- The price of gold rises, more than 1.5% this week before the deadline of Trump tariffs.

- The operators prepare for the “Day of Liberation” in which Trump will implement reciprocal tariffs to all countries.

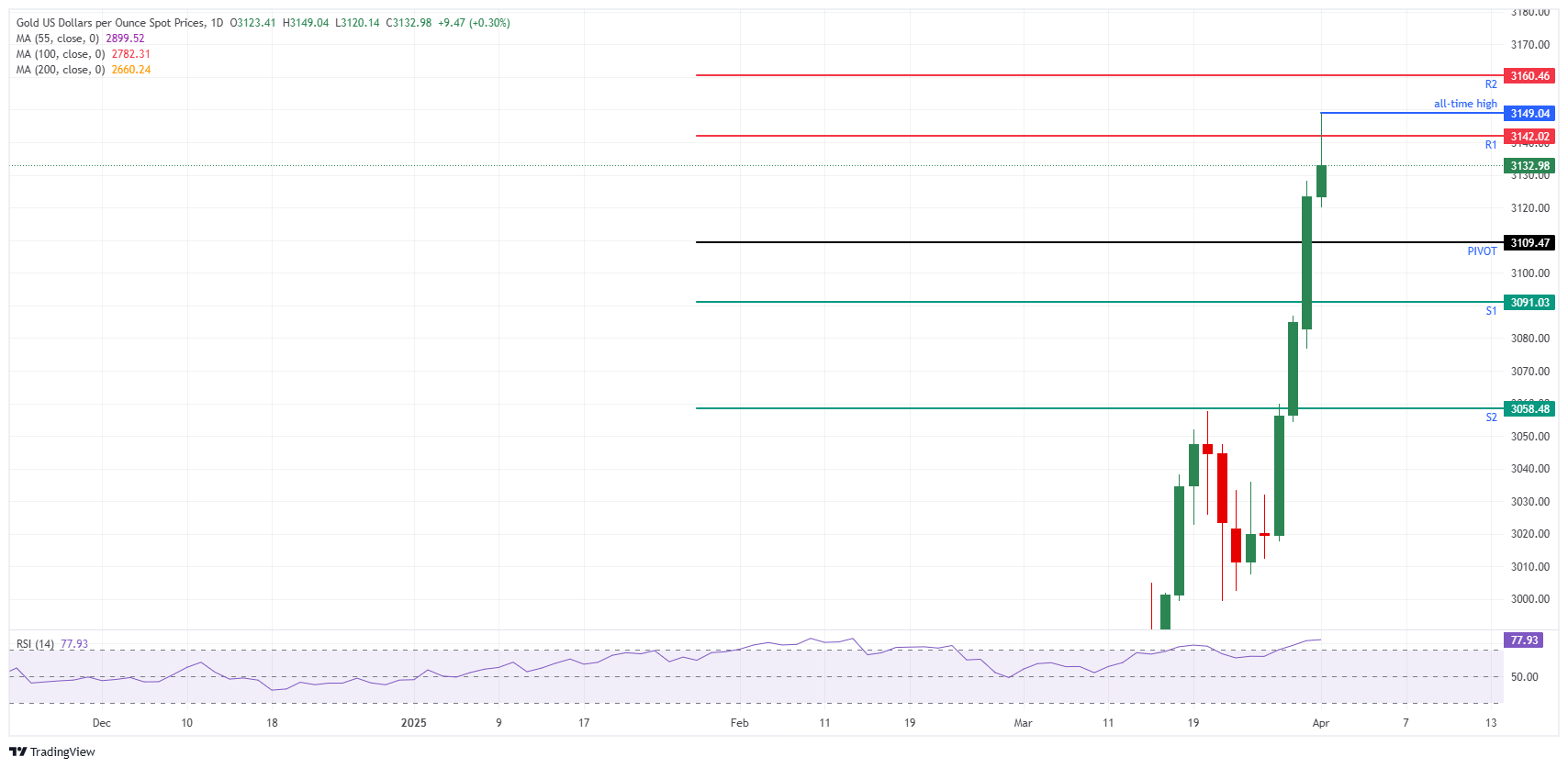

- Gold traders are looking for upward levels with $ 3,200 as the next close objective.

