ETF with a double credit shoulder

American investment company Tuttle Capital, specializing in ETF, Submitted Correct to its application for an exchange fund with a double credit shoulder on Bonk. In accordance with it, ETF can be launched no earlier than July 16 – it is after this date that the company expects further actions from regulators.

Note that the ETF with a double credit shoulder is funds that offer double profitability for the index that they have been monitored. Initial application Tuttle Capital Submitted January 27.

The news about the new product associated with Bonk gave an incredible impetus to the bulls. Since July 2, when the amendments to the application of Tuttle Capital were announced, Memcoin demonstrated six trade sessions in a row.

Lift letsBonk

The platform for the launch of memecoons on Solana Pump.fun was a leader in all basic indicators from the moment of its start in January 2024. Nevertheless, in 2025 she had a competitor – Letsbonk (aka Letsbonk.fun or just Bonk.fun), behind which was the Bonk team. In July, the latter was able to bypass PUmp.fun in volume, the number of tokens launched and coins, turning from native to other decentralized sites.

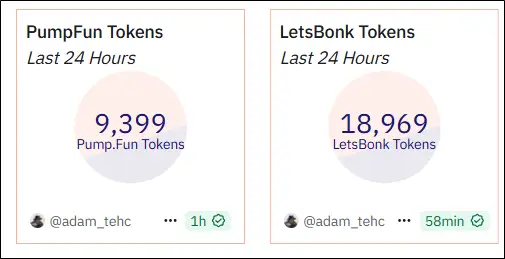

If you look at the statistics for July 7, then almost 19,000 memcoirs were launched on LetsBonk during the day. At the same time period, Pump.fun limited only 9 399.

Source: Dune.com

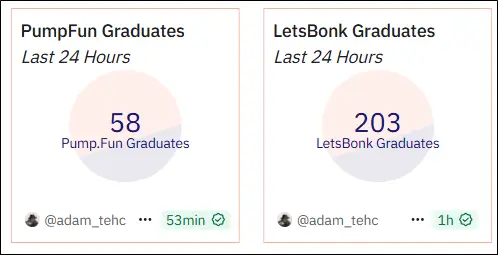

The number of memcoirs that switched from Letsbonk to other decentralized trading platforms was 203. Pump.fun was noted 58 – that is, 3.5 times less.

Source: Dune.com

Moreover, according to the information aggregator of decentralized exchanges on Solana Jupiter, LetsBonk occupies more than half of the market – 54.8%. The share of PUMP.FUN decreased to 34.9%.

Source: Jup.ag

So far, the Useless Coin has become the most successful project with a market capitalization of about $ 276 million.

The platform has a direct impact on BONK, since half of its commission revenues is used to acquire a crypto acting and its subsequent burning. Given this, it is not surprising that the success of Letsbonk aroused a flurry of interest in the memcoran from investors and enthusiasts around the world, especially among representatives of the Asian region.

Demand growth in South Korea

On the South Korean exchanges of Upbit and BitHumb in early July there was a surge in demand for BONK. According to the trade volume indicator on July 6, Memcoin took the second place with more than $ 138 million, losing only the XRP with almost $ 180 million. But the dog memcorana succeeded surpass Bitcoin is 1.8 times, and ether is 2.4 times even.

Search requests

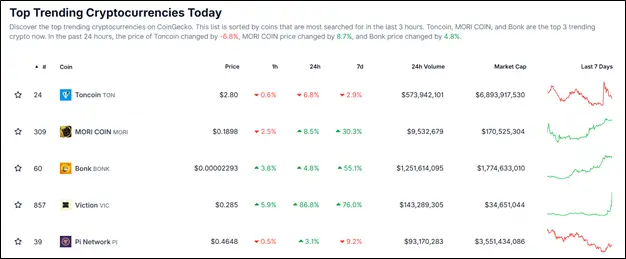

According to the Coingecko portal, Bonk is included in the top 3 cryptocurrencies, information about which users are looking for on the Internet. The first place was taken by Toncoin against the background of the saga with the authorities of the United Arab Emirates (UAE), and the second went to another memcorana on SOLANA – Mori Coin.

Source: Coingecko.com

Further prospects

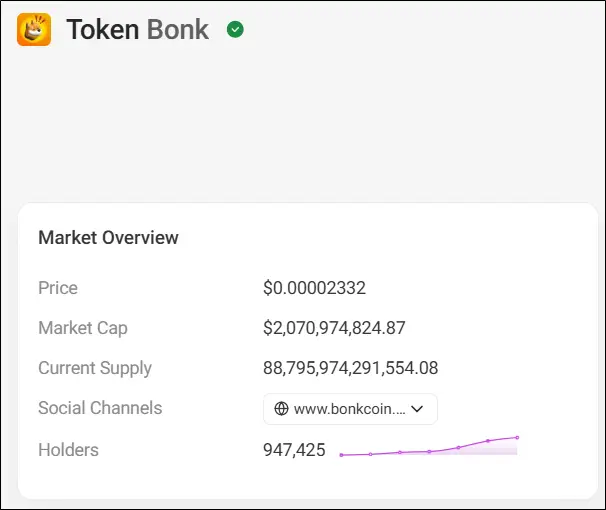

In the near future, the memcorana will have mass burning. Bonk team announcedthat 1 trillion coins (more than 1% in circulation) will be destroyed as soon as the number of holders reaches 1 million. Given that the demand for this cryptoactive is now quite high, and the proposal will decrease significantly, further growth can be expected. As of July 7, the number of Bonk holders slightly exceeds 947,000, and about 53,000 users are needed before the treasured mark.

Source: Solscan.io

Technical analysis

Despite the fact that Bonk has grown by 50%over the first week of July, in general, from the beginning of the year, Memcoin has been in the minus. At the end of 2024, its cost was 31% higher than the current one. Since March, Bonk has a price turbulence: it will either increase in price by 188% in two months, then it will fall in 1.5 months by 55%.

At the moment, a new growth phase is observed. The current trend is bullish, which is confirmed by an excess of the price of a 50-day sliding average (indicated in blue). Nevertheless, it is worth approaching purchases with caution, given that the RSI has entered the overwhelming area, and this usually warns of a possible reversal, at least short -term. The nearest levels of support and resistance: $ 0.00001835 and $ 0.00002573, respectively.

Source: TradingView.com

Conclusion

The growth of Bonk memcoid is explained primarily by the rise in popularity of the site for launching letsBonk memcoirs, as well as the updated Tuttle Capital application on the ETF with a double credit shoulder. Fundamental and technical indicators speak in favor of the bull trend, however, due to the outburst, a local rollback may occur.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.