A sword of Damocles hangs over Solana (SOL) in the form of the possible liquidation of FTX assets, but this does not prevent the token from growing in price and the protocol from vigorously increasing its TVL.

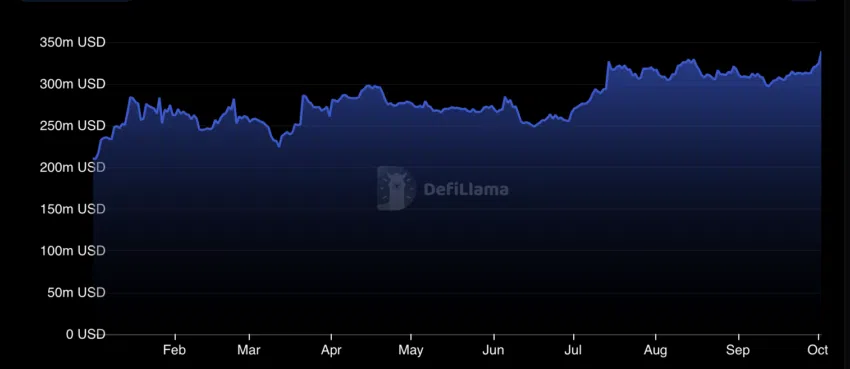

The total value of assets locked in the Solana (SOL) blockchain reached $338.82 million and updated the 2023 high. Traders are trying to understand what triggered the sharp jump in the indicator.

Over the past 24 hours, the total value of locked assets (TVL) in the Solana protocol increased by more than 4%, rising from $324.64 million to $338.82 million. Since the beginning of 2023, the figure has increased by approximately 38% (from $210.47 million).

SOL rises in price after breaking resistance

The SOL rate has also increased noticeably: over the past 24 hours, the cryptocurrency has risen in price by almost 15% and has become the growth leader among the hundred largest coins by market capitalization. However, some users noted that despite the strengthening, Solana is still 30% cheaper than its 2023 peak.

At the time of publication, SOL is trading at $24.52, with upward momentum accelerating after breaking through resistance in the $20 area.

The complicated relationship between Solana and FTX

In September, a court allowed bankrupt crypto exchange FTX to sell its cryptocurrency assets to pay off creditors. Considering that the company’s accounts had accumulated about $1.2 billion worth of SOL tokens, rumors spread in the market that FTX would collapse the SOL rate when it began to liquidate assets.

However, nothing of the sort happened. Moreover, since the court approved the liquidation, the token has risen in price by 20%.

According to a crypto analyst known as DeFi Squared on Twitter, Galaxy, the company responsible for liquidating FTX’s assets, is likely in no hurry to sell, waiting for all lenders to finalize their bids. In addition, according to the analyst, transactions could be carried out in the over-the-counter market to reduce the potential effect on the value of the cryptocurrency.

According to experts, 17-22 million SOL tokens are currently available to the crypto exchange. This is about $400 million. Another 40-44 million tokens are staked and will be unlocked gradually over four years. In other words, the company will not be able to sell them all at once and will do it gradually.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.