- Non -agricultural payrolls of the US show a constant growth of employment, but the Fed is not in a hurry to cut rates.

- Powell reiterates that the path of inflation will be “rugged”, maintaining the stable policy for now.

- The PBOC adds 10 tons of gold in early 2025, while the NBP of Poland buys 29 tons.

Gold prices fell on Friday while the dollar cuts some of its losses and yields of the US Treasury Bonds are recovered after the publication of a report on the US labor market. At the time of writing, the Xau/USD is quoted at 2,907, with a 0.11%drop.

The US Labor Statistics Office (BLS) published the February Non -Agricultural Payroll (NFP) report, which showed that the economy added more people to the workforce than in January, despite not reaching the goal. The same data showed that the unemployment rate remained within family levels, with the governor of the Federal Reserve (Fed), Adriana Kugler, saying that the hiring remains above the equilibrium level.

Kugler added that uncertainty is difficult for all parts of the economy. Previously, he said that monetary policy would remain stable for some time and added that wages are not an inflationary source of pressure.

Recently, the president of the Fed, Jerome Powell, reiterated that the Central Bank is in no hurry to lower the rates. Powell added that taking 2% inflation will be injured and that the Central Bank does not need to react excessively to one or two readings. Powell said Fed is well positioned in monetary policy.

When asked about tariffs, Powell said it remains to be seen if they would be prone to inflation.

The decrease in geopolitical tensions limited the advance of gold, since there are some progress in a possible high fire agreement between Ukraine and Russia. In the Middle East, the US president, Trump, continued to put pressure on Hamas to release the hostages.

Central banks buy gold

Meanwhile, the Popular Bank of China (PBOC) continues to buy gold, according to the World Gold Council (WGC). The PBOC increased its reserves in 10 tons in the first two months of 2025. However, the largest buyer was the National Bank of Poland (NBP), which increased its reservation in 29 tons, its largest purchase since June 2019, when it bought 95 tons.

Daily summary of market movements: the advance of gold stops as the real yields of the US rose

- The performance of the US Treasury bonds at 10 years rises three basic points to 4,318%.

- The real US yields, measured by the performance of US Treasury Treasury values against inflation (Tips) at 10 years, which correlates inversely with gold prices, three and a half basic points rise to 1,981%, an obstacle to xau/USD prices.

- The non -agricultural payrolls of the United States for February were 151K, an improvement with respect to January 125k, but below the 160K forecast.

- The unemployment rate rose to 4.1%, slightly above 4.0% expected, indicating a certain weakening in the labor market.

- The GDPnow model of the Atlanta Fed projects GDP for the first 2025 quarter in -2.4%, improving from the estimated contraction of -2.8% on Wednesday.

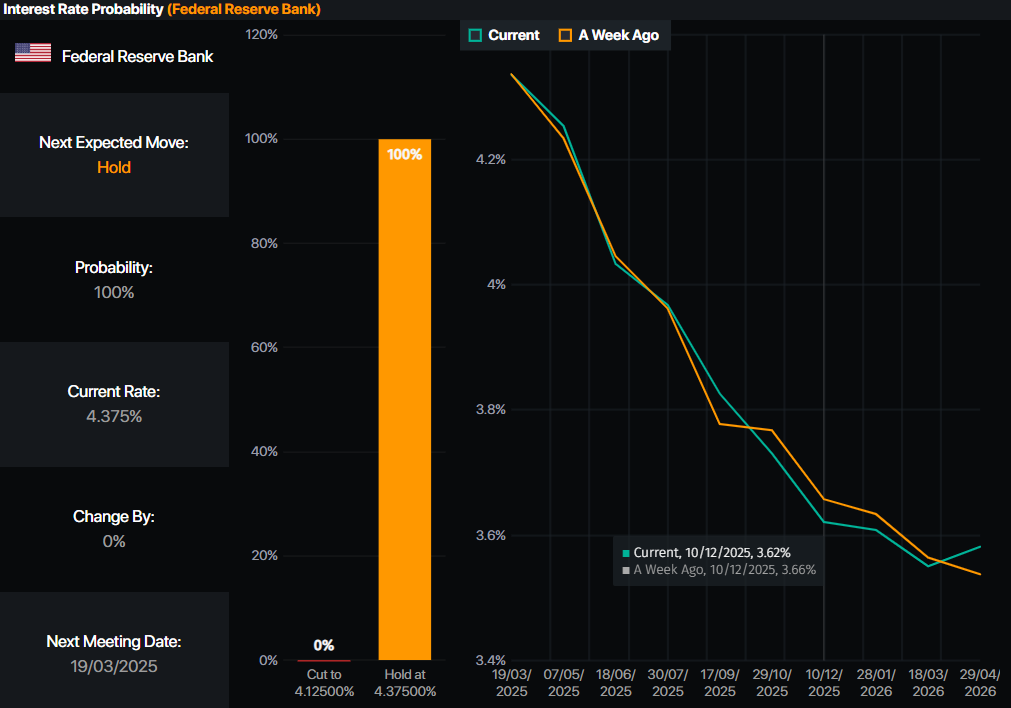

- The monetary market operators had discounted 69 basic flexibility points in 2025, below the 80 PB on Thursday, according to data from the Prime Market Terminal.

- Source: Prime Market Terminal

Xau/USD technical perspective: The price of gold falls, sellers sign at $ 2,900

Gold prices continue to quote laterally, unable to exceed $ 2,930 after a stellar advance of more than 1.72% in the month. The relative force index (RSI) suggests that a possible additional increase is seen, since the RSI remains bullish.

Therefore, the next resistance of the Xau/USD would be $ 2,950, followed by the historical maximum of 2,954 $. A rupture of the latter would exhibit the $ 3,000 mark. On the contrary, a fall below $ 2,900 would expose the minimum of February 28, $ 2,832, followed by the figure of $ 2,800.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.