- The price of gold falls after reaching $ 3,452 due to the increase in geopolitical risk in the Middle East.

- Iran indicates its opening to nuclear conversations, cooling the demand for secure refuge for the ingots.

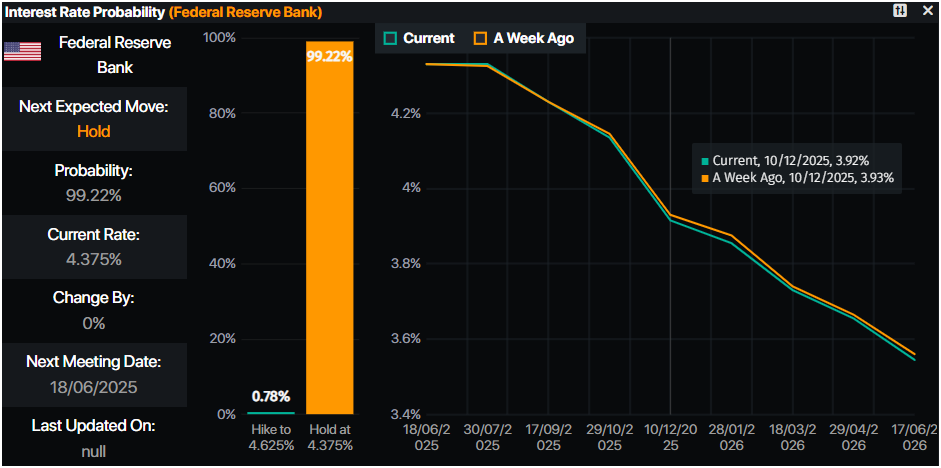

- The operators expect the decisions of the FED, BOJ and BOE in the middle of a occupied week of US economic data.

The price of gold collapsed below $ 3,400 during the American session, falling more than 1% despite the fact that tensions in the Middle East remain high as the conflict between Israel and Iran intensifies. At the time of writing, the XAU/USD quotes at $ 3,399 after reaching a peak of eight weeks of $ 3,452.

On Friday, Israel attacked Iran’s military and nuclear facilities and pointed to senior officials after arguing that Tehran could produce nuclear bombs in a matter of days, an argument in opposition to American intelligence. The conversations between the United States (USA) and Iran have stopped due to the beginning of the war by Israel.

In last minute news, gold shot sharply. However, the ingots have retired since Iran pointed out that he is ready to end hostilities and resume conversations about his nuclear program, according to the Wall Street Journal (WSJ), which has improved appetite for risk. However, some Iranian officials have denied that report.

The main central banks are expected to deliver their latest monetary policy decisions. It is projected that the Federal Reserve (FED) maintain the rates without changes. The operators are also attentive to the decisions of the Bank of Japan (BOJ) and the Bank of England (BOE).

In the coming week, after the decision of the FED, the US economic agenda will include the publication of retail sales, housing and business activity revealed by the regional banks of the Fed.

What moves the market today: gold retires, but the growing geopolitical risks stalk

- Despite the withdrawal, gold is expected to rise slightly since the main central banks, such as the Popular Bank of China (PBOC), will probably continue their shopping streak.

- The latest inflation reports in the US justify greater relief by the Fed. Any moderate indication by the US Central Bank could boost the perspectives of gold, since the metal without performance performs well in lower interest rates environments.

- The geopolitical risks would maintain the prices of the bullion at high levels. The lack of progress in conversations between Russia and Ukraine and the expansion of the conflict in the Middle East to include Iran would keep the yellow metal backed by risk aversion.

- The yields of the US Treasury bonds are recovering, with the 10 -year Treasury bonus yield of the US, uploading more than three basic points (PBS) to 4,446%. The real US yet yields followed the same trend, uploading almost four PBS to 2,166%, limiting the advance of the bullion.

- The US dollar index (DXY), which tracks the value of the dollar against a pairs basket, has dropped 0.16% to 97.98, close to reaching a minimum of several years of 97.60.

- Monetary markets suggest that operators are discounting 46 basic relief points towards the end of the year, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

Technical perspective of the Xau/USD: The price of gold is consolidated by about $ 3,400 before the FOMC meeting

The upward trend of the gold price remains despite the fact that the Xau/USD fell below $ 3,400. The price action indicates that the precious metal is maintaining its higher and highest maximum market structure, confirming the bullish bias. The relative force index (RSI) remains bullish, although buyers are losing some impulse, since the RSI continues to point down towards its neutral line.

If the Xau/USD closes daily below $ 3,400, a setback is anticipated towards the $ 3,350. A rupture of this level would exhibit the simple mobile average (SMA) of 50 days at $ 3,281, followed by the maximum of April 3 turned into a support in $ 3,167.

On the other hand, if the gold is maintained above $ 3,400, look for a $ 3,450 test, since the path would clear to challenge the historical maximum of $ 3,500 in the short term.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.