The Lightning Labs team has presented an alpha version of the Taproot Assets v0.3 protocol for the Bitcoin main network. The solution ensures the issuance and management of financial assets such as stablecoins on the blockchain of the first cryptocurrency.

Announcing the first mainnet release of Taproot Assets 🥕, a protocol for assets on #bitcoin and Lightning.

With this release, developers can issue financial assets on-chain in a scalable manner. 💱

Today marks a new era of multi-asset bitcoin. 🌅https://t.co/2cNvZSvv8v

— Lightning Labs⚡️🍠 (@lightning) October 18, 2023

According to the statement, the release provides forward compatibility, which means that there will be no critical changes in the protocol that could affect assets released on the mainnet. The version supports functionality within the Bitcoin blockchain, and the developers will add support for the Lightning Network (LN) in the “near future.”

In September 2022, Lightning Labs launched the Taro protocol, which provided the ability to issue assets and use them in LN-based applications. The team announced the solution in April, and its creation was made possible thanks to the activation of the Taproot update on the Bitcoin network.

In May 2023, the developers presented a new version of the protocol – already called Taproot Assets v0.2.

According to the team, the mainnet release “marks the beginning of a new era for Bitcoin.”

Bitcoinization of the dollar and global financial assets

Since El Salvador legalized Bitcoin as legal tender in 2021, the LN community has experienced explosive growth, especially in emerging markets, the team noted. One of the main requests from projects serving these users was tools that would add support for stablecoins to their applications.

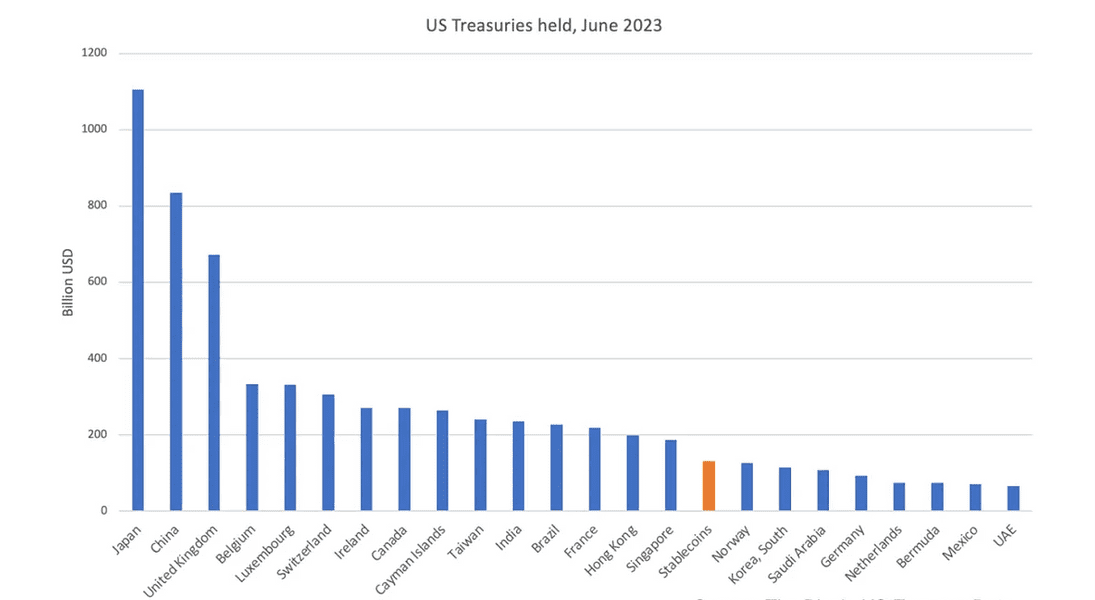

According to the developers of Lightning Labs, this is not surprising: the importance of such assets in the financial system is emphasized by the fact that their issuers own more US government bonds than countries like Germany and South Korea.

US bondholders. Data: Lightning Labs.

US bondholders. Data: Lightning Labs.

User demand for “stable coins” exists because they are simply “a better product than local currencies in developing countries,” the developers emphasized. In addition, more than 2 billion people in the world live in conditions of double-digit inflation in national currency, they recalled.

During tests, developers experimented with various real assets such as gold, US bonds and corporate bonds. Together with early users, they implemented a total of about 2,000 cases, for which they synchronized nodes with the Universe server to initialize and check the status more than 420,000 times.

Lightning Labs emphasized that Taproot Assets v0.3 “provides a complete set of tools to begin issuing, managing, and exploring mainnet assets on the chain.”

The release includes:

- full-fledged API issues and redemptions, supporting the possibility of issuing multiple sets at different times while maintaining fungibility;

- asynchronous reception functionality, which allows you to send and receive messages without both parties being online at the same time;

- “multiverse” mode for Universe, combining several servers – if one of them is disabled, the recipient has other sources to check the legitimacy of the sender;

- improvements in scalability, security and convenience for developers, such as solutions that allow you to independently conduct software stress tests, providing protection against possible reorganizations in the mainnet.

The Taproot Assets team noted that the protocol for the mainnet has launched in an alpha version, and therefore is looking forward to feedback, comments and other user participation in further improving the solution.

Many bitcoin participants with enthusiasm We met the release for the mainnet from Lightning Labs. However, a Bitcoin developer under the nickname Hunter Beast said that the solution is a “poor simulator of the RGB protocol,” which has been working on the main network for several months.

Good for you. Meanwhile, RGB has been on mainnet for months, works with cold wallets instead of being on hackable hot nodes, can do smart contracts, not just assets, and you have no plans to scale beyond Lightning. Taproot Assets will always remain a poor simulator of RGB.

— Hunter ₿eaṩt (@cryptoquick) October 18, 2023

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.