- Gold goes back but is directed towards the third strongest monthly gain for 2025.

- The operators discount 100 basic points of FED cuts even though inflation remains resistant.

- The contraction of the US GDP feeds the fears of recession and increases the bets for fed rates cuts.

- The underlying PCE falls in line with the forecasts, but remains above the inflation target of 2%.

Gold fell around 0.69% during the American session on Wednesday after reaching a daily maximum of $ 3,328. The United States data (USA) revealed an economic contraction and fed speculation about future interest rate cuts by the Federal Reserve (Fed). At the time of writing, the Xau/USD is quoted at $ 3,293, near the minimum of the current week.

The world’s largest economy faces a continuous economic slowdown, as revealed by the US Department of Commerce. The figures of the Gross Domestic Product (GDP) of the first quarter of 2025 disappointed investors, exerting pressure on the Federal Reserve, which fights to bring inflation back towards its objective of 2%.

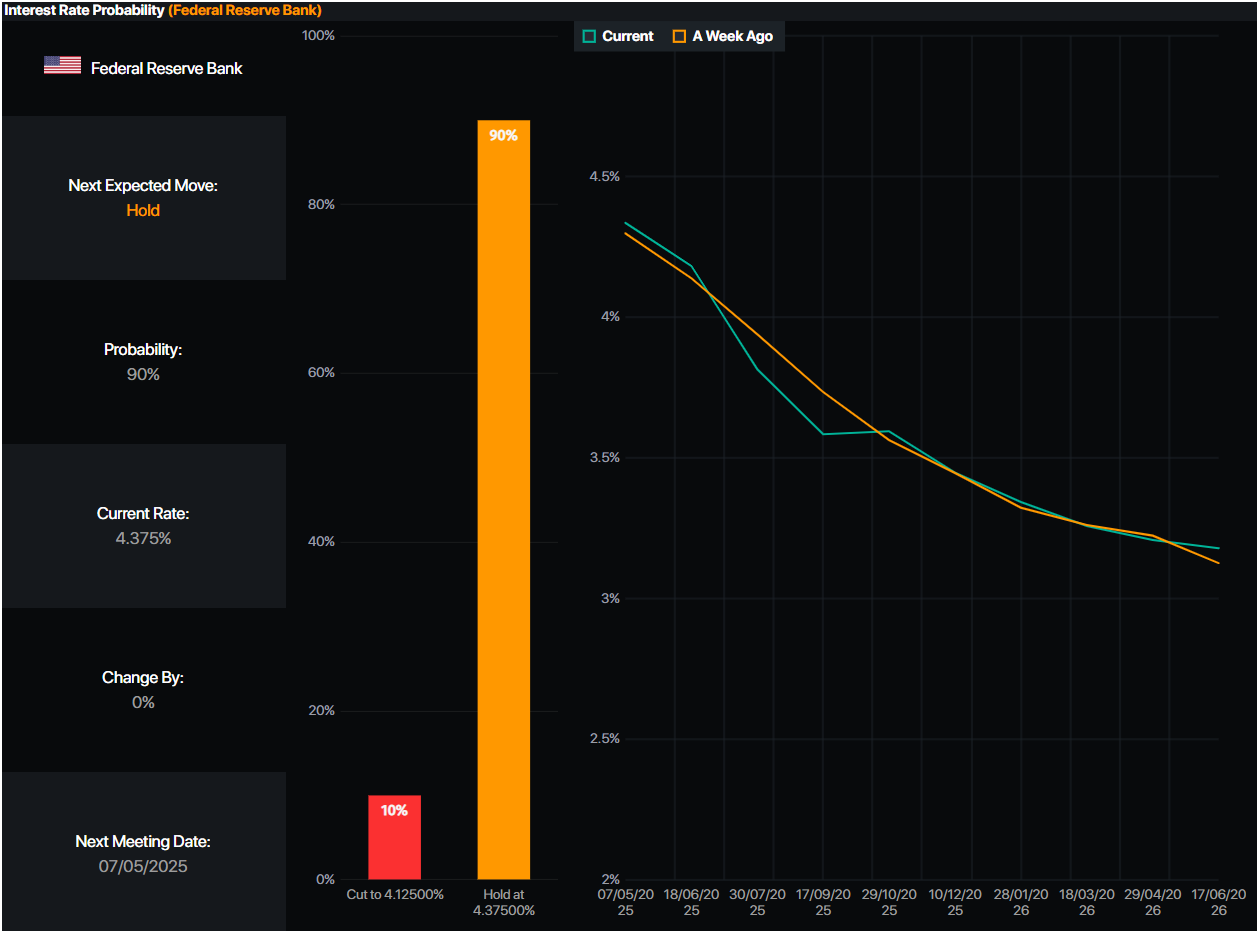

After the publication of the data, investors rushed to discount 100 basic points of feat cuts by the Fed, which means that the federal fund rate will end about 3.45%, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

Precious metal operators were also attentive to the March publication of the Fed’s favorite inflation indicator, the underlying personal consumer price index (PCE). The figures fell as expected by analysts, although they remain above the 2% target of the US Central Bank.

The labor market data were weak, as ADP revealed in its national employment change report in April.

Despite registering daily losses, precious metals prices are ready to close April with profits of more than 5.49%.

In next week, the operators are pending the publication of the PMI manufacturing ISM of April and the non -agricultural payroll figures for the same period.

Daily summary of market movements: The price of gold records losses and fails to capitalize on the fall of US yields.

- The 10 -year Treasury bonus yield performance falls a basic point and a half, reaching 4,154%.

- The real US yet yields fall two basic points to 1.90%, as shown by the yields of treasure protected against inflation to 10 years of the US.

- The US GDP for the first quarter of 2025 contracted 0.3%, failing in the goal of an expansion of 0.4% and a drop in the 2.4% increase in the fourth quarter of 2024, the US Department of Commerce revealed.

- The labor market data revealed by the change of national employment of ADP in April suggest that the non -agricultural payroll figures on Friday could be lower than projected. Private companies hired 62,000 people, below the estimates of 108,000.

- At the same time, the preferred inflation indicator of the US Federal Reserve, the underlying Personal Consumer Price Index (PCE), increased 2.6% as projected, lowering the 3% increase in February.

Technical Perspectives of the Xau/USD: It remains bullish but is ready to test the $ 3,200

The upward trend of the price of gold is maintained, although the vendors seem to be gaining impulse since the Xau/USD has fallen below $ 3,300; It is still reluctant to exceed the last minimum of 3,261 $ of April 23. A rupture of this last will expose the level of $ 3,200, followed by the level of $ 3,150.

On the other hand, if gold claims $ 3,300, the following resistance would be $ 3,350, followed by the figure of $ 3,400.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.