What is Toncoin

Toncoin is a native blockchain coin of the first level The Open Network (Ton). Initially, the work on its development was carried out by a team under the leadership of Paul and Nikolai Durov. Then the cryptocurrency had a different name – Gram. The regulators had many questions for this project. For example, the American Securities and Exchange Commission (SEC) believed that Gram was a security. The result was the trial and the closure of the project in 2020.

Simultaneously with the closure of GRAM, a new project appeared – Toncoin. In 2021, Pavel Durov said that he transferred the project to the Swiss non -profit organization The Open Network. At the moment, it is officially stated that Toncoin is an open code initiative that is supported by a large number of developers and sponsors.

And although officially Pavel Durov does not have a direct impact on cryptocurrency, its cost often changes on the news about its creator. For example, when he was detained in France in 2024, Toncoin Speak by more than 14%. In March 2025, when it became known that Durov had left Paris, Ton, on the contrary I crossed To growth.

Technical analysis

Since the beginning of 2025, Toncoin has lost almost 45%, and now the cryptocurrency is reduced again. The descending trend is confirmed by the fact that the price dropped below the 50-day sliding average. In addition, the RSI indicator continues to decrease – it has already dropped below the 50 mark, which indicates a potential continuation of the downward trend. At the same time, trading volumes remain at a fairly low level.

To move on to short -term growth, it is necessary to overcome the resistance level of $ 3.24. If it is not possible to stay higher than the support level of $ 2.94, then sales may intensify.

Source: TradingView.com

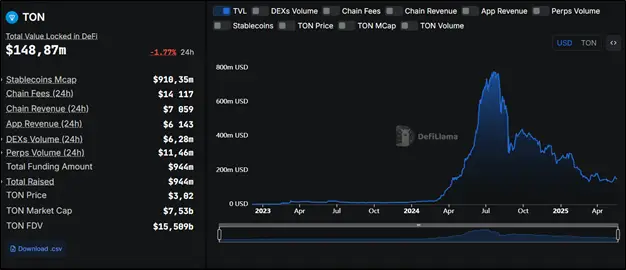

Total Value Locked (TVL)

The Total Value Locked (TVL) indicator – the total number of assets blocked in the Toncoin network protocols is $ 148.87 million. The total trend for it is downward. From the maximums on July 21, 2024 ($ 778.17 million), TVL fell more than five times. At the minimum on May 6, it was even lower – $ 129.51 million. Thus, in the last two weeks, TVL Toncoin has grown by 15%. This shows that interest in the blockchain of cryptocurrency is gradually reviving.

Source: Defillama.com

In mid -May 2025, the Toncoin network ranks 36th in terms of TVL. If the cryptocurrency managed to return to its maximums of 2024, then it would be immediately in 15th place.

Source: Defillama.com

Derivatives

One of the main characteristics of derivatives is an open interest – their total number in circulation. Toncoin showed the historical maximum at this metrics exactly when Pavel Durov’s detention in France – in August 2024. Then the indicator reached the solid $ 40.8 million. On February 12, 2025, open interest again came close to its maximum – $ 39.6 million. But then there was a rigid subsidence: the indicator fell 40 times, and more than a month lasted $ 1 million below. Nevertheless, since the end of March, the situation began to correct $ 11 million. Actually, it remains in the same time, it remains in the time of that time remained in the range from $ 8 million to $ 12.5 million. The current value is $ 10.3 million.

Obviously, the interest in Toncoin and his derivatives is far from the maximum. However, it cannot be called minimal, given that in February the indicator was smaller than the current more than ten times.

Source: Coinglass.com

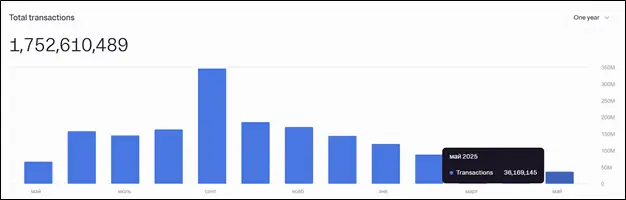

Network indicators

Activity in the Toncoin network by May 2025 also decreased. If in September 2024 the total number of transactions amounted to over 346 million, then by January the indicator dropped to 119.5 million, and in the last two months (March and April) and completely rolled up to 65.7 million. At the moment, about 36.2 million transactions were made in May. And although there are even more than a third until the end of the month, it is likely that it will not be possible to achieve even the indicators of the previous far from a record month.

Source: tonscan.com

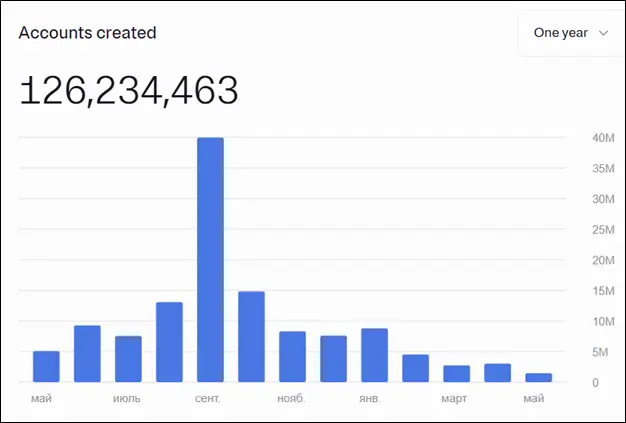

Negative dynamics is noticeable from new accounts. For September 2024, almost 40 million were created, in January 2025 the bar dropped to 8.8 million, and in March – up to 2.7 million. Some hope for the revival of the popularity of Toncoin among users brought April when more than 3 million accounts were created. However, this is the second worst month after March 2025 for this indicator over the past year.

Source: tonscan.com

Conclusion

The current situation in Toncoin is not the most positive. Activity in the network falls, the TVL indicator is located about 11 months of minimums, the general trend for technical analysis is downward, and all this is accompanied by low trade volumes. Some positive can only be found in the derivatives market, taking into account the fact that open interest has increased since February 2025 more than ten times.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.