USDT profitability

For 2024 Tether I was able Earn over $ 13 billion, and for the first quarter of 2025, the company’s operating profit exceeded $ 1 billion. However, such amazing results are not related to either commission or the release of additional stablecoins. The Tether earnings scheme consists in buying American Treasury (debt securities), which are produced by the US Treasury. By the end of the second quarter of 2025, the company accumulated Thus more than $ 127 billion.

The entire procedure comes down to the following:

-

Users deposit fiat money by receiving USDT for this;

-

Tether invests the dollars she acquired in debt securities.

The scheme has been working well in recently, given that the bets remain high, allowing you to generate increased passive income. In addition, trezelris is a tool with a much lower risk compared to derivatives or the same shares. But the securities of the US Treasury is not the only source of Tether’s earnings.

Sources of Tether income

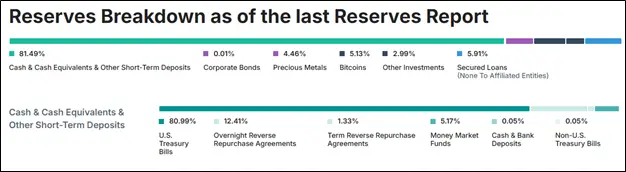

The image below presents information on the company’s reserves for the first quarter of 2025:

Source: Tether.to

It follows that Tether is not alien to the principles of diversification – the company does not hold money in one place. Of course, American Treferses occupy a significant share in reserves. However, Tether also has investments in precious metals in the amount of 4.46% and bitcoin – 5.13%. The company also issues loans for security. And although in a percentage ratio the numbers look quite modest – 5.91%, the latter bring Tether tangible profit annually.

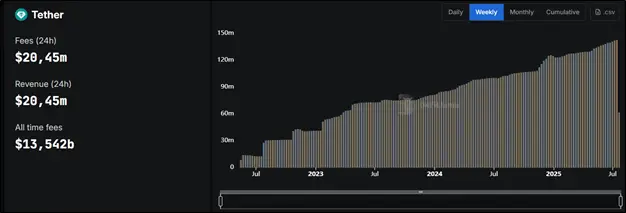

Do not forget about the commissions. It should be included here both transaction commissions that make up 0.1%and verification in the amount of 150 USDT. On the one hand, they do not look sky -high. On the other hand, the largest stablecoin is so popular that since the beginning of 2025, Tether only earned more than $ 120 million on the commissions, and starting from April over $ 130 million.

Source: Defillama.com

In addition, the company has a profit from various collaborations with other organizations. For example, from the latter, an agreement can be noted with focusing food and renewable energy of the enterprise from Luxembourg Adecoagro. Together with him will engage in mining in Brazil.

The reasons for the growth of profit Tether

Tether’s financial success in the first half of 2025 is based on three components. The first is high rates that led to increased profitability of Treasury. That is why the company was able to earn breathtaking money.

The second is the scale. USDT remains the first stable in capitalization. USDC, which takes the second place, is less than 2.5 times. In fact, other stablecoins simply do not have a resource to match the USDT financially. In addition, Tether remains the most popular among users.

The third component – stablecoins are still not so much exposed to the oppression on the part of legislators. Although the situation can worsen with the possible adoption of Genius ACT, it is still far from the same banks. In this regard, until the lawmakers decided to finally “block oxygen”, Tether was able to earn almost $ 15 billion in a year and a half.

Tether risks

Oddly enough, the risks lie where the profit comes from. The rates in the USA will not always be high. Inflation earlier or later will come to Target (the target value of the regulator) in 2%. After that, the yield of the trezelris will fall. For Tether, a decrease in even 50 basic points will be sensitive.

In addition, the regulation of stablecoins will continue. Tether will have less freedom of action. With the introduction of Mica in Europe, a number of exchanges (Binance, Kraken and Coinbase) have already limited the functionality associated with USDT, and some completely delusted the largest stablecoin. In the United States, the situation is unlikely to become better. Obviously, the American authorities will get to the audit of Tether reserves.

These two aspects can significantly reduce the profit of the operator of the largest stablecoin. Soldering can also be observed due to fluctuations in gold prices and bitcoin. For example, it was precisely because of this that the profit in the first quarter of 2025 was 83% belowthan for the fourth quarter of 2024.

Conclusion

A profit of $ 13 billion, which Tether showed in 2024, is mainly associated with high rates and profitability of the Treasury, which occupy most of the company’s reserves. And the operator of the largest stablecoin became the beneficiary of his dominant position in the market and diversification of assets. In the future, Tether risks encountering a reduction in profit due to the strengthening of legislative regulation and reducing rates in the United States.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.