Decentralized exchange (DEX) Uniswap has increased trading fees for swaps in the platform interface by approximately 67%. The reason for this decision was a potential lawsuit from the US Securities and Exchange Commission (SEC), which targeted the crypto platform.

Users will now have to pay a 0.25% fee to exchange tokens on Uniswap. Previously the rate was 0.15%.

Promotion is not for everyone

By words Uniswap team, now the site needs to ensure sustainable financing for its activities. One way was to increase swap fees.

Increased fees will apply to transactions conducted on the main network – Ethereum (ETH) – and supported second-layer (L2) solutions.

However, users can still exchange stablecoin pairs or wrap and deploy Wrapped Ethereum (WETH) at no extra cost. You can also bypass transaction fees using the alternative Uniswap interface.

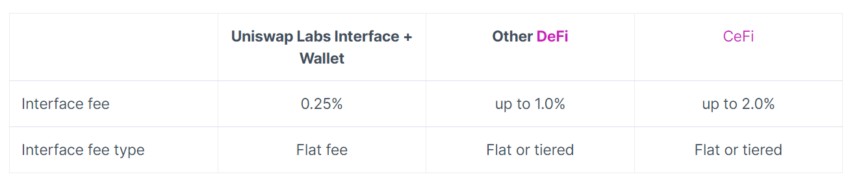

Interface fee Uniswap Labs. Source: Uniswap

Interface fee Uniswap Labs. Source: Uniswap

DEX introduced swap fees for some cryptocurrencies in its web app and wallet in October last year. At the same time, the crypto community initially voted against such an initiative.

Why Uniswap is increasing fees

Raising swap fees is a strategic move ahead of potential SEC litigation, some analysts say. Last week, the US regulator sent Uniswap a Wells Notice, which usually signals an imminent lawsuit from the agency.

Confrontations between the SEC and cryptocurrency companies usually drag on and become a heavy financial burden for the latter. For example, the popular fintech startup Ripple spent more than $200 million on its case against the Commission.

Meanwhile, despite the potential costs, Uniswap announced its readiness to challenge the lawsuit.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.