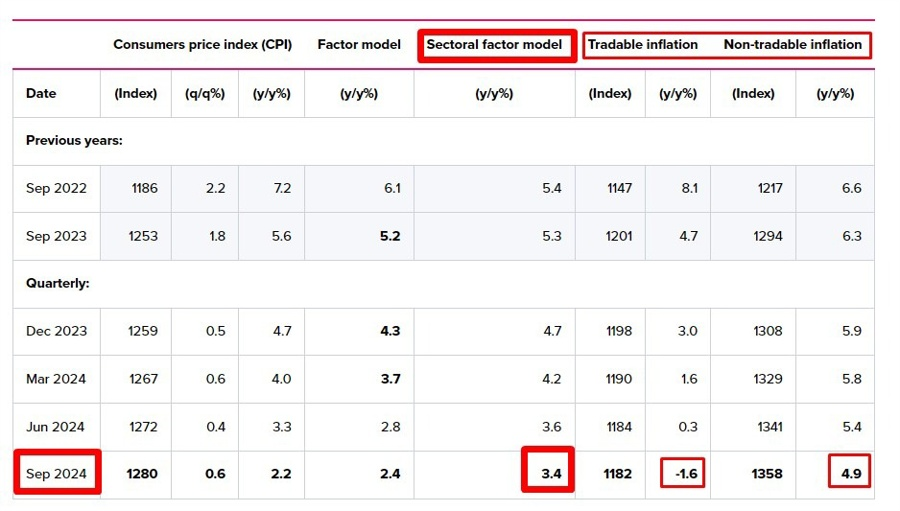

The Reserve Bank of New Zealand (RBNZ) published its Sector Factors Model inflation indicator for the third quarter of 2024, following the release of the official Consumer Price Index (CPI) by NZ Stats early on Wednesday .

The inflation measure continues to fall, standing at 3.4% year-on-year in the third quarter of 2024 compared to 3.6% in the second quarter.

Inflation measures are closely followed by the RBNZwhose monetary policy objective is to achieve inflation of 1% to 3%.

Data released by NZ Stats on Wednesday showed New Zealand’s annual Consumer Price Index (CPI) rose 2.2% in the third quarter, a sharp slowdown from 3.3% growth in the second quarter. The market forecast was +2.2%. Meanwhile, CPI inflation rose to 0.6% quarter-on-quarter in the third quarter versus 0.4% in the second quarter and 0.7% expected.

Implications on the foreign exchange market

He NZD remains under heavy selling pressure following RBNZ inflation data. At the time of writing, NZD/USD falls 0.33% on the day to trade at 0.6062.

About the RBNZ Sector Factor Inflation Model

The Reserve Bank of New Zealand has a set of models that produce estimates of core inflation. The sectoral factor model estimates a measure of underlying inflation based on co-movements: the extent to which individual price series move together. It adopts a sectoral approach, estimating underlying inflation based on two sets of prices: the prices of tradable items, which are those imported or exposed to international competition, and the prices of non-tradable items, which are those produced domestically. national and that do not face import competition.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.