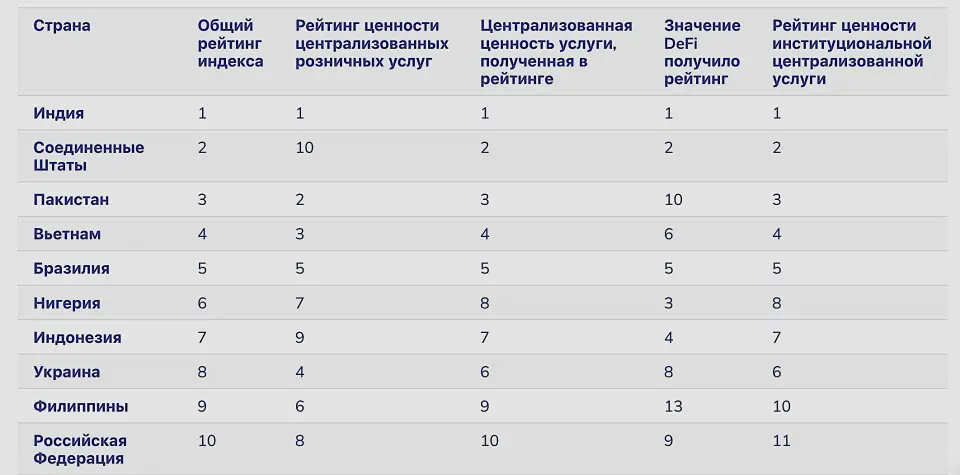

Chainalysis chief economist Kim Grauer in an interview with Cointelegraph said that the GCAI index methodology takes into account the volume of cryptocurrency transactions obtained through centralized crypto platforms and defi protocols with adjusting the gross domestic product for the soul of the population Parity of purchasing power. At the same time, the private activity of traders is measured by the number of transactions up to $ 10,000, and the corporate one is over $ 1 million.

In the USA and India, the main reasons for the growth of the index have become progress in regulating digital assets and launching crypto services useful for people.

“The main factor is the benefit: whether it is stablecoins or other assets used for money transfers, savings in economies subject to inflation, or decentralized applications that meet the needs of users,” Kim Grauer explained.

In addition to the United States and India, Pakistan, which rose at once by six positions, as well as Vietnam and Brazil, entered the five leaders.

According to the Chainalysis analytical platform, in June, participants in Russian cryptocurrencies increased investments in digital assets to $ 25.4 billion, which is equivalent to 2.3 trillion rubles.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.