- Treasury yields rise after the CPI; The 10 -year performance rises 5.5 bp, the 2 -year -old rises 3 bp on a firm inflation panorama.

- Fed Jefferson says that politics is well positioned, but points out that tariffs could cloud the inflation trajectory.

- The market cuts the expectations of fed cuts by 2025 to 49.5 bp, from 76 bp in early May.

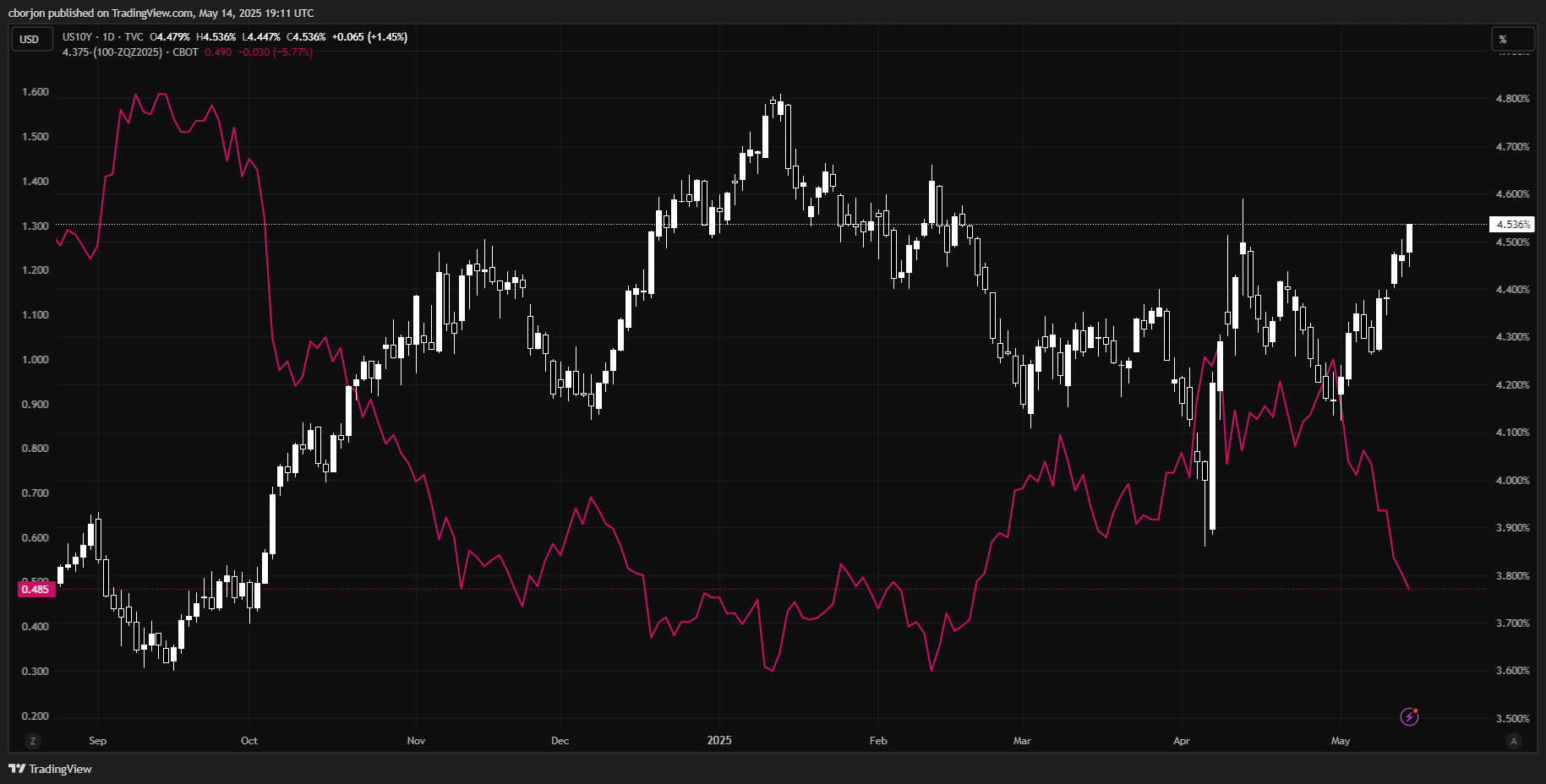

The US treasure yields are rising throughout the yield curve while market participants digest US inflation data on Tuesday on the consumer side, with the operators waiting for the publication of the April data of the production price index (IPP) and retail sales. At the time of writing, the performance of the 10 -year reference note of the US has risen five and a half basic points to 4,525%.

10 -year yield rises to 4,525% while real yields shoot at 2.21%, since Fed officials indicate tariff risks and flexibilization bets fader

The 2 -year Treasury bonus yield

The US treasure yields remained within the maximums of the week while the market mood changed positively after the news that the US and China had agreed a 90 -day break in the tariffs and reduced the rights in more than 115%. The White House decided to impose 30% tariffs on Chinese products and 10% on US goods.

The Vice President of the Fed, Philip Jefferson, declared that the current monetary policy position is well positioned to respond to economic developments, noting that inflation data are consistent with additional progress towards the objective of 2%, but the future path remains uncertain due to the impact of tariffs.

Jefferson added that tariffs could enliven inflation, but it is not clear if they would be temporary or persistent.

The Trump Budget bill approved by the US Congress.

Republicans advanced elements of the broad Trump budget package on Wednesday, approving tax cuts that would add American dollar trillion to US debt.

Investors are attentive to the publication of inflation data on the producer’s side, together with retail sales and labor market data.

The real US yol

The real yields of 10 years from the US, which are the difference between the 10 -year nominal performance of the US and the expectations of inflation for the same period, three basic points are fired to 2.21%.

The operators have discounted a rate cut by the Fed, since market participants expect only 49.5 basic points (PB) of flexibility, in contrast to the 76 PB scheduled for May 7.

Treasury Performance Graph at 10 years from USA / Fed interest rates

Fed Faqs

The monetary policy of the United States is directed by the Federal Reserve (FED). The Fed has two mandates: to achieve prices stability and promote full employment. Its main tool to achieve these objectives is to adjust interest rates. When prices rise too quickly and inflation exceeds the objective of 2% set by the Federal Reserve, it rises interest rates, increasing the costs of loans throughout the economy. This translates into a strengthening of the US dollar (USD), since it makes the United States a more attractive place for international investors to place their money. When inflation falls below 2% or the unemployment rate is too high, the Federal Reserve can lower interest rates to foster indebtedness, which weighs on the green ticket.

The Federal Reserve (FED) celebrates eight meetings per year, in which the Federal Open Market Committee (FOMC) evaluates the economic situation and makes monetary policy decisions. The FOMC is made up of twelve officials of the Federal Reserve: the seven members of the Council of Governors, the president of the Bank of the Federal Reserve of New York and four of the eleven presidents of the regional banks of the Reserve, who exercise their positions for a year in a rotary form.

In extreme situations, the Federal Reserve can resort to a policy called Quantitative Easing (QE). The QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non -standard policy measure used during crises or when inflation is extremely low. It was the weapon chosen by the Fed during the great financial crisis of 2008. It is that the Fed prints more dollars and uses them to buy high quality bonds of financial institutions. The one usually weakens the US dollar.

The quantitative hardening (QT) is the inverse process to the QE, for which the Federal Reserve stops buying bonds from financial institutions and does not reinvote the capital of the bonds that it has in portfolio that they expire, to buy new bonds. It is usually positive for the value of the US dollar.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.