TokenInsight analysts report that in Q3 the trading volume on decentralized exchanges in Ethereum decreased by 23%, and versions on second-tier solutions have not yet gained popularity.

The most popular decentralized exchange on the Ethereum network, Uniswap, also runs on Arbitrum and Optimism solutions. As of September 30, in the main network of the second cryptocurrency in Uniswap v3 smart contracts, tokens worth $ 2.6 billion are circulating.In the Arbitrum solution network, the indicator is two orders of magnitude lower, only $ 37.3 million, and in Optimism $ 32.4 million.

The situation is similar with the trading volume. In the main network of Ethereum, the trading volume on the Uniswap exchange was $ 1.19 billion, and on Arbitrum and Optimism, respectively, $ 17.6 and $ 9.4 million.

It should be noted that Uniswap v3 is far from the first line in terms of the volume of blocked assets in Arbitrum. The Curve project is in the lead there with $ 206.8 million, and DEX SushiSwap ($ 145.6 million) is in second place in the rating.

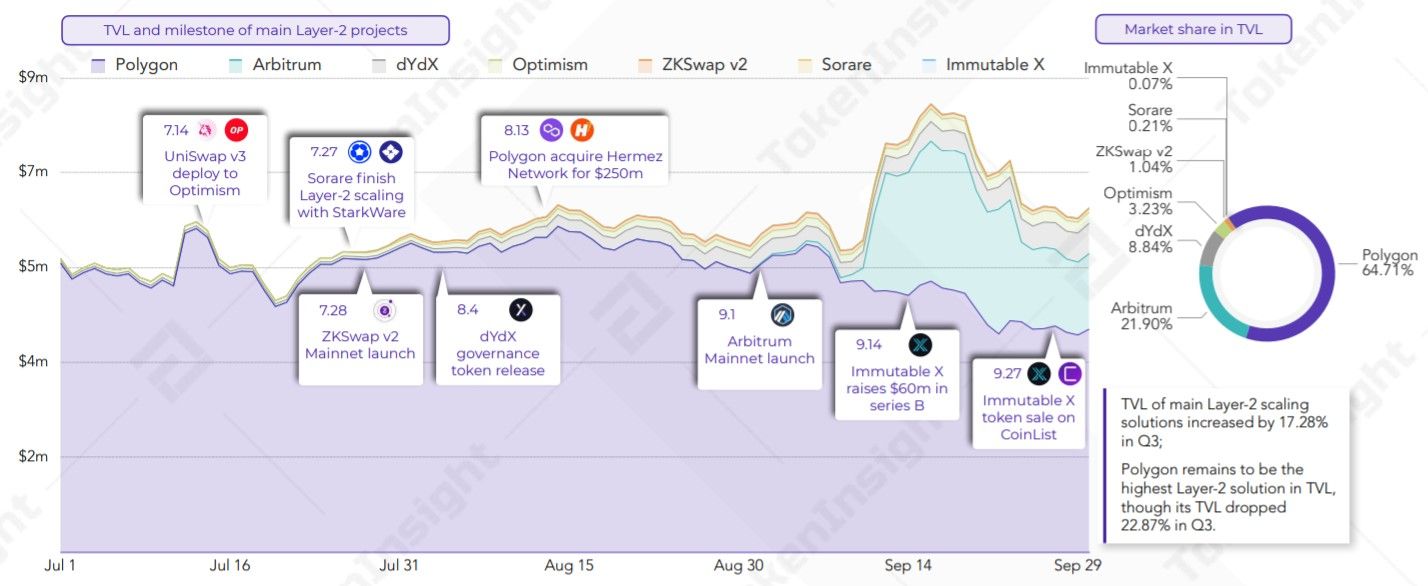

Among the second-tier networks, Polygon continues to lead in terms of the volume of blocked assets, although in the third quarter of this year the indicator decreased by 22.87%. At the same time, the volume of blocked assets in Arbitrum increased by 21.9%.

At the end of October, Polygon’s management paid $ 2 million to a “white hacker” who discovered a critical vulnerability in the protocol. The vulnerability could lead to the loss of $ 850 million tokens.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.