Bitcoin

Bitcoin in seven days from June 27 to July 4 grew by 1.98%. The first cryptocurrency is about $ 110,000 again. Moreover, on Thursday, July 3, BTC has already taken this mark. $ 112,000 bitcoin is separated from the historical maximum.

Source: TradingView.com

Investors violently reacted to the trading transaction, which was concluded by Trump with Vietnam. The conditions for the United States look extremely pleasant. The exported Vietnamese goods will be taxed 20%, and the re -exported ones – 46%exported for resale to other countries. American exports to Vietnam from duties will be released. The news is important, since this Asian country has become

Sixth In terms of volume supplier of goods in the United States over the past year. The news about the transaction was the main catalyst that prompted Bitcoin in the course of a week above $ 110,000.

Bull moods are confirmed by BTC reserves on exchanges. According to analysts of the platform

Glassnodein June, the indicator decreased by 9.4%, to 2.8 million. This means that only about 14% of all bitcoins in circulation are now contained on crypto -rms. The last time the like

observed In 2017.

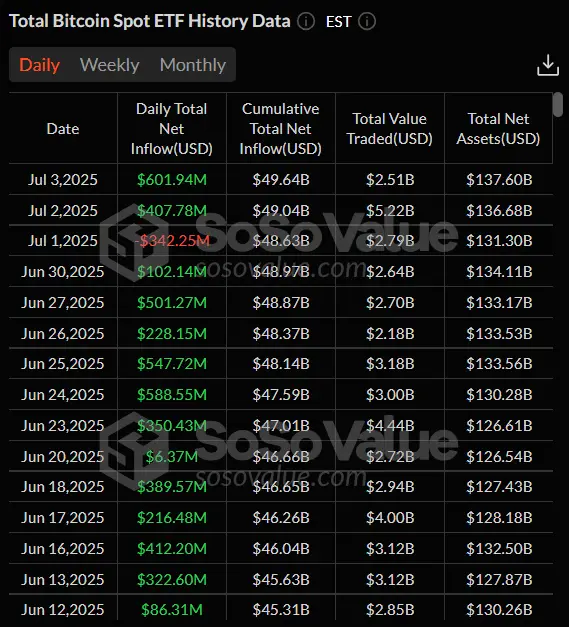

Springs ETF on bitcoin continue to show positive dynamics. Last week, exchange funds again recorded a flow of funds in the amount of $ 769.6 million. It is interesting that on July 1, money from $ 342.25 million took place on July 1. This interrupted a series of fifteen trading sessions in a row, when the influx of funds was observed.

Source: sosovalue.com

From the point of view of technical analysis, Bitcoin continues to remain in the sidewall for a month and a half, alternately moving between support levels – $ 100,000 and resistance – about $ 110,500. The weakness of the trend is confirmed by the drop in the ADX indicator to 11.54. BiCoin buyers remain an easy initiative. The proof is the excess at the price of a 50-day sliding average (indicated in blue).

Source: TradingView.com

Index

Fear and greed Compared to last week, it grew by eight points. The current value is 73. This indicates a predominance of greed over fear in the moods of crypto investors.

Ethereum

Air from June 27 to July 4 went up by 6.45%. The week growth of ETH was achieved at the expense of one trading session on Wednesday, on July 2, when the second in capitalization of cryptocurrency increased by 6.89%immediately. On the rest of the days, according to the results of trading, the price of the broadcast did not change by more than 3.5%.

Source: TradingView.com

ETH growth was facilitated by records reached by the second cryptocurrency in June in several metrics in June. The analyst of the Cryptoquant platform Carmelo Aleman noted that the addresses that are inclined to accumulate the air are held by its maximum number in history – over 22.7 million coins. It is worth noting that in June the indicator has grown by almost 36%. In addition, on July 1, the record was updated by the number of broadcasting in stakeing. Now it is more than 35.56 million ETH. In many ways, such numbers were achieved at the expense of

activity corporate investors.

And the ether is growing due to the activity of spotes ETF on ETH. The last week was the eighth in a row when the exchange funds recorded the flow of funds. In total, during this period, spotal ETFs were replenished in the amount of over $ 1.9 billion.

Source: sosovalue.com

The positive dynamics of the ether is associated not only with the actions of large capital. Ethereum remains one of the most developing networks. Last week, cryptocurrency took second place in terms of developers’ activity, fixing 225 commits (separate file changes) on GitHub. Only the Cardano blockchain with 244 commits turned out to be above.

Source: Cryptometheus.com

In terms of technical analysis, ether, like Bitcoin, continues to bargain in the sidewall. However, the bulls have a clear reason for optimism. The so-called golden cross was formed on the daily schedule-the situation, when the fast 50-day sliding average (indicated in blue) crossed the slow 200-day (marked with orange) from the bottom up. Usually this serves as an omen of further growth. While waiting for confirmation – a breakdown of the resistance level $ 2,880.3. The support level is still a mark of $ 2,112.

Source: TradingView.com

Shiba Inu

The cost of Shiba Inu from June 27 to July 4 increased by 2.39%. The Memecron managed to stay above the bottom reached on June 22. However, there is no need to talk about the vastingly advantage of bulls: in the week, three days of falling were found for four growth sessions.

Source: TradingView.com

SHIBA Inu since the end of June has been experiencing some surge in network activity. The volume of transactions

achieved Trillion tokens. True, this can hardly be called a signal for growth. More often, this state of affairs portends an increase in price volatility.

In addition, the week was marked by a large outflow of Shib with a crypto -streak. One of the users in four days led 2 billion tokens worth a little more than $ 2.4 million. Usually

conclusion From the centralized trading floors (CEX), it indicates the desire of investors to accumulate cryptocurrency in anticipation of further growth.

Santifica analysts believe that Shiba Inu is not the best choice for a retail investor. The thing is that the ten largest holders

Control Almost 62% of the total offer of memcoid. This state of affairs can lead to sharp jumps in prices, as well as to various kinds of market manipulations.

From the point of view of technical analysis, Shiba Inu remains in a descending trend. This is in favor of the fact that the price of memcoid is below the 50-day sliding average (marked in blue). It is worth noting: in the last days, when Coin has grown somewhat in price, an increase in the trade volume has been observed, and the indicator for July 3 became maximum since February 26 (according to the BTISTAMP exchange). This serves as a positive signal for bulls. The next levels of support and resistance: $ 0.00001031 and $ 0.00001215, respectively.

Source: TradingView.com

Conclusion

Last week, the largest cryptocurrencies showed prices. This was mainly due to the first truly successful trading transaction of Trump-between the United States and Vietnam. Although the graphs have some signals for the growth of cryptocurrencies, for example, the gold cross at the air, talk about the bull trend prematurely.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.