The day before, the decentralized exchange (DEX) Uniswap came under the radar of the US Securities and Exchange Commission (SEC). Over the course of a day, the rate of the UNI token fell by almost 20%.

Due to the ambiguous situation and the jump in the UNI rate, the user lost more than $1 million. Meanwhile, whales are actively getting rid of Uniswap tokens, expecting that the SEC will continue to put pressure on the site.

When everything goes against you

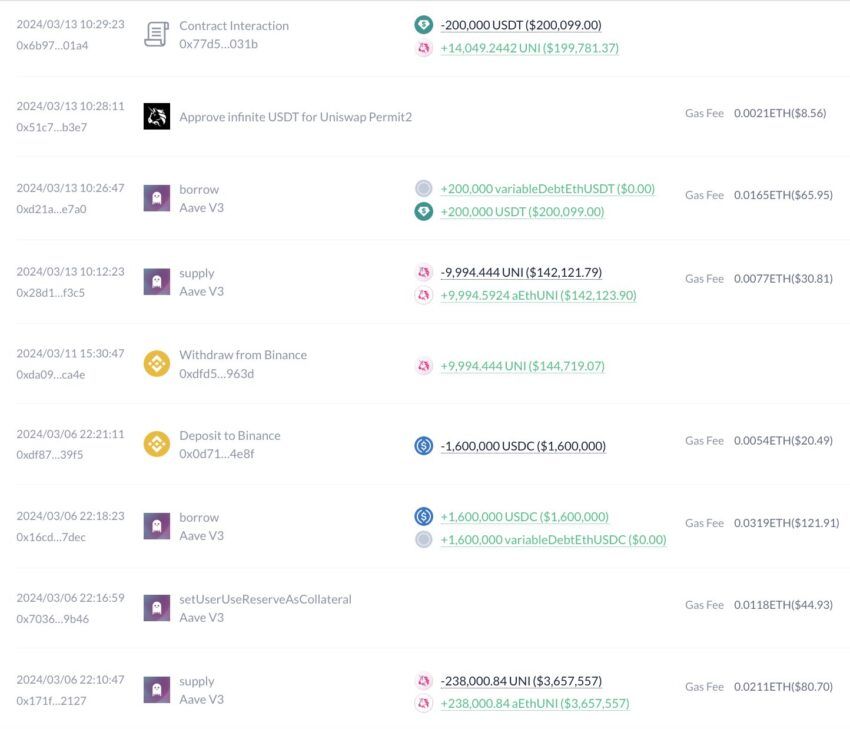

Lookonchain analysts noticed for one unpleasant incident. A user under the nickname whitzardflow.eth lost 107,010 UNI (about $1 million), which he used to pledge on Aave. It happened like this:

- from March 1 to March 13, whitzardflow.eth bought a total of 262,045 UNI, spending $3 million;

- he then deposited them on Aave as collateral and took out a stablecoin loan for $1.8 million;

- after all the above transactions, the price of UNI fell, which led to the liquidation of 107,010 UNI to partially repay the investor's debt;

- As a result, whitzardflow.eth was left with 155,034 UNI for $1.47 million.

Whales are selling out UNI

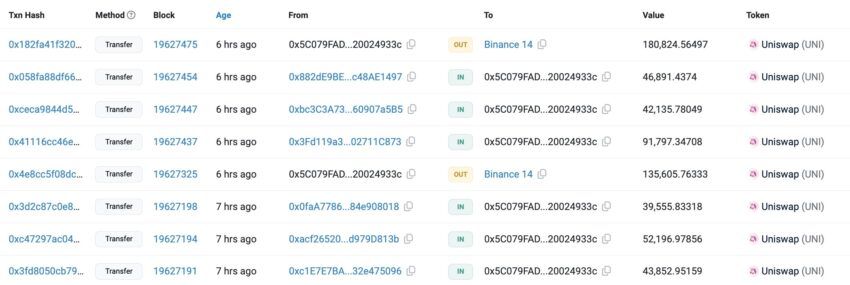

Almost immediately after information about the SEC notification spread across the network, three pillars dropped 2.03 million UNI worth $20 million. Because of this, the price of the native Uniswap token immediately fell by 17%.

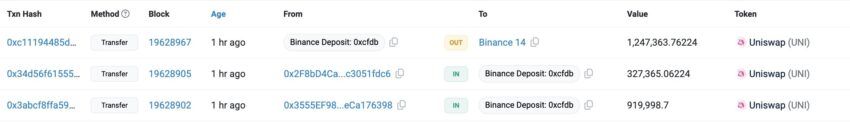

A few hours ago, two addresses – 0x2F8b and 0x3555 – withdrew about 1.25 million UNI in the amount of $11.7 million. These funds came to them from the Binance crypto exchange back in March last year. If sold, the whales could record a profit of about $3.5 million at current rates.

Wallet 0x4A0B then sold 472 thousand UNI for 4.59 million USD Coin (USDC). The average sale price was $9.71. This whale managed to earn $1.67 million.

Later, six more wallets withdrew a total of 316 thousand UNI worth $3.16 million on Binance.

What's up with the Uniswap token price?

According to CoinGecko, at the time of writing, UNI is trading at $9.18. Over the past 24 hours, the value of the asset has dropped by 17.1%, and over the month – by a total of 33.6%. The minimum value over the past day was $9.10.

UNI trading volume, meanwhile, jumped more than 425%. The token’s capitalization dropped to $5.5 billion.

Uniswap intends to fight the SEC because it is absolutely confident that it is right. Trading platform founder Hayden Adams statedthat the products DEX offers are completely legal and its activities are “on the right side of history.”

After receiving Wells' notification Wells notice), which was sent by the regulator, the cryptoplatform has 30 days to respond to the identified violations.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.