- The XAU/USD quotes at $ 3,328, rising 0.10%, after bouncing from an intradic minimum of $ 3,300.

- The positive commercial conversations between the US and China in London raise the appetite for risk and drive actions.

- The price action is volatile while the traders expect the key data of the US CPI that will be published on Wednesday.

The price of gold clings to modest profits on Tuesday after bouncing from a minimum daily near the figure of $ 3,300, since the conversations between the United States (USA) and China seem to be progressing well, improving the appetite for the risk among the investors that are promoting US actions up. The XAU/USD quotes at $ 3,328.

The mood on the market is still positive, fed by the meeting between US officials and China in London. Meanwhile, the price action in the financial markets remains volatile while traders expect the publication of the latest US Consumer Price Index (CPI) for May. Estimates suggest that prices probably increased, with US homes feeling the impact of Trump administration tariffs.

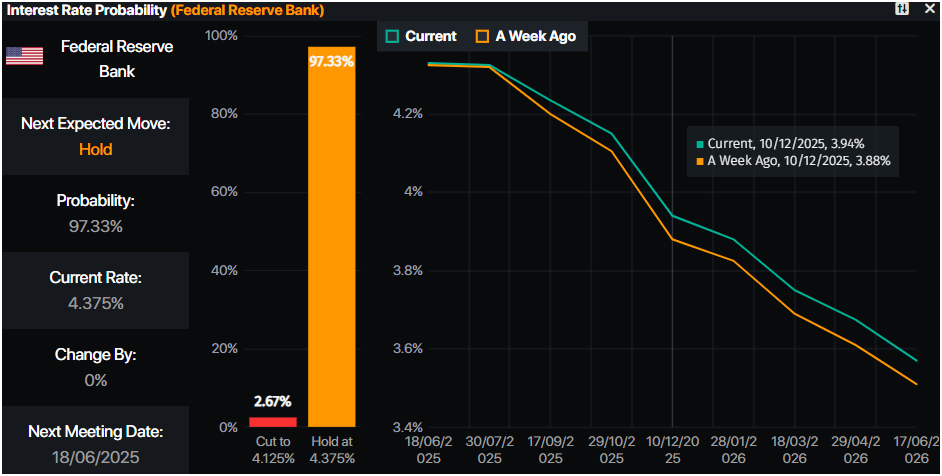

Therefore, the Federal Reserve (FED) could remain in its waiting mode, maintaining interest rates in the range of 4.25%-4.50%.

The US dollar index (DXY), which tracks the value of the dollar against a pairs basket, is recovered after reaching a daily minimum of 98.86 and is rising 0.06% to 99.07.

On Tuesday, the US economic calendar revealed that small businesses are growing more optimistic, according to the optimism index of the National Federation of Independent Business (NFIB), which improved in May compared to the figures revealed in April.

What moves the market today: the price of gold remains firm amid stable yields of the US Treasury bonds.

- The 10 -year Treasury bonus yield performance is maintained by 474%. The real US yields have also remained unchanged by 2.16%, limiting the progress of the price of gold.

- The NFIB optimism index rose from 95.8 in April to 98.8 in May, carrying the index above its long -term average. The figure ended a four -month streak of worsening of conditions and feeling for small US businesses due to uncertainty about tariffs.

- Traders would feel relieved if conversations between Washington and Beijing show a positive result, which could lead investors to change to riskier assets, such as shares. However, the publication of US inflation figures could limit gold exits.

- The US CPI is expected to rise from 2.3% to 2.5% year -on -year, with projected underlying figures to increase 2.8% to 2.9% year -on -year.

- Geopolitical tensions are still high, since the US president Trump told Fox News that Iran is becoming much more aggressive in nuclear conversations. This, together with Russia’s statement to control territory in the East-Central Region of Ukraine, could push the prices of upward gold, clearing the way to prove the $ 3,350 in the short term.

- The monetary markets suggest that traders are discounting 43.5 basic points of relief towards the end of the year, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

XAU/USD technical perspective: The price of gold is listed laterally within the $ 3,3,350 corridor

From a technical point of view, the Xau/USD found a strong support around $ 3,290 -300 provided by a line of support trend, together with the minimum of the current week. The momentum also favors a greater rise since the relative force index (RSI) remains bullish.

If the Xau/USD exceeds $ 3,350, this would open the door to a movement towards $ 3,400. More strength is found in $ 3,450 and the historical maximum (AH) at $ 3,500.

On the other hand, if gold falls below $ 3,300, the way will open to challenge key support levels, such as the simple mobile average (SMA) of 50 days at $ 3,265, followed by the maximum of April 3, which has since supported 3,167 $.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.