- The price of gold is stabilized just above $ 3,120 on Wednesday before Trump’s announcement.

- The markets prepare for the official announcement of the implementation of reciprocal tariffs.

- Gold operators could undo the recovery of gold, if the size of tariffs is much less severe than anticipated.

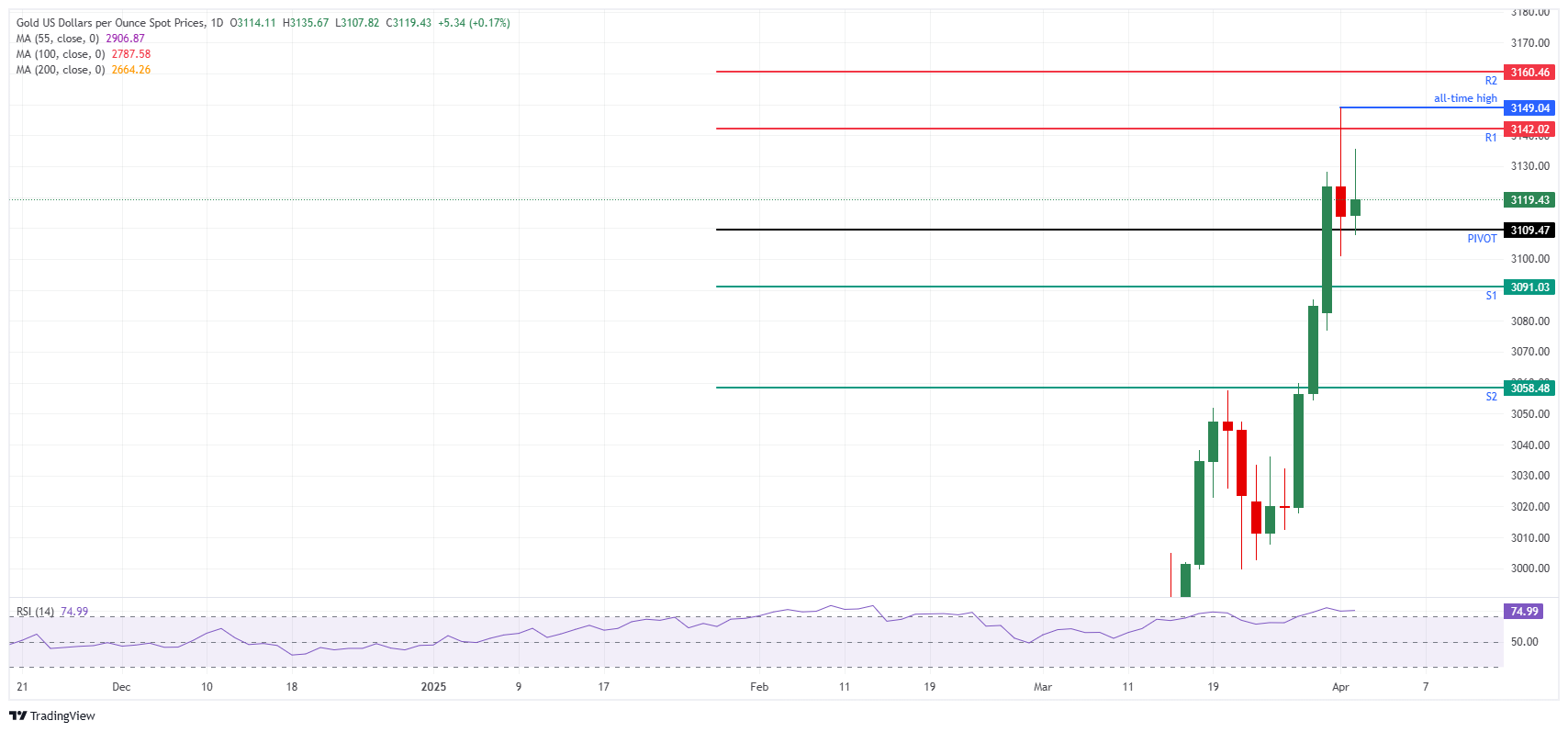

The price of gold (Xau/USD) is stabilized just above $ 3,130 at the time of writing on Wednesday, after a reversion movement the previous day, after a new historical maximum of $ 3,149 was reached before closing in negative territory. The recovery of gold stopped before the president of the United States (USA), Donald Trump, officially announced the implementation of reciprocal tariffs later this Wednesday at the White House with all his present cabinet. However, with uncertainty accumulating towards this day, the announcement itself could be less shocking than was initially thought, resulting in acute correction for gold this week as an event of “Buy the rumor, sells the news.”

Meanwhile, operators are preparing for the always important employment data of the private sector provided by Automatic Data Processing (ADP). Although there is no proven correlation with the publication of non -agricultural payroll (NFP) on Friday, operators still see it as a Litmus test. An increase of 105,000 new jobs in the private sector is expected in March, compared to 77,000 in February. This could make sense since the Department of Government Efficiency (Doge) has been trying to push public sector employees towards private jobs.

What moves the market today: late negotiation hours

- The White House has been reluctant to provide details about the objectives and scale of the encumbrances, which will be applied just after they are implemented in the 20:00 GMT event in Washington this Wednesday. The pending announcement has generated a new wave of volatility, including a massive sale of shares in the USA. While uncertain times are generally good for gold, investors are eager to see the impact of the next set of taxes on trade, global economy and geopolitics, Bloomberg reports.

- The CME Fedwatch tool sees the possibilities of a rate cut in May at 15.8%. A rate cut in June remains the most plausible result, with only a 25.6% probability that rates remain at current levels.

- The ETF of Gold Huaan Yifu, the largest investment vehicle of this type in China, received record tickets of 1.4 billion yuan ($ 194 million) on Monday. Followed by another 1 billion yuan, the second highest, the next day. The frantic purchase rhythm means that gold ETFs now have the greatest assets under management among all pairs related to raw materials in China, reports reports.

