 50 days, at 3,080 $. On the contrary, if buyers raise gold prices above $ 3,300, would clear the way to challenge the $ 3,350, followed by $ 3,400.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.