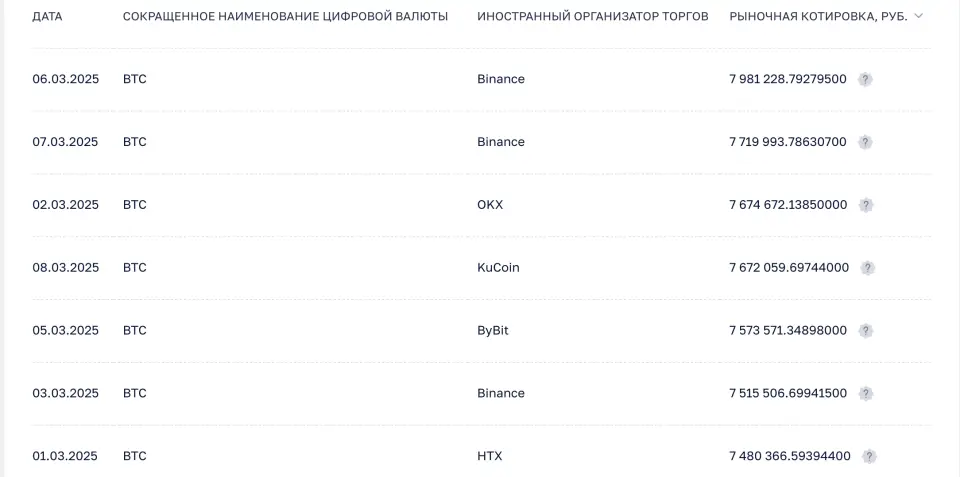

Mining income is considered in kind income, its cost Determined Based on a market quotation at the date of recognition of income – the day when the taxpayer receives the right to dispose of digital currency. The service will help to calculate the income from the produced cryptocurrency and determine the cost of the realized currency for accounting for expenses and the formation of the tax base, said the Federal Tax Service.

A market quotation will be considered the closing price set by a foreign organizer of trade (for example, an exchange) based on the results of transactions committed for a trading day. Information on the reporting procedure and calculation of the tax base placed On the page “Miningreestr.”

Earlier, the Federal Tax Service of Russia announced the launch of the taxpayers in the personal accounts of the reports of reporting on the cryptocurrency obtained and received in another way. Miners are invited to hand over data through a special section of the site.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.