- The price of gold attracts buyers for the second consecutive day in the midst of a combination of support factors.

- Fed feature clippings are dragged to the USD to a minimum of several years and support the yellow metal without performance.

- The uncertainty about Trump’s policies counteracts the positive risk tone and benefits the Xau/USD torque.

The price of gold (Xau/USD) is based on the good recovery of the previous day from the 3,248-3,247 $ region or a minimum of one month and earns positive traction for the second consecutive day on Tuesday. The sale of the US dollar (USD) continues incessantly to the growing acceptance that the Federal Reserve (Fed) will resume its cycle of feat cuts in the near future, which turns out to be a key factor that acts as a tail wind for the ingot without performance. Apart from this, the high uncertainty about the tariff policies of US President Donald Trump before the deadline of July 9 raises the price of gold as a safe refuge above the level of $ 3,320 during the Asian session.

Meanwhile, the actions in Asia follow the night rebound in the S&P 500 and the Nasdaq towards new historical closing maximums. This could stop the operators to carry out aggressive bullish bets around the price of gold before the important macroeconomic launches of the United States this week, starting with the ISM manufacturing PMI and the ISM manufacturing survey and the job offers survey (Jolts) later on Tuesday. However, the attention remains focused on the US Non -Agricultural Payroll (NFP) report on Friday, which will influence the USD price dynamics and will provide a new impulse to the raw material. However, the fundamental context supports the case for an additional appreciation movement for the Xau/USD.

What moves the market today: the price of gold benefits from a weaker USD and commercial nervousness

- The president of the United States, Donald Trump, expressed frustration for the stagnation of commercial negotiations between the US and Japan and also threatened to increase tariffs to certain countries as its deadline of July 9 is approaching. In addition, the White House spokeswoman, Karoline Leavitt, said Trump will meet with her commercial team to establish tariff rates for countries if they do not reach the table to negotiate in good faith.

- Meanwhile, US Treasury Secretary Scott Besent warned that countries could be notified that tariff rates are scheduled to drastically increase from a temporary level of 10% at rates of between 11% and 50% announced on April 2. This, in turn, drives some flows to safe shelters during the Asian session on Tuesday and helps the price of gold to continue with the good recovery movement last night.

- Trump intensifies his pressure campaign on the president of the Federal Reserve, Jerome Powell, to reduce indebtedness costs in a handwritten note on Monday. This occurs after the US PERSONAL CONSUMPTION EXPENSECTION REPORT (PCE) showed on Friday that consumer spending decreased unexpectedly in May and keeps the door open for greater relief of monetary policy by the Central Bank.

- The markets are currently valuing a lower probability that the next reduction of Fed rates occurs in July and they see a probability of approximately 74% of a rate cut as soon as in September. This, together with the concerns about the worsening of the US fiscal condition, drags the US dollar at its lowest level since February 2022 on Tuesday and provides additional support to the Xau/USD pair.

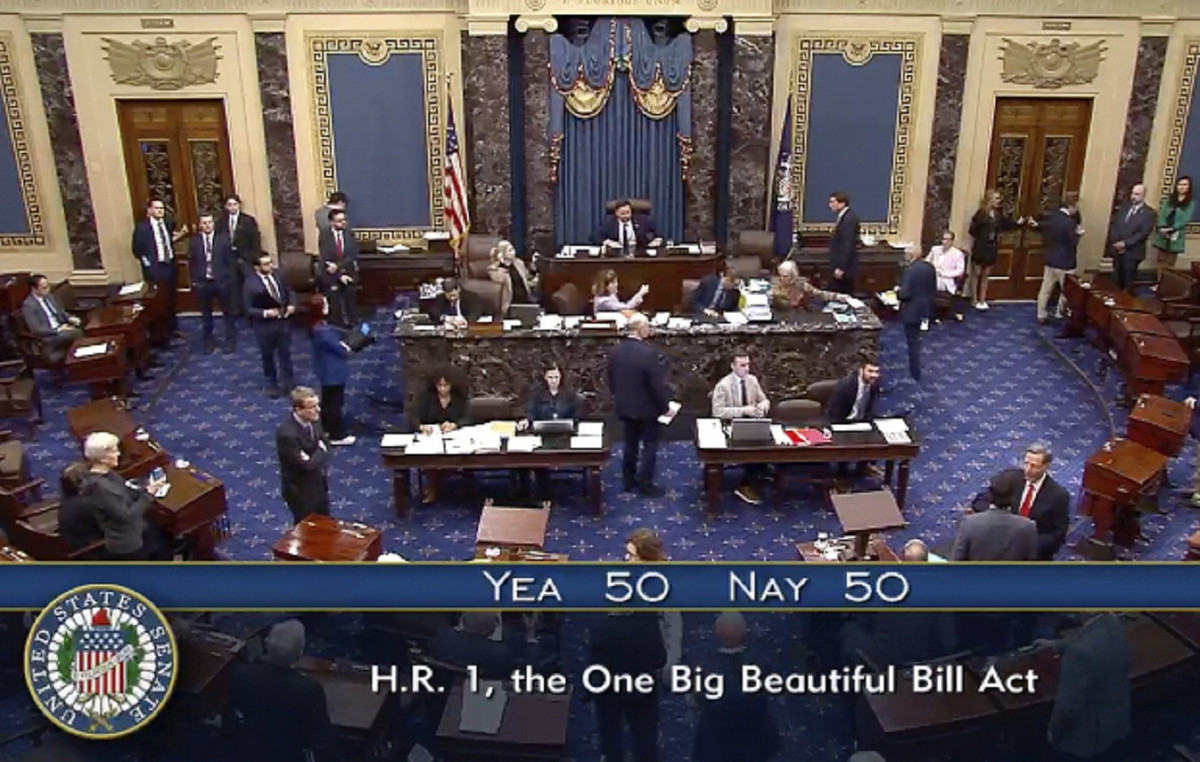

- The Senate approved little procedure vote to open the debate on the “great beautiful law” of Trump, which would add approximately 3.3 billion dollars to the federal deficit during the next decade. This should keep USD on the defensive before the key macroeconomic launches of this week and support the prospects for an additional movement of raw material.

- The operators now expect the publication of the USS of the US ISM and the Survey of Employment and Labor Rotation (Jolts) to obtain some impulse later during the North American session. However, attention will remain focused on the monthly US employment data, popularly known as the Non -Agricultural Payroll (NFP) report on Thursday.

The price of gold could accelerate the positive movement above the immediate barrier of 3,324-3.325 $

From a technical perspective, any subsequent fortress beyond the immediate barrier of 3,324-3.325 $ could attract some vendors near the 3,350 region. This is followed by resistance near the region of 3,368-3.370 $, above which the price of gold could accelerate the positive movement and aim to recover the level of $ 3,400. A sustained strength beyond the latter would change the short -term trend in favor of the bulls of the Xau/USD and paved the way for additional profits.

On the other hand, the round figure of $ 3,300 now seems to protect the immediate fall before the horizontal support of 3,277-3.276 $ and the minimum of the previous night, around the 3,246-3.245 $ region. The inability to defend the mentioned support levels could make the price of gold vulnerable to accelerate the fall towards testing the intermediate support of 3,210-3.200 $ before eventually falling to the area of $ 3,175 in the middle of slightly negative oscillators in the daily chart.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.