Bitcoin

From May 2 to 11, Bitcoin grew by 7.6%. The largest cryptocurrency in capitalization again overcame the line of $ 100,000, which did not happen to it since February 7. Most of the growth – 6.4% – came for one trading session on Thursday, May 8.

Source: TradingView.com

On May 7, the next meeting of the Federal Reserve System (FRS) was held, at which its chairman Jerome Powell announced that the key rate of the United States remains unchanged-in the range of 4.25%-4.5%. Powell remained faithful to the chosen course despite the obvious discontent expressed by the American president. The main reason for his decision, he called uncertainty. From the point of view of the head of the Fed, the risks of both high inflation and unemployment are great, so the best way out will simply look and wait. At first, investors negatively reacted to Powell’s speech – Bitcoin fell below $ 96,000. However, the very next day It happened A jerk above $ 104,000.

But why did such a reaction followed if Powell’s rhetoric was neutral at best, but not positive? The fact is that on May 8, Donald Trump announced that he would be soon Concluded A trading transaction with a large respected country. As it turned out later, it was about the UK. Trump promised to reduce duties on cars, aluminum and steel for the island state. With regard to transportation, the rate should fall from 27.5% to 10% per quota of 100,000 vehicles. Aluminum and steel will be supplied at all without taxation, and the initial rate on them was supposed to make up 25%. In addition, on May 9, Trump hinted that imported rates for China will be reduced from 145% to 80%.

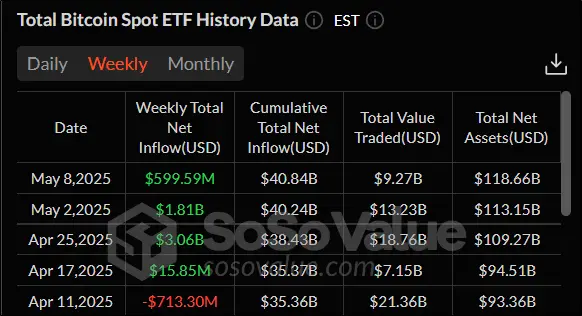

BTC growth is facilitated by demand from large players. For example, last week, the Bitcoin spotto on Bitcoin again demonstrated a flow of money in the amount of $ 599.59 million. The outflow of money was observed only on May 6 and amounted to $ 85.64 million.

Source: sosovalue.com

From the point of view of technical analysis, bitcoin remains in the upward trend. In favor of this, the excess of a 50-day sliding average (indicated in blue) speaks in favor of this. But the RSI indicator climbed into the overwhelming area (above 70%). This indicates a possible imminent rollback. Support and resistance levels: $ 100,000 and $ 109,356, respectively. Index Fear and greed Compared to May 2, he climbed three points. Its current value is 70. This indicates that greed still prevails over fear in the moods of crypto-investors.

Source: TradingView.com

Ethereum

From May 2 to 11, the broadcast increased by 36.26%. This allowed ETH to rise above $ 2,500 for the first time since March 3. As in the case of bitcoin, the growth of the air fell on the period after May 8, when over three trading sessions he added more than 6% in each.

Source: TradingView.com

ETH dynamics was also largely determined by Trump’s rhetoric relative to duties. However, there were also reasons for improving investment moods. For example, on May 7, Pectra updated was finally deployed on the main network. This made it possible to implement several new functions:

-

User wallets can now function as smart contracts, and the commissions are paid by other tokens;

-

The number of blobs to the block has been increased, which should increase scalability and reduce transaction commissions for decisions of the second level;

-

The maximum balance of validators is increased from 32 to 2 048 ETH.

The indicator of the number of blocked assets (TVLs) in the protocols of the Ethereum increased in nine days by 20% – from $ 52.1 billion to $ 62.7 billion. This suggests that users’ trust in the second cryptocurrency capitalization is gradually returning.

Source: Defillama.com

Stormy growth is also observed in the market of derivative financial instruments. Open interest in the air from May 2 to 11 increased by 40% – from $ 21.71 billion to $ 30.4 billion.

Source: Coinglass.com

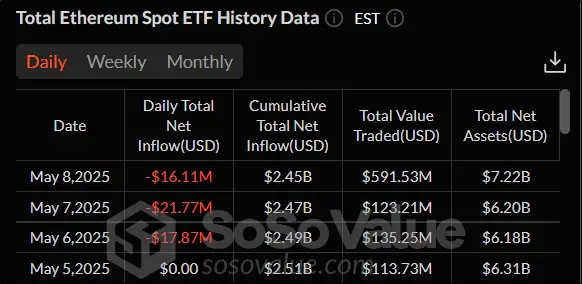

It is interesting that in the spotal ETF on the air after two weeks of tributaries, an outflow of $ 55.76 million was recorded. At the same time, if on the first day the speaker was zero, then the investors stably seized money from exchange funds.

Source: sosovalue.com

From the point of view of technical analysis, the ether is in an upward trend. This is evidenced by the cost of both a 50-day sliding average (indicated in blue) and the Parabolic SAR indicator (marked by orange). Current support and resistance levels: $ 2,112 and $ 2,815,2, respectively.

Source: TradingView.com

Chainlink

Chainlink from May 2 to 11 increased by 14.2%. Within a week, cryptocurrency rose above $ 17, updating its maximums in two months. As in the case of bitcoin and ether, all growth came for the period from 8 to 10 on May.

Source: TradingView.com

The growth of bitcoin and broadcast on May 8 and 9 provoked the demand of large players (whales) and other altcoins. The most popular among them, by data Nansen analytical platform was wrapped in Bitcoin (WBTC), the influx of which amounted to $ 11.47 million, and the second place went to ChainLink with $ 4.5 million.

Another reason for growth was new collaborations. Mint Blockchain – a second -level solution on the Ethereum for NFT – announced cooperation with Chainlink. In particular, he integrated the protocol of inter -sequences (CCIP). Such a step will allow Mint to carry out reliable and safe communication between different blockchains. CCIP integration will improve the functioning of the ecosystem smart contracts, which are used to transfer assets and data transfer. In turn, Chainlink expand His presence in the market will be able to attract new users.

On Tuesday, May 6, CHAINLINK representatives announced the new ChainLink Reward award system. Its essence is to distribute the Build project tokens between the ecosystem participants and Link stakers. The initial distribution will be subjected to 4% of the STX infrastructure company Space and Time. The recipients will be Link steakers. The Build program is designed to maintain projects in the ecosystem of cryptocurrencies, Providing Help in the entering the market, access to various services and much more.

In terms of technical analysis, Chainlink is in an upward trend. This is evidenced by excess at the cost of a 50-day sliding average (indicated in blue). However, the trend is quite weak: the ADX indicator barely exceeds 20. Support and resistance levels are about $ 16 and $ 17.65, respectively.

Source: TradingView.com

Conclusion

The largest cryptocurrencies again moved to growth. The main cause of positive dynamics is the softened rhetoric of Donald Trump relative to import duties.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.