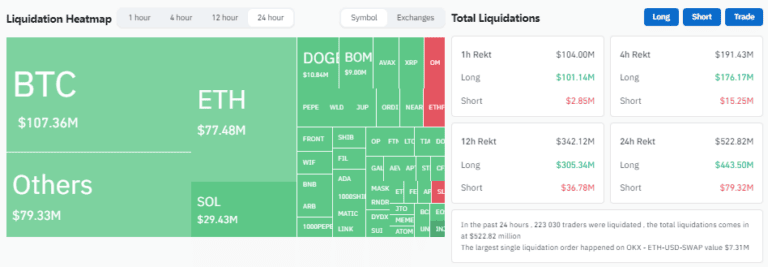

From March 18 to March 19, 2024, the volume of liquidations on futures contracts on the crypto market amounted to $522.82 million, according to CoinGlass. This happened against the backdrop of Bitcoin’s decline below $65,000.

In total, 223,030 traders were subject to liquidation. Long positions prevail in terms of losses – $443.5 million. Short positions account for $79.32 million.

Among crypto assets, Bitcoin (BTC) prevails. Pairs with the first cryptocurrency account for about 20% of all losses as a result of liquidations. Next come Ethereum (ETH) and altcoins, in particular Solana (SOL), Dogecoin (DOGE) and Ripple (XRP).

Traditionally, the leaders in crypto exchanges are Binance and OKX. Their total share is almost 70%.

At the time of writing, Bitcoin is trading around $64,000, according to TradingView. There is a downward trend in the market:

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.