- The Underlying Price Index for Personal Consumption Expenditure (PCE) rose 0.2% monthly in April, below the 0.3% expected.

- At the close of the session, the speech by Raphael Bostic, president of the Atlanta Federal Reserve, is contemplated.

The S&P 500 began the European session with a daily low of 5,215, but rebounded shortly after and hit a daily high of 5,255. After the opening of Wall Street, the index is trading at 5.225, losing 0.20% daily.

The Underlying Price Index of Personal Consumption Expenditure (PCE) rises less than expected

He PCE core rose 0.2% monthly in April, below the 0.3% expected, based on information from the United States Bureau of Economic Analysis. The core PCE, which does not consider food and energy, remained at 2.8% annually in line with expectations. This data may affect the Federal Reserve's decisions, as it could consider cutting its interest rate sooner than expected.

Later, at the close of the American session, Raphael Bostic, president of the Federal Reserve Bank of Atlanta and member of the Federal Open Market Committee (FOMC), will give a speech, concluding a week full of statements from Fed members.

Technical levels in the S&P 500

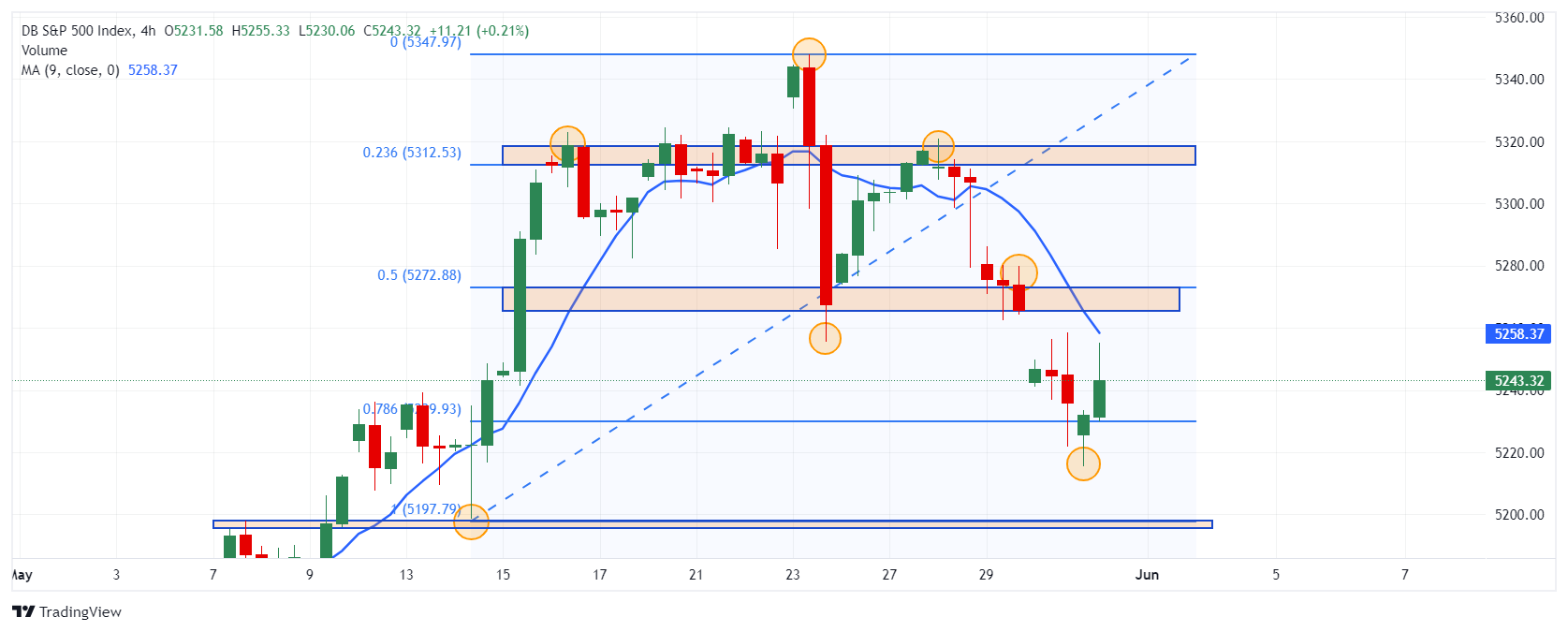

The S&P 500 has established a series of lower highs, confirming a bearish trend in the near term. We observe the first resistance at 5,320, given by the pivot points of May 28 in confluence with the 23.6% Fibonacci retracement. The second resistance is at 5,347, the maximum reached on May 23. The closest support is located at 5,298, the low of the session on May 14.

S&P 500 4-hour chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.