The transfer of ~$10.2 million in assets from an FTX-linked wallet has raised concerns about the beginning of a wave of emptying of its contents as part of bankruptcy proceedings.

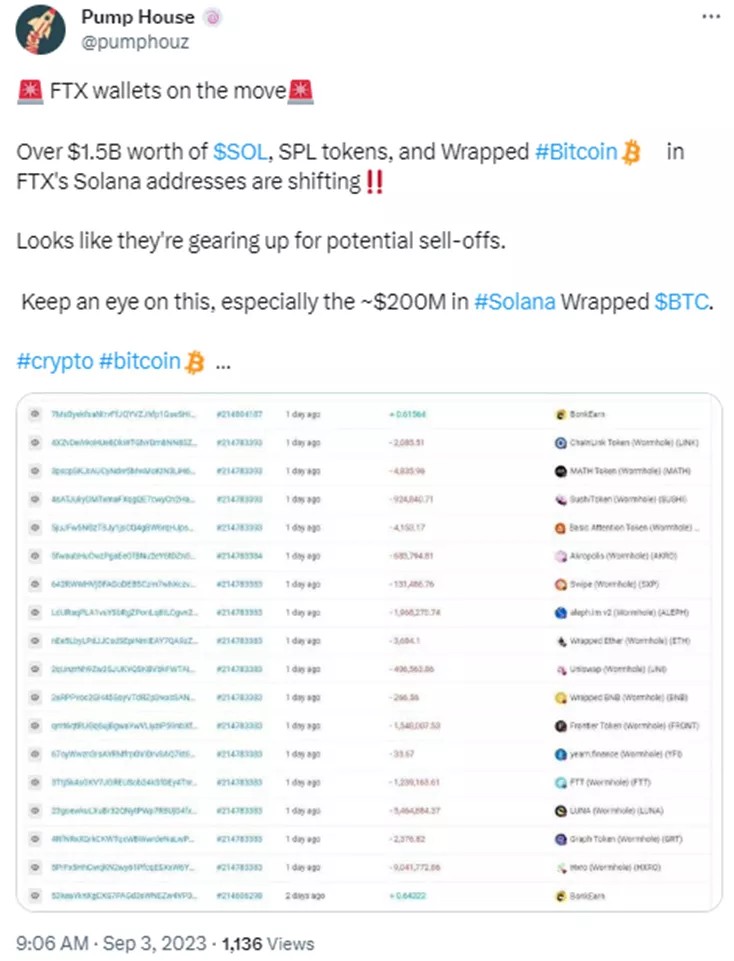

According to Arkham Intelligencesince August 31, the wallet has transferred ~$6.23M to ETH and over $5M to FTT (~$1.2M), UNI (~$1.8M), HXRO (~$1.3M), SUSHI (~$550,000 ) and FRONT (~$260,000).

On August 24, FTX notified the court of plans to “sell, stake and hedge” its cryptocurrencies for $3 billion — for this, the exchange will hire Mike Novogratz’s Galaxy Digital.

According to the plan, the platform will be allowed to sell no more than $100 million worth of tokens per week, but this limit can be doubled for each individual asset. The restrictions are intended to reduce the impact of transactions.

The exchange’s lawyers also filed a separate petition to sell bitcoin and Ethereum.

The court will consider the applications on September 13.

On July 31, FTX presented a plan to restart the offshore exchange with access for users outside the United States. The company’s creditor committee later criticized the management’s idea.

In June, the platform’s current management team said it had returned about $7 billion in liquid assets.

/a>

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.