- The USD/CAD rises as the divergence in monetary policy and the demand for sure refuge supports the strength of the USD.

- The Ormuz Strait is still a concern for oil markets, but fails to support the Canadian dollar on Monday.

- The USD/CAD is approaching the single 50 -day mobile average, below the psychological level of 1,3800.

The USD/CAD is quoting stronger on Monday, keeping around 1,3780 after touching an intradic of 1,3803 earlier in the session.

The pair is on its way to its fifth consecutive day of profits, driven by a mixture of safe refuge flows to the US dollar and concerns about Canada’s internal economic perspectives.

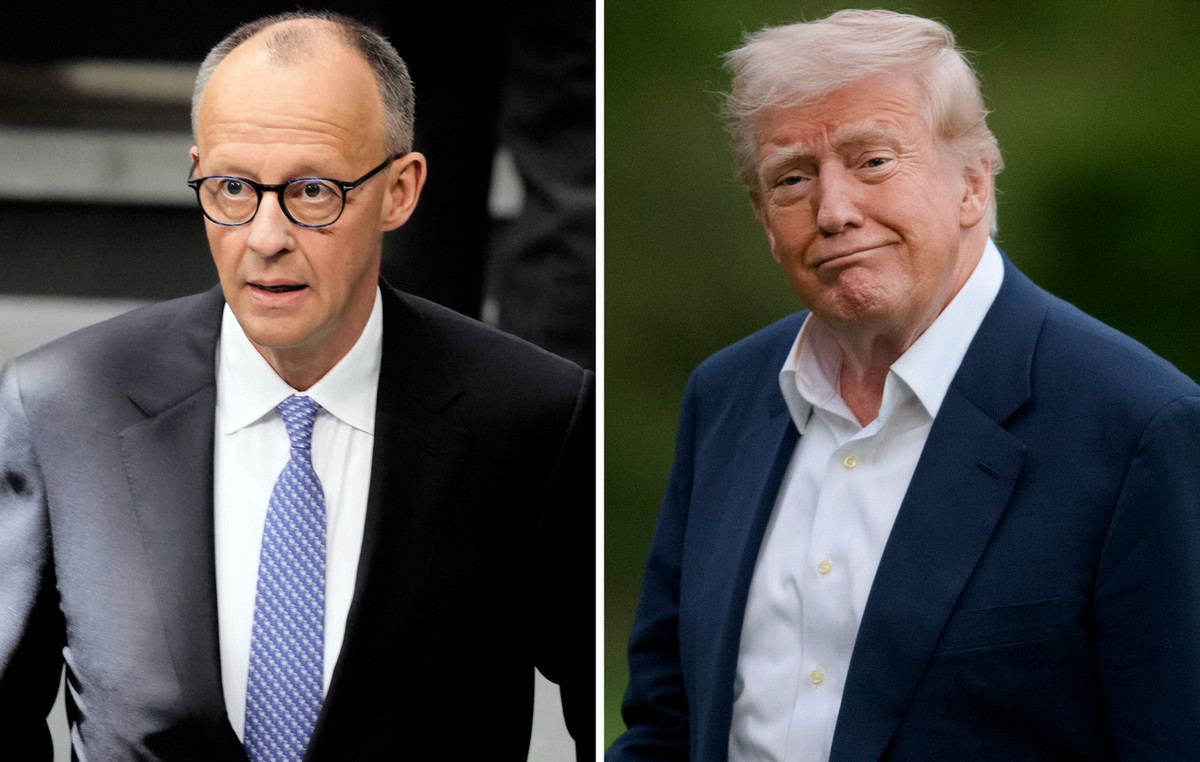

The feeling of risk is still fragile after the United States launched air attacks on three Iranian nuclear sites over the weekend. In a televised statement, President Donald Trump said the attacks were a “very successful attack” and warned about more military actions if they will be scale. The attacks increased tensions throughout the Middle East, particularly on the Ormuz Strait, a key oil shipping route.

This occurs after the renewed demand for sure refuge for the US dollar last week, caused by US air attacks in Iranian nuclear sites, which injected uncertainty into global markets and raised the dollar in general.

The resulting risk aversion tone has kept the US dollar supported, even while oil prices rise. Risk -sensitive assets have seen a limited increase, while safe refuge flows have driven the strength of the USD against its main peers.

The dovish of the BOCs provides additional support for the USD/Cad

Meanwhile, Canadian economic foundations have provided little support for the CAD. The preliminary retailers of May on Friday of Statistics Canada showed a more pronounced 1.1% contraction than expected, after a modest increase of 0.3% in April. This underlines the weakness of the consumer demand and adds weight to the case of additional cuts of interest rates by the Bank of Canada.

Technical analysis: the USD/CAD is approaching the resistance in the 50 -day SMA

From a technical point of view, the USD/CAD faces immediate resistance in the single mobile average (SMA) of 50 days about 1,3803.

A sustained rupture above that level could pave the way for a proof of the minimum of November 2024 in 1,3823. Downwards, the initial support is found in the 20 -day SMA in 1,3704, followed by a more significant floor about 1,3640. The relative force index (RSI) is maintained just above 55, suggesting a neutral to slightly bullish momentum in the short term.

Canadian dollar faqs

The key factors that determine the contribution of the Canadian dollar (CAD) are the level of interest rates set by the Bank of Canada (BOC), the price of oil, the main export product of Canada, the health of its economy, inflation and commercial balance, which is the difference between the value of Canadian exports and that of its imports. Other factors are market confidence, that is, if investors bet on riskier assets (Risk-on) or seek safe assets (Risk-Off), being the positive risk-on CAD. As its largest commercial partner, the health of the US economy is also a key factor that influences the Canadian dollar.

The Canada Bank (BOC) exerts a significant influence on the Canadian dollar by setting the level of interest rates that banks can provide with each other. This influences the level of interest rates for everyone. The main objective of the BOC is to maintain inflation between 1% and 3% by adjusting interest rates to the loss. Relatively high interest rates are usually positive for CAD. The Bank of Canada can also use quantitative relaxation and hardening to influence credit conditions, being the first refusal for CAD and the second positive for CAD.

The price of oil is a key factor that influences the value of the Canadian dollar. Oil is the largest export in Canada, so the price of oil tends to have an immediate impact on the value of the CAD. Generally, if the price of oil rises, the CAD also rises, since the aggregate demand of the currency increases. The opposite occurs if the price of oil drops. The highest prices of oil also tend to give rise to a greater probability of a positive commercial balance, which also supports the CAD.

Although traditionally it has always been considered that inflation is a negative factor for a currency, since it reduces the value of money, the opposite has actually happened in modern times, with the relaxation of cross -border capital controls. Higher inflation usually leads to central banks to raise interest rates, which attracts more capital of world investors who are looking for a lucrative place to save their money. This increases the demand for the local currency, which in the case of Canada is the Canadian dollar.

The published macroeconomic data measure the health of the economy and can have an impact on the Canadian dollar. Indicators such as GDP, manufacturing and services PMIs, employment and consumer confidence surveys can influence the CAD direction. A strong economy is good for the Canadian dollar. Not only attracts more foreign investment, but it can encourage the Bank of Canada to raise interest rates, which translates into a stronger currency. However, if the economic data is weak, the CAD is likely to fall.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.

%20MATHIEU%20RAINAUD-03.jpg)