The price of gold (Xau/USD) marks a new historical maximum, the second already this week, with the implementation of reciprocal tariffs just one day away. The precious metal lies slightly above $ 3,130 at the time of writing and the new historical maximum was reached at $ 3,149 on Tuesday. Investors are still looking for refuge in the gold market, since the president of the United States (USA), Donald Trump, is ready to announce reciprocal tariffs on Wednesday around 7:00 p.m.

Meanwhile, operators prepare for a week of intense trading in terms of US economic data in the prelude to the publication of non -agricultural payrolls scheduled for Friday, markets will wait for several data that will be published. During the night, in an interview with CNBC, the president of the Federal Reserve Bank (Fed) of Richmond, Thomas Barkin, said that the economic reading is wrapped in a dense fog and is unclear so that those responsible for policies read where the fees should go, while the fears of recession are still on the table, CNBC reports.

Daily summary of market movements: South African miners win

- The price of increasing gold has promoted South African mining actions to their best registered monthly performance, protecting the reference index of the country of chaos in global markets, reports Reuters. South African mining actions had their best monthly performance registered in March, with an increase of 33%, driven by the increase in gold prices.

- The CME Fedwatch tool sees that the possibilities of a rate cut in May decrease to 13.1% compared to about 18.1% on Monday. A rate cut in June remains the most plausible result, with only 23.1% probability that rates are maintained at current levels.

- Physical demand and a favorable macroeconomic environment are helping to boost gold recovery, according to Amy Gower, raw material strategist in Morgan Stanley, which predicts that prices could rise to $ 3,300 or $ 3,400 this year. That perspective coincides with the forecasts of other great banks, with Goldman Sachs Group Inc. now looking for $ 3,300 for the end of the year, reports Bloomberg.

Technical analysis of the price of gold: general rule

A small ‘parental warning’ about the longevity of gold recovery makes sense at this time. With the main wind in favor for gold fever ready to be officially announced, the rule of buying the rumor must be considered, selling the fact ‘. The risk could be that once the reciprocal tariffs enter into force on Wednesday, only one relief occurs due to the gain takeover once separate commercial agreements are made and partial undone.

On the positive side, the daily resistance R1 at $ 3,142 has already been tested in the strong rebound on Tuesday. R2 resistance at $ 3,160 could still be the objective later in the US trading session as the European session see that the action of gold price is stabilized a bit. Above, the objective of greater rise is at $ 3,200.

On the negative side, the daily pivot point at $ 3,109 should be strong enough to support any sales pressure. Below, S1 support in $ 3.091 is quite far, although it could still be tested without completely erasing the movement of the previous day. Finally, S2 support at $ 3.058 should ensure that gold does not fall below $ 3,000.

Xau/USD: Daily graphic

Commercial War between the US and China Faqs

In general terms, “Trade War” is a commercial war, an economic conflict between two or more countries due to the extreme protectionism of one of the parties. It implies the creation of commercial barriers, such as tariffs, which are in counterbarreras, increasing import costs and, therefore, the cost of life.

An economic conflict between the United States (USA) and China began in early 2018, when President Donald Trump established commercial barriers against China, claiming unfair commercial practices and theft of intellectual property by the Asian giant. China took retaliation measures, imposing tariffs on multiple American products, such as cars and soybeans. The tensions climbed until the two countries signed the Phase one trade agreement between the US and China in January 2020. The agreement required structural reforms and other changes in China’s economic and commercial regime and intended to restore stability and confidence between the two nations. Coronavirus pandemia diverted the attention of the conflict. However, it is worth mentioning that President Joe Biden, who took office after Trump, kept the tariffs and even added some additional encumbrances.

Donald Trump’s return to the White House as the 47th US president has unleashed a new wave of tensions between the two countries. During the 2024 election campaign, Trump promised to impose 60% tariff particularly in investment, and directly feeding the inflation of the consumer price index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.