According to CEX.io, a similar surge in interest in the raids was observed during the banking crisis caused by the collapse of Silicon Valley Bank, Silvergate Bank and Signature Bank. A surge of interest coincided with a record increase in physical gold prices, which reached a historical maximum on March 31 – above $ 3100 for the Troika ounce – and by the end of the first decade of April, about $ 3118 were selling.

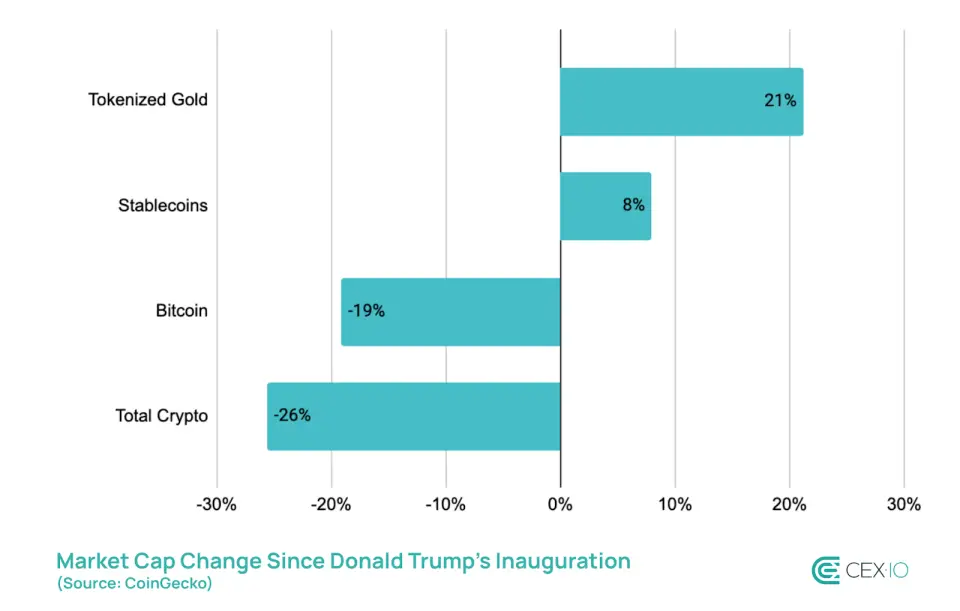

According to TradingView, since the beginning of the year, gold added more than 18%, overtaking bitcoin, which lost 12% of the cost. CEX.IO analysts associate steady increase in price-tokenized gold with increasing demand for assets-refuge in the conditions of the escalation of the US trade war.

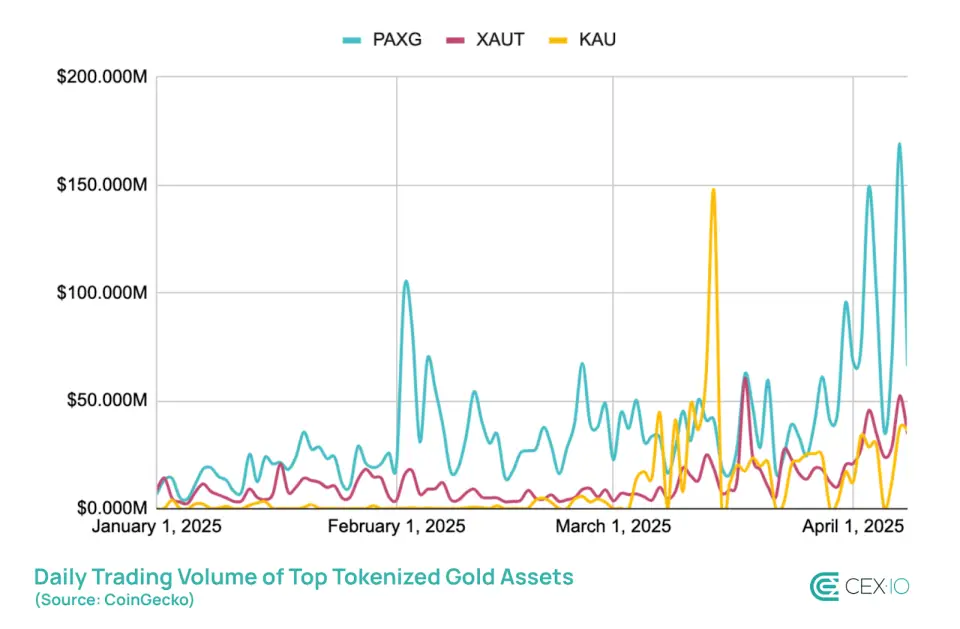

“Tokenized gold has become one of the most effective categories of digital assets since the inauguration of Trump: market capitalization has increased by more than 21%, and the volume of bidding by more than 1000%. While stablecoins for the same period showed an increase in market capitalization by 8% and expanding the volume of bidding by 285%, ”the report said.

The authors of the study emphasize that tokenized gold cannot yet compete with physical gold due to restrictions on the development of the system of tokenization of real assets (RWA).

But it has already become a significant part of the RWA market, including digital versions of real estate, art and other material values. RWA is gaining popularity as a diversification tool, especially in conditions of market uncertainty.

Earlier, the head of the research department of the financial services platform Bitcoin New York Digital Investment Group (Nydig) Greg Cipolaro said that, due to the tokenization of the US gold reserve in society, perception of bitcoin and other cryptocurrencies may improve.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.