In April, US-based crypto exchange Coinbase notified users that it had received a Class F license under the Digital Asset Business Law from the Bermuda Monetary Authority (BMA).

At the completion of the preparatory phase, the administration of Coinbase announced that it will allow international users to trade bitcoin and ether pegged perpetual futures through a new platform based in Bermuda.

“Coinbase International Exchange has successfully launched. We intend to continue to actively work to increase market share and plan to offer users new functionality and additional products in the second half of the year,” said Emmanuel Goh, product manager at Coinbase.

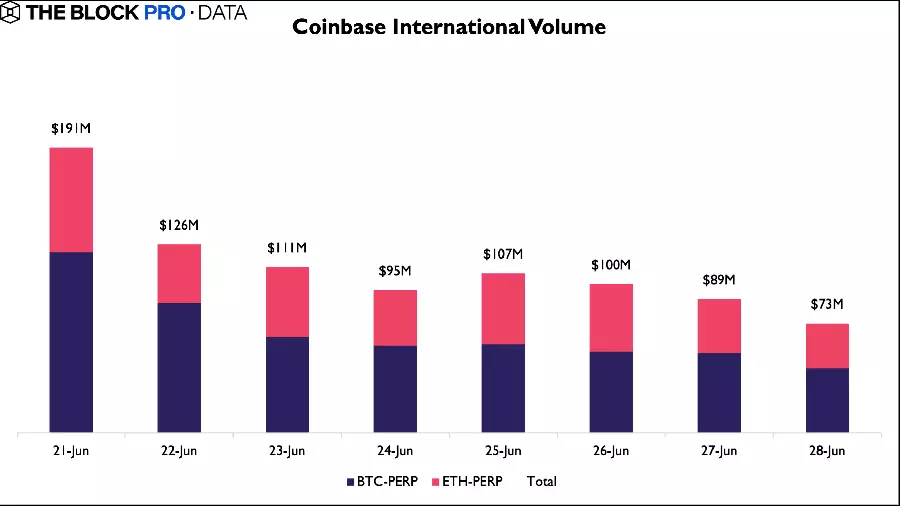

According to The Block analysts, for the period from June 21 to 28, the trading volume on the exchange amounted to almost $900 million.

In addition to the representation in Bermuda, the site in Ireland remains under the control of the Coinbase exchange. At the end of 2022, the Central Bank of Ireland issued a Virtual Asset Service Provider (VASP) license to Coinbase to provide services to residents of the country.

On Wednesday, June 28, Coinbase filed a motion in the New York District Court to dismiss the US Securities and Exchange Commission (SEC) lawsuit, arguing that the cryptocurrency exchange does not trade assets that can be considered investment contracts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.