- The S&P 500 closes the week with a rise of more than 80 points.

- The CPI result published on May 15 has driven the rise of the index.

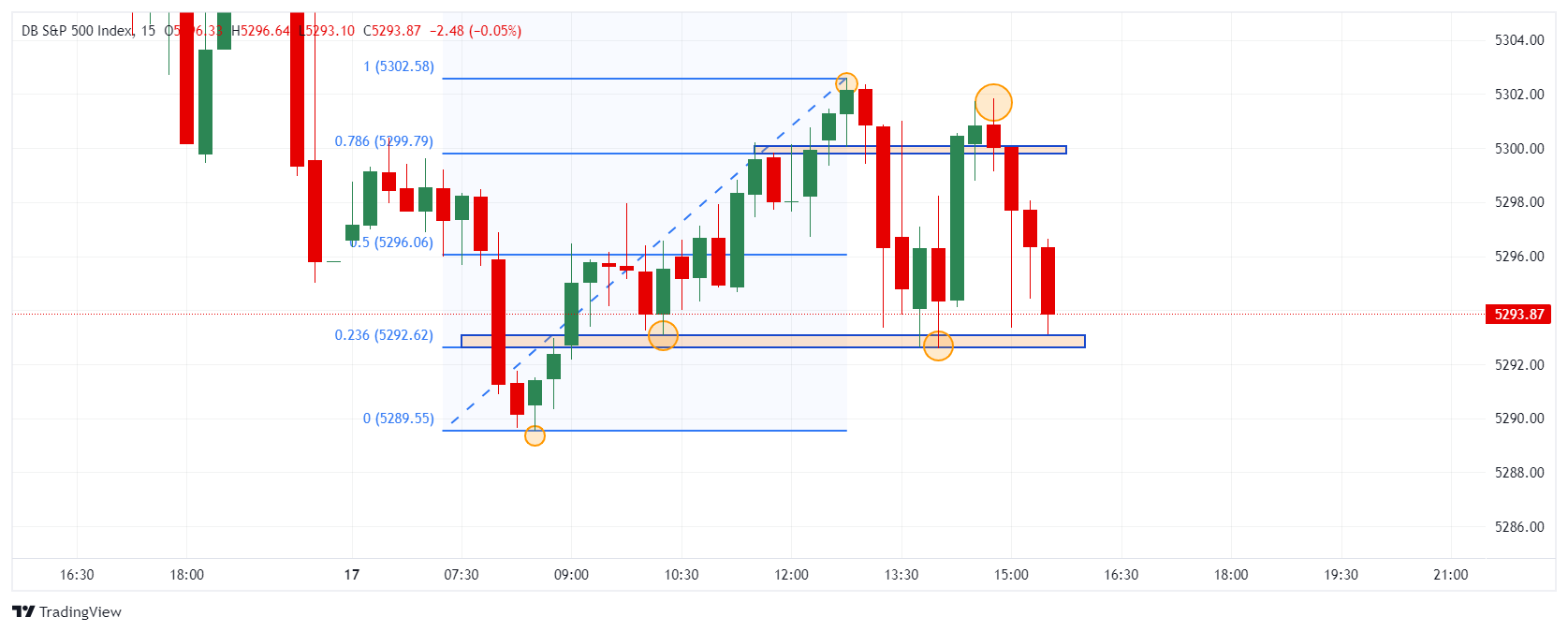

The S&P 500 started the European session with a low of 5,289 points, finding buyers and taking the market to a high of 5,302. Investors have decided to pause, reflected in an operating range of 10 points, in the middle of a week saturated with economic data and statements from Fed members.

The week concludes with speeches by Christopher Waller, Neel Kashkari and Mary C. Daly

Christopher Waller, member of the Board of Governors of the Federal Reserve, and Neel Kashkari, president of the Minneapolis Federal Reserve, have not said anything relevant regarding monetary policy in the short term. Pending Mary C. Daly's speech, the focus will be on the FOMC Minutes that will be published on May 22.

The index was helped this week by US inflation data for the month of April, as the monthly CPI showed growth of 0.3%, below the expected 0.4%, fueling rumors that the Fed could start its rate cuts in September.

Technical levels in the S&P 500

The S&P 500 has established near-term support at 5,292, converging with the 23.6% Fibonacci retracement. The next support is at 5,290, given by the low of today's European session. The closest resistance is at 5,300, given by the 78.6% Fibonacci retracement. Currently, the S&P 500 is trading at 5,294 points, marginally bearish.

S&P 500 15-minute chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.