Expansion of awards

March 20, Brachain Foundation She saidthat on March 24, the Proof-OF-LIQUIDITI mechanism will be launched (POL, Evipation of liquidity) for more vaults. This will expand the distribution of rewards outside the pools on Bex. Pol is not an innovative consensus algorithm for Brachain. It used to be used to distribute BGT tokens (BERA GOVERNANCE TOKEN) inside the Bex pools to ensure decentralized control.

The innovation will allow BGT to determine the BGT for where to store awards. Brachain, in turn, will be able to balance the safety of its blockchain and Defi-active. If in the traditional stayking, the validators receiving remuneration for confirmation of transactions are delegated part of the extracted, then in Pol they must send the lion’s share of the earned BGT to the storage. Thus, the applications have an incentive to bribery.

Usually, the motivation for validators to send BGT to a specific storage is native coins. As a result, the competition between applications is intensified. At the same time, validators receive an incentive to support only the best projects.

TVL growth

In early March, it became known that Brachain became the fifth largest network in terms of the number of assets blocked in the protocol (TVL). In just a month, the indicator increased more than three times – from $ 2.3 billion to $ 7 billion. Brachain was able to bypass such large -scale projects as Arbitrum and Sui.

By data The analytical platform Cryptorank.io, the main contribution to the growth of TVL brachain made a landing platform Dolomite.io, adding 200%, Kodiak Finance liquidity hub, almost doubled the INFRARED Finance protocol – $ 2 billion. In total, these sites account for a little less than a third (29%) of the total TVL brachain.

Interest of users

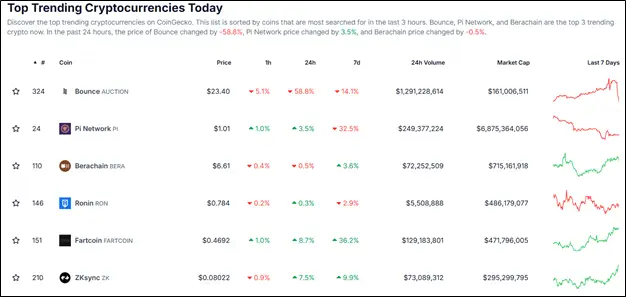

Brachain is a fairly young project – the main network was launched recently, on February 6. However, this does not interfere with cryptocurrency to stay in the top of user requests. Among the coins, who are looking for visitors to the Coingecko portal, Brachain settled in third place, losing only the Bounce and Pi Network.

Source: Coingecko.com

Interest in Bragachain is caused by an innovative approach to stakeing, strong potential for development, as well as a huge variety of Defi applications in its ecosystem. Against this background, many large centralized crypto -tires (CEX) have already conducted Bera leaflets – among them Binance, BYBIT, COINBASE and others.

Scandals in brachain

Although Brachain turned only 1.5 months, several events have already occurred with the project, some of which are negative.

So, in early March, the portal tokenomist.ai reportedthat Braachain was going to unlock 10 million braa. Thus, their general offer should have increased by 2%. However, the information was not entirely reliable. The situation was clarified by the representative of Brachain Foundation Nezha:

“The information that Bera will unlock 10 million coins this week is a lie. In fact, 10 million is 2% of the total that there is now, all coins are deposited by Boyco. This part of the Coins will be issued to depositors at the same time after expiration of the validity period in early May. Media received information about unlocking, and these incorrect data led to a large mass of reprint in Chinese. ”

Thus, 10 million coins will not be unlocked, as stated in the media. This is the amount of braa, which was deposited on the Boyco liquidity market. Coins will not be freely launched on the market, but will return to the depositors. Besides will happen This is not in early March, but in May.

March 15 It became known On the hacking of the project on social trading Belly, based on Brachain.

“It looks like we were hacked. Something from the deployment key on our side was compromised, as a result of which all the Snown Tokens fell and were removed from the liquidity pool. The contracts of decentralized applications are still safe, and the hacker attack on them did not affect them, but please refuse to access decentralized applications and stake. We are actively studying the incident and provide the latest information as soon as possible, ”said the project representatives.

Thus, Bragachain inflicted a reputation blow, which resulted in a decrease in the cost of cryptocurrency by almost 2%.

Technical analysis

BERA began to bargain on February 6, and on February 7, it reached its maximum price of $ 9.2. The cryptocurrency came close to this mark twice: February 20 and March 2, but it was not possible to overcome it. Thus, it can already be argued that $ 9.2 is a sufficiently strong level of resistance.

Since March 11, Brachain began to grow again, adding almost 30%. At the moment, trade is conducted at a local resistance level of $ 6.8. If it can be overcome, then growth is quite possible by $ 9.2. The support is at least March 18 – $ 5.79.

Indicators give less positive signals. RSI remains around the mark 50, but just below it. This is rather a neutral signal with some bear tint. But ADX is 11.2, which indicates the weakness of the trend. So to be seduced by Brachain investors, according to indicators, is not worth it.

Source: TradingView.com

Conclusion

Bragachain is a new 2025 world in the world of cryptocurrencies. The project has a fairly large audience in view of the quality of Defi, as well as a fresh view of the distribution of stake awards. From the point of view of technical analysis, the prospects of the coin are at the present moment are uncertain.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.