Within three months after the launch, the total trading volume of spot exchange-traded funds based on the first cryptocurrency exceeded $200 billion. This is evidenced by data The Block Data.

The figure for March almost doubled and became a record, reaching $111 billion for the month.

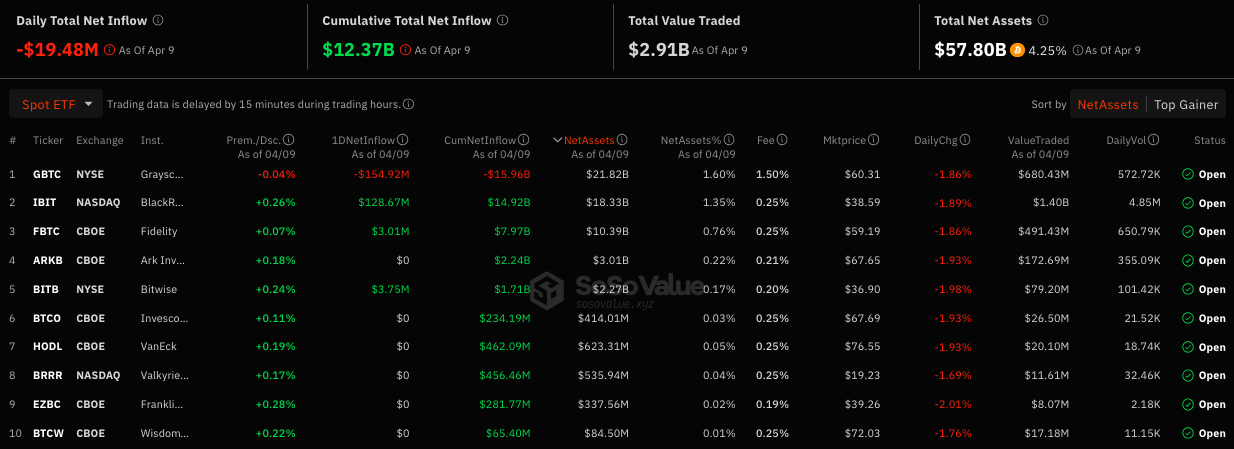

According to SoSoValueOn April 9, Bitcoin ETF trading volume amounted to $2.91 billion, which is significantly lower than the March 5 peak of $9.9 billion.

Three exchange-traded funds from Grayscale (GBTC), BlackRock (IBIT) and Fidelity (FBTC) continue to dominate the sector. The bulk of the turnover in recent days has gone to IBIT, exceeding $1.4 billion (48%) during the last trading session.

It was followed by GBTC and FBTC with $677 million and $488 million respectively. After the launch of the products in January, the bulk of the volume was dominated by Grayscale (about 50% of daily trading volume), but this figure has now decreased by about 23%.

On April 8 and 9, the funds recorded net outflows of $223.8 million and $19.48 million.

The bulk still falls on GBTC – in the last session, investors withdrew $154.9 million from the instrument. The inflow into IBIT amounted to $128.7 million.

Inflows into spot Bitcoin ETFs have slowed slightly since peaking at $1.05 billion on March 12.

At the time of writing, the rate of digital gold is around $68,000, having decreased by 1.6% per day. Its market capitalization is $1.33 trillion with a trading volume of $32.6 billion.

CoinShares admitted that Bitcoin ETFs will face a demand shock in the coming months.

Bitwise Investment Director Matt Hougan predicted an increase in the share of the first cryptocurrency to 3% amid the success of exchange-traded funds.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.