Bitcoin

Bitcoin grew by 9.2% from March 22 to March 29. The short correction ended, and BTC again set off to storm $71,000. Most of the week was positive for the world’s largest cryptocurrency: five out of seven trading sessions.

Source: tradingview.com

What is the reason for this dynamic? It is difficult to name a single reason. A fairly reasonable explanation was given by crypto trader Ali Martinez. Referring to data from the Santiment platform, the investor

indicated on the fact that major players (whales) over the past week

bought 100,000 BTC for a total value of over $7 billion. It is logical that the greater the demand, the higher the price.

Opinion

confirms and another analytical platform – CryptoQuant. According to their data, monthly demand for BTC in 2024 jumped from 40,000 to 213,000 coins. This is ensured by both the actions of whales and ETFs. At the same time, CryptoQuant notes a reduction in the volume of available bitcoins to 2.7 million, which

is the lowest level in four years.

Interesting data

leads Kaiko platform. Its experts noticed a strong drop in the Bitcoin rate on some exchanges and an increase on others. For example, on March 18, BTC fell to $7,800 on Bitmex, while its average price on other major platforms

amounted to $66,000. A similar situation happened at Coinbase. There, in early March, Bitcoin sharply dropped in price relative to the euro. In Kaiko among the causes of metamorphosis

called low liquidity, fragmentation and isolated attempts at market manipulation.

From a technical analysis perspective, Bitcoin remains in an uptrend. This is evidenced by the price location above the 50-day moving average (indicated in blue), as well as the growth of the RSI indicator above 50. Resistance and support levels: $73,794 (historical maximum) and $60,760, respectively.

Source: tradingview.com

Index

fear and greed Compared to last week, it increased by four points to 79. This indicates the extreme greed of Bitcoin investors.

Ethereum

Ethereum growth last week was about 7%. The price reached a maximum of $3,680. The volatility compared to the previous week was much less: on none of the days did the rise or fall of ETH reach even 4%.

Source: tradingview.com

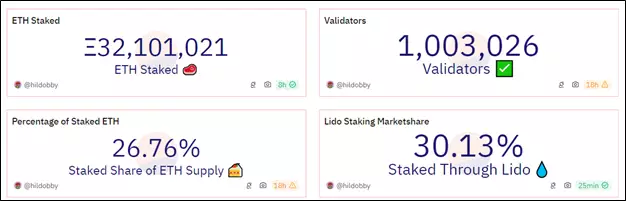

The second largest cryptocurrency by capitalization was able to reach several peaks at once. The number of validators in Ethereum has exceeded 1 million. It would seem that this is positive news. However, not all representatives of the crypto industry agree with this. Founder of the management company

novadash.io Gabriel Weide

believeswhat is the number of validators is a problem:

“Too many validators can ultimately lead to failed transactions. But the maximum effective staking rate (more than 32 ETH) should reduce this risk.”

Source: dune.com

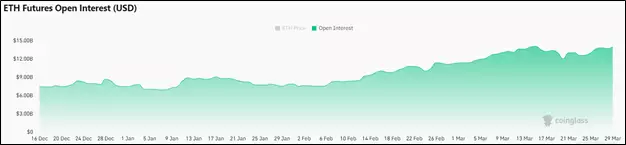

And on March 29, 2024, the open interest indicator (the number of futures and options on ETH on exchanges) reached $14 billion. This happened for the first time since March 15. At that time, open interest amounted to $14.11 billion.

Source: coinglass.com

According to technical analysis, Ethereum is very similar to Bitcoin. ETH is also in an uptrend, having recently completed a correction. The predominance of bullish sentiment is indicated by the price being above the 50-day moving average (indicated in blue) and the growth of the RSI indicator above 50. Support and resistance levels: $3,059 and $4,095.4, respectively.

Source: tradingview.com

Bitcoin Cash

The popular hard fork of Bitcoin – Bitcoin Cash – increased by more than 32% during the period from March 22 to March 29, 2024. Six out of seven trading sessions ended in positive territory. The only exception was Tuesday, March 26, when the coin lost 1.67%.

Source: tradingview.com

Since the beginning of 2024, BCH has gained more than 120%. Moreover, 92% occurred in March. The main reason for such rapid growth

is upcoming halving on April 4th. After it, the mining reward for miners will decrease from the current 6.25 BCH to 3.125 BCH. This has already allowed Bitcoin Cash to return to the top 15 cryptocurrencies by market capitalization. As of March 29, the coin ranks 14th with $11.2 billion.

For ten days, from March 20 to March 29, the open interest indicator increased more than three times: from $213.6 million to $673.99 million. This information is provided by the Coinglass analytical portal.

Source: coinglass.com

Crypto exchanges, in response to such a rush, began to introduce more derivatives on Bitcoin Cash. Coinbase announced that it will launch BCH futures on April 1st. For now, their duration will not exceed one month.

A number of representatives of the crypto industry predict a continuation of the upward trend. For example, analysts under the pseudonym Thunder.BCH made a bold

assumptionthat Bitcoin Cash will reach $2,000:

“Already 50% after this tweet. Further more. $2,000 in the coming months. Bitcoin maximalists will be hard-copied. BCH will go to the moon.”

From a technical analysis perspective, Bitcoin Cash is in an uptrend. This is evidenced by the price exceeding the 50-week (indicated in blue) and 200-week (indicated in orange) moving averages. The coin may (hardly) reach $2,000, but the initial target will be the resistance level around $800. Support is at $527.74.

Source: tradingview.com

Conclusion

After a short correction, Bitcoin and Ethereum are back on track. Bitcoin Cash is renewing 2024 highs in anticipation of the halving, which is scheduled for April 4. And soon – Bitcoin halving.

This material and the information contained herein do not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.