- Gold is quoted at $ 3.380 while the strongest US dollar eclipses the demand for safe refuge.

- Trump considers to join Israel in attacks on Iran, feeding geopolitical anxiety.

- The Fed is expected to keep the stable rates; DOT PLOT reviews can insinuate less cuts in 2025.

Gold prices retreated below the level of 3,400 $ on Tuesday despite the deterioration of appetite due to risk, since the general fortress of the US dollar (USD) led the yellow metal downward. However, the escalation of the conflict between Israel and Iran will probably support the precious metal due to its attractiveness as a safe refuge. At the time of writing, the XAU/USD quote $ 3,380, with a 0.05%drop.

The feeling of the market is pessimistic, but the ingot has failed to recover while the US dollar performs a rebound. The US dollar index (DXY), which tracks the performance of the dollar against six main currencies, has risen 0.46% to 98.58.

On Monday, the US president, Donald Trump, abruptly left the G7 meeting in Canada due to events in the Middle East. He published in his social network that “everyone should evacuate Tehran immediately,” in a clear sign of an escalation of the conflict that exploded last Friday.

Previous news sources revealed that Trump is evaluating to join Israel to attack Iran. At the time of writing, Walla News/axios, citing senior US officials, said Trump is considering seriously attacking Iran and is holding a crucial meeting with his advisors.

Although the feeling remains the main engine, the economic data in the United States (USA) were weaker. Retail sales in the US were mixed in May, with monthly contraction figures, while in the 12 months until May they increased. Industrial production, revealed by the Federal Reserve (FED), contracted in May.

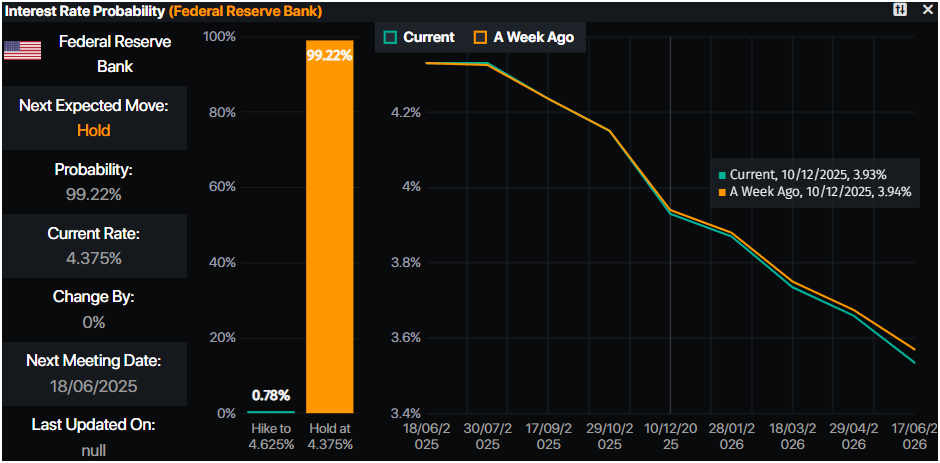

The operators are preparing for the Fed’s decision. The president of the FED, Jerome Powell, and other governors of the Fed began their “conclave” and is expected to keep the rates without changes. It is worth noting that those responsible for monetary policy will update their economic projections, which would point out the path of monetary policy towards the second half of 2025.

Win Thin, Global Market Strategy Chief at BBH, revealed that he waits for a dovish bias by the Fed, but pointed out that “we see some risks of a Hawkish change in the Dot Plots, since only two officials would be needed to move from two cuts to one to obtain a similar movement in the DOT of 2025.”

Daily summary of market movements: gold remains stable while geopolitical risks increase

- Retail sales in the US fell dramatically in May, dragged by a notable decrease in cars purchases. The main figure fell 0.9% intermensual, below the expectations of a decrease in -0.7%. In interannual terms, sales increased 3.3%, slowing down from the robust increase of 5% in April.

- Meanwhile, industrial production in the US slid 0.2% in May, marking the second fall in three months. The data did not reach the market forecasts of a modest increase of 0.1%, indicating weakness in the manufacturing sector.

- The latest inflation reports in the US justify greater relief by the Fed. Any dovish indication by the US Central Bank could boost the perspectives of gold, since the non -generating metal metal benefits in lower interest rates environments.

- The World Gold Council published its annual survey to central banks, revealing that 95% of the 73 respondents awaits an increase in gold reserves during the next 12 months.

- The US treasure yields are falling, since the 10 -year Treasury performance lowers almost five basic points (PBS) to 4,403%. The real US yu. Followed the same trend, falling almost five PBS to 2,103%.

- The monetary markets suggest that the operators are discounting 44 PBs of relief towards the end of the year, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

Technical perspective of the Xau/USD: The price of gold is consolidated by about $ 3,400 before the FOMC meeting

The upward trend of gold price remains intact, since the price action remains constructive, achieving a successive series of higher maximum and minimum. Any setback could be seen as an opportunity to buy in the fall, since the impulse measured by the relative force index (RSI) remains bullish.

That said, the first resistance of the XAU/USD would be the level of $ 3,400, followed by $ 3,450 and the historical maximum of $ 3,500 in the short term.

On the contrary, if the Xau/USD remains below $ 3,400, the recoil could be extended to the level of $ 3,350 and possibly lower. The following key support levels would be the simple mobile average (SMA) of 50 days at $ 3,293, followed by the maximum of April 3 turned into a support in $ 3,167.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.