- The Nasdaq composite collapses as the market becomes more pessimistic about China’s tariffs.

- The White House says that Trump’s tariff on China is actually 145%.

- Trump imposes 10% tariffs on Canada and Mexico that are applied worldwide.

- Economists and analysts care about the continuation of the commercial war with China.

He market US stock market continues its volatile trend, this time falling on Thursday after the historic rebound on Wednesday. He Nasdaq Composite (Ixic) It has quoted 5.7% lower at the time of writing these lines on Thursday.

This occurs after US President Donald Trump Pausara big tariffs to more than 70 commercial partners for 90 days in the regular session on Wednesday, sending Nasdaq composite to his second largest gain in history, closing with an increase of 12.16%.

Although the market is quite excited by the pause in the highest tariffs on Japan, the European Union, India and Vietnam, on Thursday investors are dealing with the continuation of Trump of base tariffs of 10% worldwide and extremely high tariffs on China.

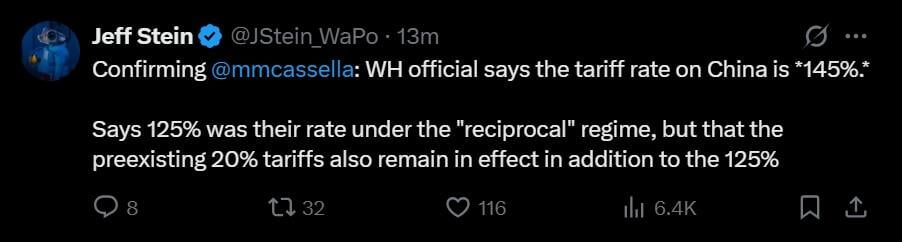

In a publication in social networks on Wednesday, Trump seemed to be saying that the tariffs on China would increase to 125%, but on Thursday, White House officials told the Washington Post that the figure adds to the tariff rate of the previous 20%and that the new rate for China is 145%.

The Washington Post reporter Jeff Stein, publishes at X.com that the White House confirms the 145% tariff on China. April 10, 2025

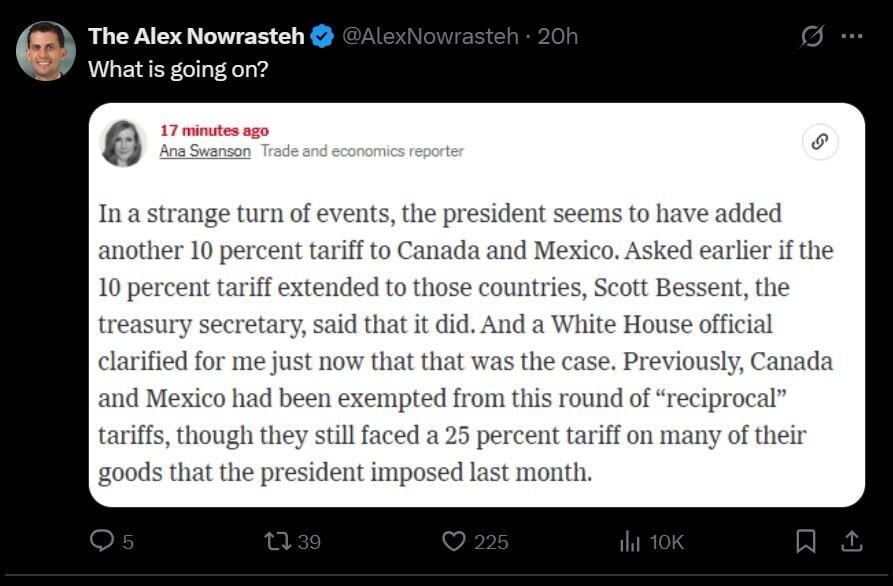

In addition, Trump’s general tariff also now applies to Mexico and Canada, something that most investors did not realize on Wednesday. When Trump paused 25% tariffs on both countries last month, most products returned to their free trade status under the USMCA agreement that Trump signed during his first mandate.

The vice president of the Cato Institute for Economic and Social Policy responds to the New York Times, Ana Swanson, on the additional Trump tariff over Canada and Mexico. April 9, 2025

Since Mexico, Canada and China are the main US commercial partners, US consumers should still feel the weight of the highest prices. But at this time, inflation seems to be balanced. Published on Thursday morning, the US Consumer Price Index (CPI) for March showed that interannual underlying inflation fell to 2.8% from 3.1% in February.

Analysts see reasons for concern despite the pause in tariffs

Pantheon Macroeconomics published a report of perspectives on Thursday that projects a 1% increase in US prices due to Trump’s current tariff policy. By increasing tariffs on Chinese products to 145%, the firm expects trade between the US and China collapse by 90%. On the other hand, US consumers will replace products with the highest price in other countries.

Since Chinese tariffs on US products will probably stop most US exports to China, Pantheon hopes that only one third of those products will find a market elsewhere. “That implies that total exports of goods will fall by 5%, reducing GDP by 0.35%,” said Samuel Tombs, head economist of Pantheon.

The chief economist of UBS, Paul Donovan, said some of Pantheon’s concerns. Donovan said that the risk of recession in the US is more under Thursday than the previous day, but is still high.

Goldman Sachs gave a 65% probability of a recession in the US on Wednesday, but quickly retracted it that Trump paused the highest level of tariffs over approximately 75 countries.

“Together, these tariffs probably add something close to our previous expectation of an increase of 15 percentage points in the effective tariff rate,” said Jan Hatzius, chief economist of Goldman. “As a result, we are returning to our previous forecast of non -recession, with a GDP growth of 0.5% and a 45% recession probability.”

However, Peter Sidorov by Deutsche Bank said the news remains negative in general, since China tariffs indicate an important decoupling of the two largest economies in the world. Unlike other countries that tried to negotiate with Trump, China quickly responded with its own set of tariffs on US products, something against which Trump had specifically noticed.

Amazon (AMZN) It is said that it is canceling billions of dollars in orders from China to avoid incredibly high tariffs. Approximately 60% of the products sold on Amazon are managed by the company itself, while around 40% of the products come from external vendors.

Hollywood will be another victim of the commercial war. On Thursday, the Chinese government’s office said it would approve fewer films produced in the US for import due to the current commercial war. This policy could harm US companies such as Warner Bros. Discovery (WBD), Global paramount (for) and Disney (Dis).

Nasdaq Composite index forecast

The Nasdaq shot again Thursday in a way that tells us that the recent volatility caused by tariffs remains high. Although it is far from its minimums, the Nasdaq broke the historical support in 15,708 and 15,222. This makes the level of 14,500 the new support focus if Thursday’s sale continues in the following weeks.

With the simple mobile average (SMA) of 50 days sinking below its 200 -day counterpart, it is clear that a period of weakness will be here for a while. Ixic needs to break above the support level of 17,500 to end this important period of pessimism among traders.

Daily GRAPH OF THE NASDAQ COMPOSITE INDEX

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.