Over the past six weeks, bitcoin liquidity has significantly decreased in both directions. The largest order clusters are at $ 112,000 and $ 120,000, the trader drew attention to the Daancrypto nickname.

The co -founder of Material Indicators, Kit Alan suggested that the large volumes of liquidity in the book of orders, including “fall protection” at the level of $ 105,000, may turn out to be a form of manipulation of prices.

2 Moves Don`t Make a Trend, But Firecharts IS Showing Some Behavior in the $ BTC Order Book That Has Similar Characteristics of What We’ve Previous Seen From “Spool the Whale” and “Notorious Bid”

Too soon to make ansumptions, but the influence on Price Direction Will Be … pic.twitter.com/sisbwrgj9n

– KEITH ALAN (@kaproductions) August 20, 2025

According to the analyst under the nickname of Thekingfisher, Bitcoin can “turn red” even more. This guarantees serious consequences for altcoins.

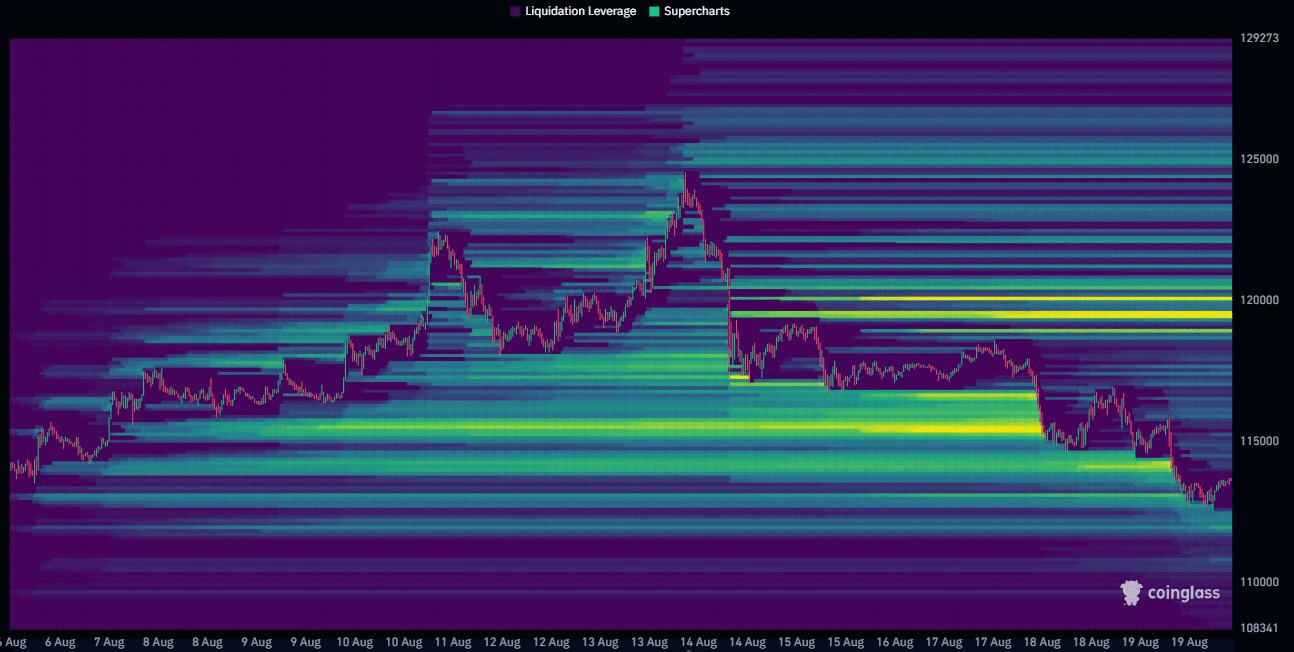

The $ BTC Liquidation Heatmap Shows a notable Cluster, Likely Marking a Seller’s Footprint From Tof this Week. A Strong Liquidation Zone Sits at $ 102,349. Altcoins Currently Show a Balanced Skew. We Might See a Minor Retrace Aimed At Liquidating High-Laverage Shorts. Momentum … pic.twitter.com/ptz4svmsdc

– Thekingfisher (@kingfisher_btc) August 20, 2025

The liquidation area with a significant volume is at $ 102,349, the expert said. It also expects a small correction that eliminates the shortists with a high levereig.

The trader under the pseudonym Rektcapital noted a positive moment: a similar type of correction took place at the same moments of the cycle in 2017 and 2021. According to his observations, each rollback preceded growth to new historical maximums.

One of the Most Positive Things ABOUT THIS CURRENT PULLBACK IS THAT THE SAME TYPE RETRACE TOKE SAME SAME MOMENT IN THE CYCLE IN BOTH 2017 and 2021

In Both 2017 and 2021, Each of Those Retracles Preceded Upside to New Time Highs$ BTC #Crypto #Bitcoin https://t.co/onprkhpuvs

– Rekt Capital (@rektcapital) August 19, 2025

At the time of writing, the first cryptocurrency is traded about $ 113,500, according to Coingecko. Now the main attention of investors is focused on the publication of the protocols of the July meeting of FOMC and the performance of the head of the Fed Jerome Powell in Jackson-Houl on August 20 and 22, respectively.

According to CME FedWatch Tool, traders assess the likelihood of reducing the Fed’s rate by 25 basic points on September 17 by 85%.

K33 Research analysts warned of impending volatility against the background of the growth of ETH/BTC to the annual maximum.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.