XRP grew by 26% per week, reaching $ 2.93 after a short rise to $ 3.01. Although this caused optimism, onchain-data indicate a possible short-term correction.

The activity of large holders and the growth of reserves on exchanges create conditions similar to past local peaks, which can portend 20% before the new increase in the price of XRP.

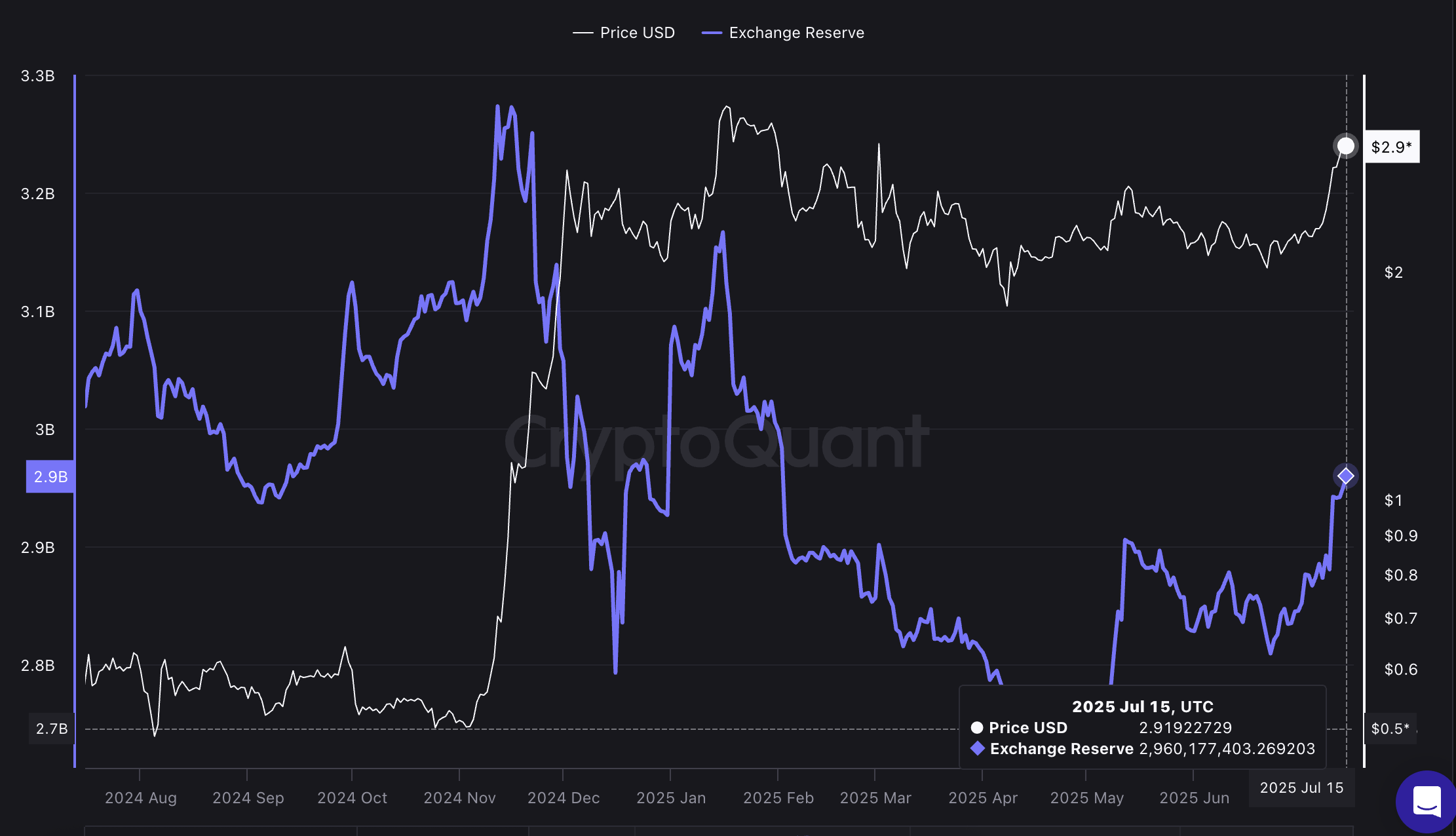

Exchange reserves signal about caution

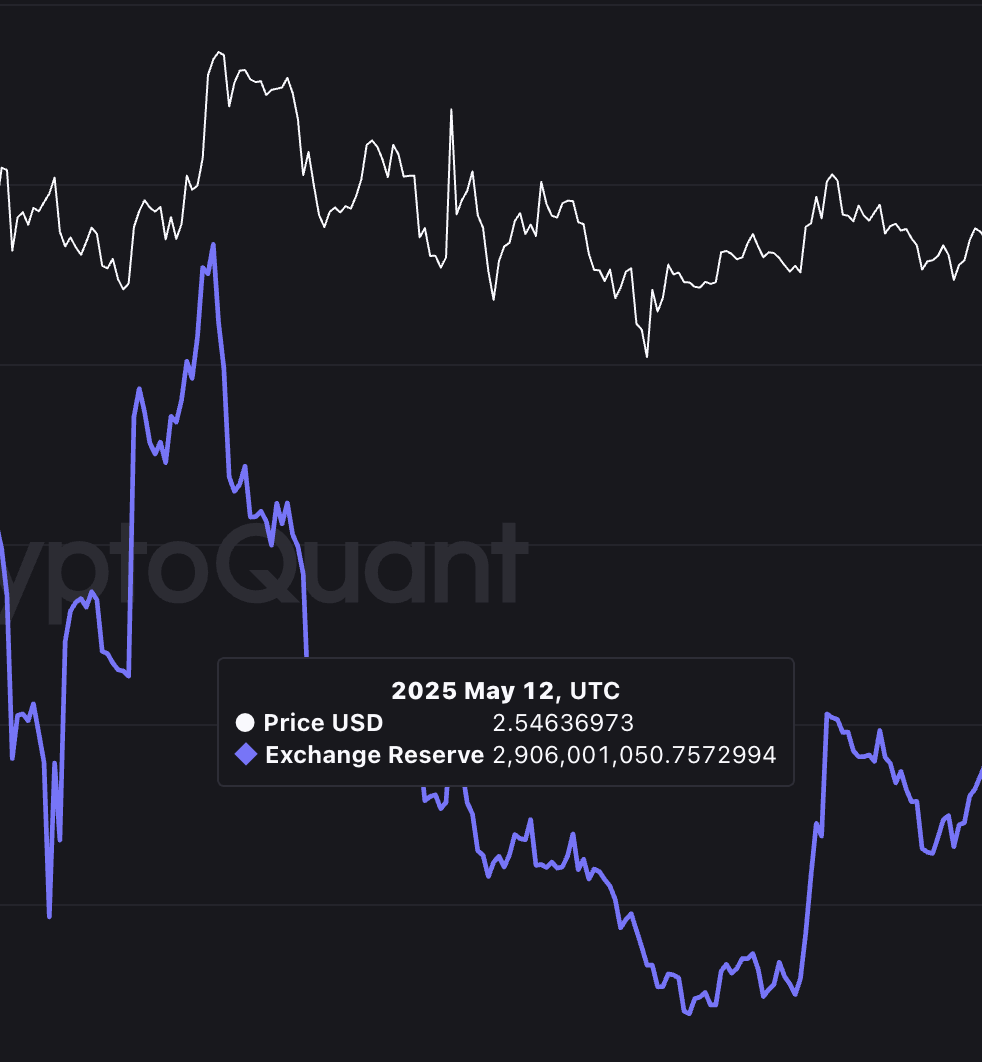

XRP reserves on Binance reached 2.96 billion, which may indicate the pressure of sales. According to Cryptoquant, the last time the reserves were so high in May 2025, when the XRP cost about $ 2.54. Then the correction was followed by 20%, and the token fell to $ 2.01 in the next weeks.

The growth of reserves on exchanges usually means that more tokens moves to exchanges, which is often associated with the upcoming sales. The current situation resembles the May peak, increasing the likelihood of a short -term reduction in the price of XRP.

Whale transactions at a 3-month maximum

The number of XRP transactions worth more than $ 1 million reached a 3-month maximum. Typically, such bursts of large translations precede distribution phases and price corrections when large holders drop their positions on local peaks.

This growth coincides with the increase in reserves on the exchange, which enhances the bear scenario.

XRP forecast: Correction is possible up to $ 2.34

From a technical point of view, a movement from $ 1.90 (minimum) to $ 3.03 (maximum) determines the level of Fibonacci correction 0.618 at $ 2.34. This is an important zone that often attracts the price during consolidation or corrections.

If the price of XRP falls from $ 2.93 to $ 2.34, this will mean a correction by 20%. Such a level was already observed in May after a similar increase in reserves on the exchange.

The nearest support is at the levels of $ 2.80 and $ 2.77 (0.236 Fibonacci level), which previously held the price during kickbacks. A breakdown below these marks can accelerate the fall to $ 2.34 in Fibonacci.

The bear scenario will change if the XRP remains above $ 2.77, and the reserves on the exchange will begin to decline. This will signal the resumption of accumulation.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.