- XAU/USD falls after solid NFP data reduces wales of feat cuts, but maintains a weekly gain above 1.30%.

- USA adds 139K jobs in May; The unemployment rate remains stable at 4.2%, promoting the US dollar and yields of treasure bonds.

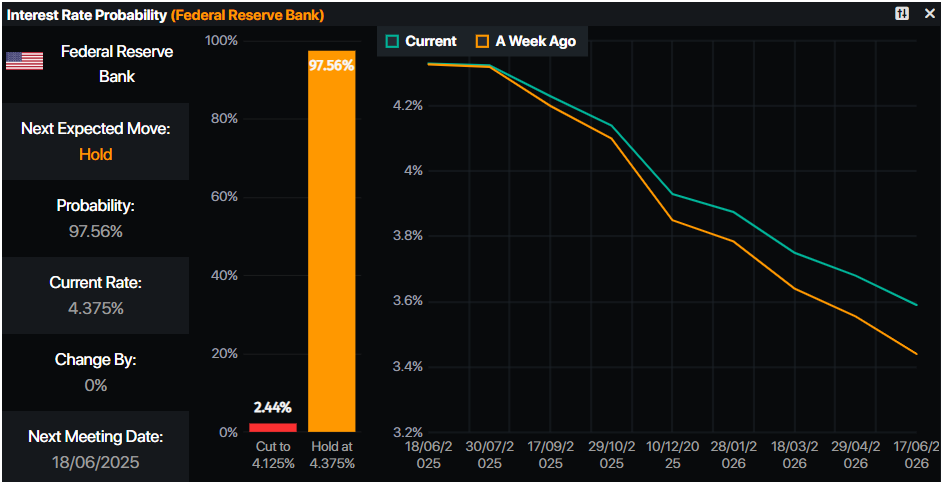

- Fed cuts expectations are fading as operators reassess the perspectives before the FOMC meeting of June 17-18.

The price of gold extended its losses for the second consecutive day on Friday, but is prepared to end the week with profits of more than 1.30% after the last report of non -agricultural payrolls in the United States (USA) was solid, pressing operators to cut their bets that the Federal Reserve (FED) will relax monetary policy. At the time of writing, the XAU/USD quotes at $ 3.316, with a fall of 0.84%.

The US Labor Statistics Office (BLS) revealed that the labor market remains resistant, since the unemployment rate figures remained unchanged compared to April. Meanwhile, Wall Street recovers some of his losses on Thursday in the middle of the continuous dispute between the US president Donald Trump and the Tesla Elon Musk CEO, promoted by the approval of the House of Representatives of the increase in the US debt roof.

The prices of precious metals suffered a blow as the dollar showed signs of life, rising 0.49% as indicated by the US dollar index (DXY). The movement was sponsored by investors that adjusted its estimates on the cutting of the Fed fees and the highest yields of the US Treasury bonds.

Although gold is suffering, augmented tensions between Russia and Ukraine and the prolonged conflict between Israel and Hamas could continue to boost rising prices.

Next week, the US economic agenda will be absent from Fed speakers, since they enter the period of silence before the June 17-18 meeting. The operators will be attentive to the figures of the Consumer Price Index (CPI), followed by the Production Price Index (IPP) and the Confidence Index of the Consumer of the University of Michigan.

Daily summary of market movements: gold falls while US yields shoot and support the US dollar

- The 10 -year American treasure bonus yield is triggered more than nine basic points to 4,484%. The real US yields have followed the same trend and have also risen the same amount to 2,196%, an obstacle to precious metals prices.

- Non -agricultural payrolls from the United States in May exceeded 130K forecasts, increasing by 139K, but did not reach the 147K reviewed down April. Although the labor market is cooling, it continues in very good condition as the US economy slows down.

- The unemployment rate stood at 4.2%, and together with the job report, it caused a revaluation of interest rates, with less than two expected cuts by the Fed towards the end of 2025.

- Metals Focus said: “Central banks around the world are ready to buy 1,000 gold metric tons in 2025, marking the fourth consecutive year of mass purchases as they divert reserves of assets in US dollars.”

- The de -escalation of tensions in the commercial war between the US and China could exert the downward pressure on gold, which until now has gained more than 26% in the year.

- The monetary markets suggest that the operators are valuing 44.5 basic points of relaxation towards the end of the year, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

Xau/USD technical perspective: gold remains bullish despite losing ground below $ 3,360

The price of gold is consolidated after the XAU/USD has fallen to a minimum of four days of $ 3,316, but is maintained above $ 3,300, which is considered a crucial floor that, if it breaks, could open the way to test $ 3,250.

The relative force index (RSI) has become bassist, indicating that the Xau/USD could extend its losses; However, the general trend favors the bulls.

If the gold is maintained above $ 3,300, this could pave the way to test the peak of the current week of $ 3,403 reached on June 5, followed by the 3,450 $ brand. If it is exceeded, the following objective would be the historical maximum of $ 3,500.

On the other hand, if the gold falls below $ 3,300, the vendors could send to the Xau/USD to a fall, testing the simple mobile average (SMA) of 50 days in $ 3,235, followed by the maximum of April 3, which has since been supported at $ 3,167.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.