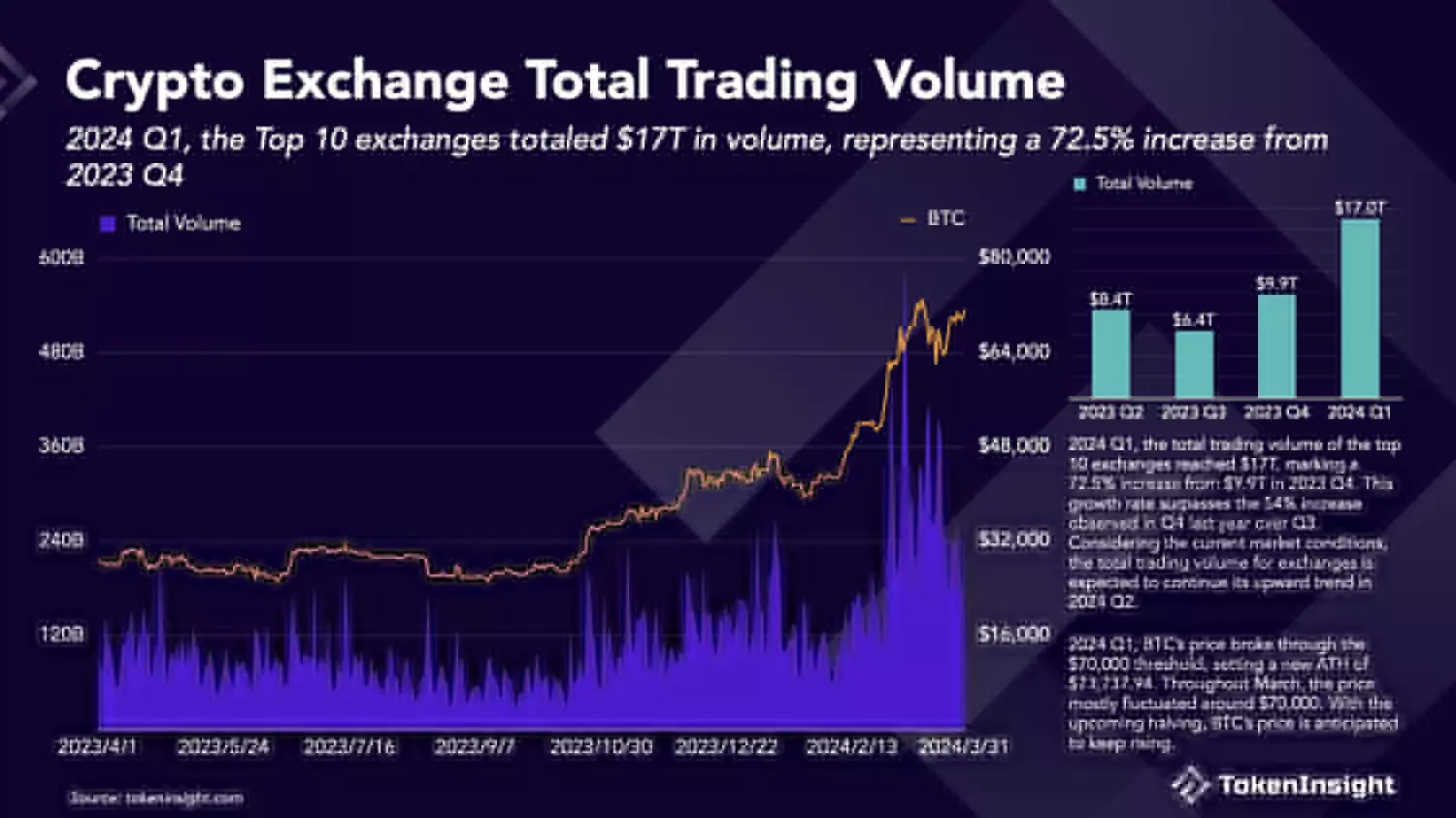

TokenInsight specialists highlight the growth in the value of flagship crypto assets, as well as speculative market expectations against the backdrop of the upcoming halving of the Bitcoin network, as drivers contributing to the growth in the activity of users of cryptocurrency exchanges.