Technical analysis of the price of gold: a pump or a failure?

Once again, this is a “parental warning” just before the main event on Wednesday. With the main tail wind for the recovery of gold that will be officially announced, the “buys the rumor, sells the fact”, must be considered. The risk could be that once the reciprocal tariffs enter into force on Wednesday, only one relief occurs due to the taking of gold benefits once separate and undoing commercial agreements are made partial.

On the positive side, the daily resistance R1 in $ 3,141 is the first level to be considered, followed by the historical maximum of $ 3,149. Above, R2 resistance at $ 3,169 could still be an objective later in the day. Beyond that, the objective of greater rise is at $ 3,200.

On the negative side, the S1 support in 3.093 $ is quite far, although it could still be tested without completely erasing this week’s profits. Below, S2 support at $ 3.073 should ensure that gold does not fall below $ 3,000.

Xau/USD: Daily graphic

Commercial War between the US and China Faqs

In general terms, “Trade War” is a commercial war, an economic conflict between two or more countries due to the extreme protectionism of one of the parties. It implies the creation of commercial barriers, such as tariffs, which are in counterbarreras, increasing import costs and, therefore, the cost of life.

An economic conflict between the United States (USA) and China began in early 2018, when President Donald Trump established commercial barriers against China, claiming unfair commercial practices and theft of intellectual property by the Asian giant. China took retaliation measures, imposing tariffs on multiple American products, such as cars and soybeans. The tensions climbed until the two countries signed the Phase one trade agreement between the US and China in January 2020. The agreement required structural reforms and other changes in China’s economic and commercial regime and intended to restore stability and confidence between the two nations. Coronavirus pandemia diverted the attention of the conflict. However, it is worth mentioning that President Joe Biden, who took office after Trump, kept the tariffs and even added some additional encumbrances.

Donald Trump’s return to the White House as the 47th US president has unleashed a new wave of tensions between the two countries. During the 2024 election campaign, Trump promised to impose 60% tariff particularly in investment, and directly feeding the inflation of the consumer price index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.