Bitcoin

Bitcoin price increased by almost 10% from November 1 to November 8, 2024. In seven days, the largest cryptocurrency by capitalization finally reached its all-time high. The new target value for crypto investors is $76,990.

Source: tradingview.com

The main news that inspired crypto enthusiasts was

election new US President. This was the candidate of the Republican Party, Donald Trump, who held this post from early 2017 to early 2021. The positive reaction from the crypto community is explained by Trump’s election rhetoric, one of the tenets of which was support for digital assets. In addition, the Republican team did not hesitate to receive funding in cryptocurrency.

Another reason for the growth of Bitcoin was a new reduction in the key rate by the US Federal Reserve. This became known on November 7, after a speech by the head of the regulator, Jerome Powell. The official, as usual, was restrained in his rhetoric. On the one hand, Powell acknowledged the positive outlook on economic activity. On the other hand, the latest inflation report in the US showed a value higher than expected. This is what explains the whole continuation

restrictive monetary policy.

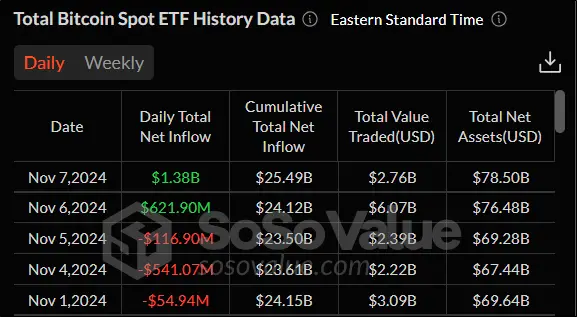

BTC was also supported by the positive dynamics of spot ETFs. At the same time, the beginning of the week did not work out for them. In the first three days, the outflow of funds amounted to more than $700 million. However, after Trump’s re-election, everything changed dramatically. The figures on November 7 set an all-time record. In one day, the influx of funds amounted to $1.38 billion.

Source: sosovalue.com

From a technical analysis point of view, investor sentiment is bullish. BTC has overcome the previous all-time high and now new horizons are opening up for it. All indicators, naturally, speak in favor of buyers. The price is above the 50-day moving average (in blue) and the RSI continues to rise. Current support and resistance levels: $73,794 and $76,990.

Source: tradingview.com

The index of fear and greed remains

unchanged compared to last week. It is still at 75. This indicates that greed still reigns in the sentiment of crypto investors.

Ethereum

Ether increased by 16.5% from November 1 to November 8. The second largest cryptocurrency by capitalization reached a three-month high, breaking the $2,900 mark. This result was achieved through two trading sessions on Wednesday, November 6, and Thursday, November 7, when ETH added 12.49% and 6.31%, respectively.

Source: tradingview.com

The main reasons for the growth of ether were the same as for Bitcoin: the election of Trump as president and the rate cut. Nevertheless, there were specific positive aspects. On November 7, the launch of the new Mekong test network was announced. Its main task will be to support interaction between clients. The launch of Mekong is one of the steps towards deployment

hard fork Pectra.

Analytical platform IntoTheBlock

recorded During the week, the activity of large players (whales) increased. This was manifested in an increase in the number of transactions, the minimum amount for which was $100,000. On November 6, the best result in three months was shown. On this day, 7,270 unique transactions of $100,000 or more were achieved.

Leon Waidmann, head of blockchain research at the non-profit organization Onchain Insights, noticed an interesting coincidence: the amount of ether staked at an all-time high, but its reserves on exchanges at

minimums. Both of these signals are bullish and should encourage further growth in the cryptocurrency.

Technical analysis also speaks in favor of buyers. The price has finally broken through the $2,811 resistance level and it has now become support. In addition, it quite significantly exceeds the 50-day moving average (indicated in blue), which also speaks in favor of the bulls. Simultaneously with the price increase, which is not surprising, volatility began to increase, as evidenced by the rise in the ATR indicator. The current state of affairs is that Ethereum has no obstacles to growth towards the resistance level around $3,100.

Source: tradingview.com

Solana

Solana from November 1 to November 8, 2024 showed even better dynamics than Bitcoin and Ethereum. The growth was 20.62%. The SOL token surpassed the $200 mark for the first time since March 18. There is less than 5% left to the historical maximum.

Source: tradingview.com

It goes without saying that Solana’s growth is also mainly related to the American elections and the Fed rate cut. This was also accompanied by a record open interest indicator for this cryptocurrency – the number of open derivatives. On November 8, it reached $4.3 billion.

Source: coinglass.com

And last week it became known that the Solana Pay payment system now supports Bitcoin and Ethereum. Thus, its recognition among crypto enthusiasts should only increase. Now traders from all over the world will be able to manage cryptocurrency payments on various blockchains within one interface. In addition, due to the use of second-level solutions, Solana will be able to

minimize transaction costs, which will also appeal to users.

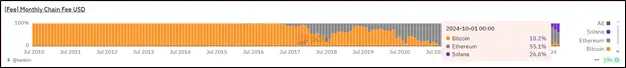

Also interesting statistics were released on commissions for October 2024. This month, Solana managed to outperform Bitcoin, although it is still significantly behind Ethereum. By the way, the trend continues in November.

Source: https://dune.com

From a technical analysis perspective, Solana is dominated by bulls. This is confirmed by the fact that the price is comfortably above the 50-day moving average (indicated in blue). Interestingly, the ADX indicator, which is only slightly above 20, suggests that the trend is still quite weak. In other words, we can expect its further strengthening, and as a consequence, the growth of Solana. The current support and resistance levels are: $193.73 and $209.7, respectively.

Source: tradingview.com

Conclusion

Thus, political and economic agendas have determined the prices of cryptocurrencies. Almost all digital assets increased in price from November 1 to November 8, 2024. Well, some, like Bitcoin, were even able to update their historical maximum.

This material and the information contained herein do not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.