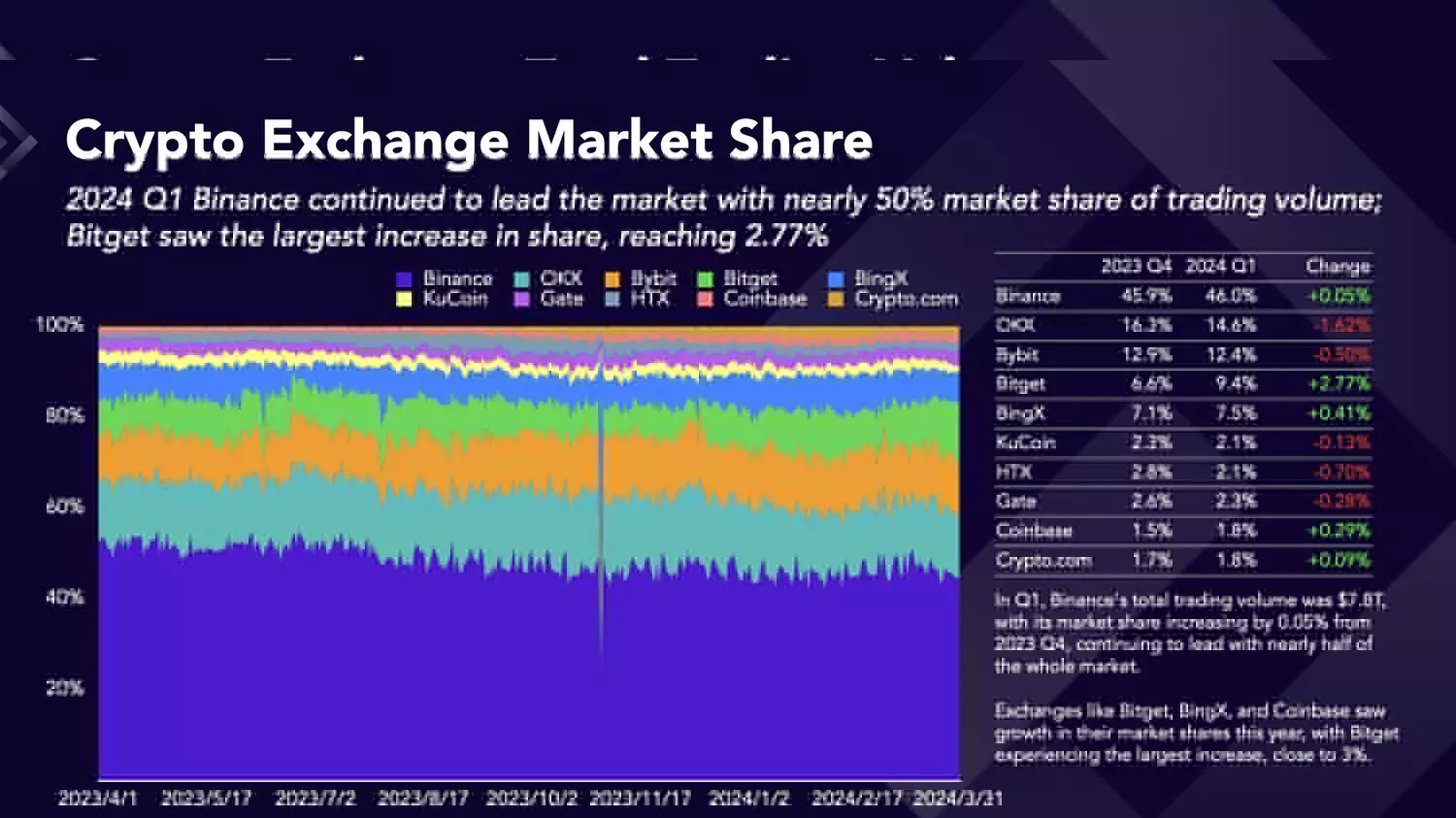

The leader with a market share of about 50% of the volume of all trading in digital assets remains the Binance cryptocurrency exchange. However, TokenInsight experts note the growth rate of trading volumes on the Bitget, BingX and Coinbase exchanges. Singapore-based Bitget was able to demonstrate the best result among competing crypto exchanges at a level of about 3%.

On the spot cryptocurrency market, total trading volume increased by almost 103% and approached $4 trillion, TokenInsight says.

TokenInsight experts are inclined to assume that market conditions and the overall trading activity of crypto exchange clients on the spot market will remain at a high level in the second quarter and may even increase.

By early April, the daily cumulative volume of transactions in the Bitcoin spot exchange-traded fund market exceeded $200 billion, according to The Block Research dashboard.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.